An update on our Investor platform - November 2020

There’s been a lot happening here at the Squirrel garage and lots of movement in the financial world, so here’s an update on quite a few things:

Let’s kick things off with investing at Squirrel

We’ve had a fairly large influx of new investor funds over the last 8 weeks and it’s cleaned us out of loans to invest in. Never fear, we have more loans across all three investment classes arriving next week, and we’re working to increase our number of loans to meet the investor demand.

Loans coming next week

Over the course of next week, we’ll have approximately $3 million of new Home Loans and Business Property Loans settling, which we’ll pass straight to our investors. We still recommend placing an order when you have the money available as this means you get into the queue and loans are allocated based on when your order was placed, which we think is the fairest way.

Our personal loan volumes have started to ramp up, and we’re currently settling around the same amounts that we were in February (back in simpler times). Demand continues to be primarily in the 1 year and 5/7 year term, with a lot less in the 2/3 year term.

Two hot tips

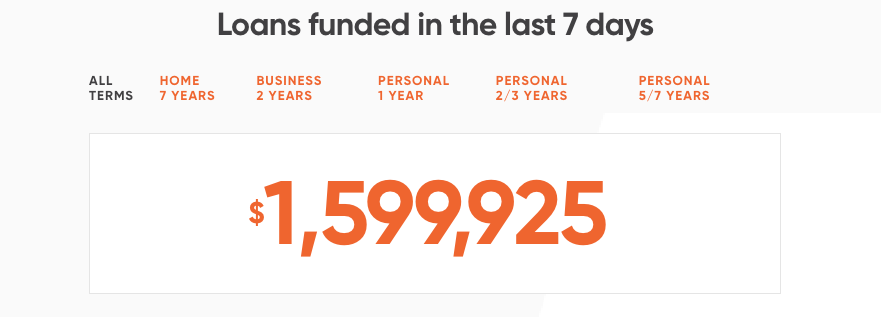

1. You can see the volume of loans flowing through our platform over the last 7 days by looking at the Investments If you scroll down the page, you’ll see we show by investment class and term how much has settled in the prior 7 days. These numbers update dynamically during the day, so should provide you with a precise view, albeit looking backwards.

(Numbers as at 18 November 2020)

2. As of Tuesday 17 November you can now see where in the investment order queue you are after you’ve placed your order. So, if you’re unsure about wait times, can track the amount of money ahead of you in the queue.

Platform updates

As mentioned earlier we’ve been busy in the Squirrel garage (in our new Sale St premises) - we do actually have a garage where we do most of our innovating! We’re cooking up some new products that we expect will come to market next year – more about those in later updates. In the meantime, we’ve made one tweak to our credit policy to remove the $1 million per security cap for Home Loans and Business Property Loans. We continue to have a maximum loan for a borrower of $2 million.

Reserve Funds and loan performance

All three Reserve Funds continue to be in a healthy shape. You can see the balances and some of the important ratios on the Investment page, updated daily. As always, we believe in being transparent about the platform and its performance.

We have no Home Loans or Business Property Loans in arrears. The arrears profile of our personal loan portfolio continues to be in good shape at 2.7%. This is about normal for the time of the year. Based on industry reporting, our personal loan arrears profile is less than half of the market average.

Lastly, a look at what’s happening in the market

The RBNZ are reintroducing LVR limits for investors and first home buyers from 1 March. Historically, this has slowed the property market. However, these aren’t normal times, and we expect to see strong demand for residential property until a vaccine has been widely distributed and NZ’s borders start opening up. We expect there will continue to be demand for new homes across many parts of the country.

We’ve seen bank Term Deposit rates reducing in the market, and lending rates on residential loans falling also to a lesser degree. The track for interest rates has become a little less certain given the booming residential property market. The RBNZ has been working with the banks to ensure they’re ready for negative interest rates, although it’s becoming less likely they will move the OCR to negative territory.

It’s entirely possible that the Funding for Lending Programme (FLP) will depress term deposit and lending rates from banks further without having to move the OCR below zero. Interestingly in Australia, their Reserve Bank moved their cash rate down from 0.25% to 0.10% in the first week of November.

That’s it for this update, check back next month for the next one!

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.