Investor appetite for risk about to change

While homeowners are relishing the lowest home loan rates we have seen in NZ, investors are doing it tough where ‘safe returns’ at the bank are now often no better than inflation.

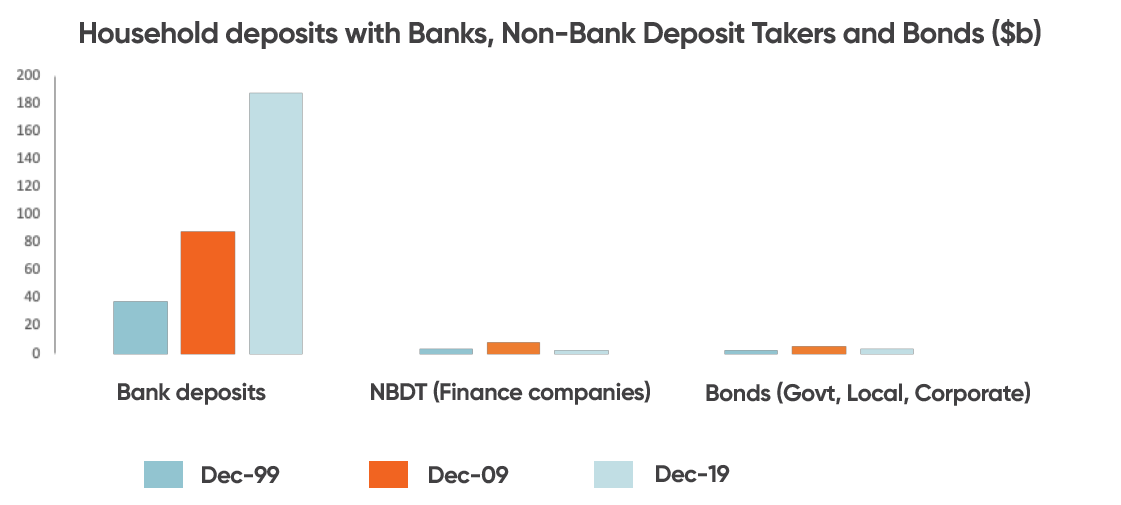

Kiwis typically keep a large amount of their semi-liquid wealth with banks, and the total dollars have more than doubled over the last decade. This is highlighted in the graph below - which also shows the use of Finance Companies and direct holdings of Bonds have both reduced over the last 10 years, although they are really just a blip compared to the banks anyway.

Data is sourced from the Reserve Bank of NZ.

The recent falls in interest rates are going to see a significant drop in the interest income earned from Term Deposits in the bank.

To add some context for just how much interest income has reduced, here’s the current state of play:

Let’s assume that 75% of the deposits at banks are in one-year term deposits. That means there is circa $138 billion of term deposits as at Dec-19 and let’s say it’s grown lots in the last six months as investors have headed back to cash:

December 2019 |

June 2020 |

|

| Term deposits with banks | $138 billion | $142 billion |

| 1-year term deposit rate | 2.6%p.a. | 1.9%p.a. |

| Interest income before tax | $3.6 billion | $2.7 billion |

Data is sourced from the Reserve Bank of NZ

While there are assumptions and gotcha’s, this simple analysis shows this:

The total amount of interest earned by households on term deposits has potentially dropped by about $900m p.a., which is a drop of 25%.

The numbers won’t be spot on, but they are directionally correct. Taking inflation into account running at 2.5% in March 2020, the value of Term Deposit money sitting in a bank is now actually reducing. While of course there will be variances in the data due to term deposit special rates, terms and maturity dates, this at least provides a guide of what is really happening.

This raises the question of what investors will do next

What value do they place on preserving their capital by holding it in a bank and seeing it’s real worth reduce over time, versus looking for other options?

That’s likely to come down to how important that interest income is to them maintaining their spending. Can they cut back on spending, or are they already living on necessities? On top of this, how frequently is the investor looking for a return? If at least some of that income is required monthly, then investors will need to stagger the maturity profile of their Term Deposits to achieve this outcome.

So, if you’re looking for alternatives, what are the options?

Finance Companies

Based on past downturns, now’s not necessarily the time to chase yield at finance companies. The Reserve Banks Financial Stability (published in May 2020) report points out that debenture* renewal rates are running at 50%. The liquidity risks here are pretty important to monitor, alongside how their loan portfolio is performing and the makeup of that portfolio. From the same report, arrears rates are running at 7% at the end of March. There are some strong finance companies out there, however it would pay to do your due diligence on what you’re investing in and understand the liquidity and credit risks before investing.

*Debentures are a time-based investment with a fixed interest rate-based return, similar to a term deposit

Equity markets – direct investment

The risk factor between capital preservation from bank deposits to equities is getting close to polar opposite territory. While there will be some equities with reliable dividends out there, the share market isn’t normally the place for placing big bets when capital preservation is important. On top of this, if you’re looking for a monthly income, it’s pretty hard to organise via equity markets.

Bonds

Either directly investing in bonds, or indirectly via a managed fund may get closer to providing some degree of certainty on the regularity of a payment, however credit risk still needs to be accounted for. NZ Government bonds are paying way less than inflation and less than bank term deposit rates, so some degree of credit risk will be necessary to understand.

Managed funds

Undoubtedly there will be some options in here for investors. Key to determining what’s right for each investor will be understanding what the fund is investing. It’s a diverse field, and hard to discuss under just one banner. As always, make sure you understand what you’re investing in, and what the risks are.

Property

This is a pretty interesting investment category right now. There are some obvious risks that have emerged over the last few months for commercial property. Questions abound around how working from home might redefine commercial property needs for office space. Clearly some businesses will not survive the year calling into question other types of commercial space. Investments into single commercial properties would clearly have a high-risk profile normally, and that probably just got higher.

The residential property space is also interesting

Lots of mixed messages feeding through this market right now. We’re seeing a variety of economists suggesting price declines of 10 – 15% over the next 12 months. On the other side of the coin, the RBNZ’s reduction of the LVR restrictions has introduced a bubble of first home buyers who were close to achieving their deposit goal – all of a sudden, it’s game on for this group. Banks will be taking a pretty cautious view of who they’re lending to, however it pays to be a teacher, fire-fighter, or nurse right now with the stability of income that can bring.

The correlation between house prices and migration is pretty clear – how many kiwis will return home this year after losing jobs offshore or wanting to be closer to family?

NZ’s residential property market by all accounts is priced near the top of the affordability scale, however the LVR profile of existing home loans suggests prices can fall 20% without borrowers getting into negative territory on any scale.

Looking at downturns of the past, credit losses related to residential property are low, even with large falls in house prices (like a 50% drop).

So… what does Squirrel have that others don’t?

Squirrel has recently introduced two new investment classes based on residential property. Here’s a brief overview of our Home Loans Investment Class, and our Business Property Loans Investment Class.

Home Loan Investment Class

Focuses on owner occupiers and property investors that are typically asset rich but are often not treated very well by banks credit policies. Often these loans have a very strong LVR position, and they’re not ready yet to trade out to cash. This is the lowest risk investment class offered by Squirrel, returning 4.00% p.a. (variable). Returns are paid monthly (and occasionally fortnightly), and could be interest only, or principal and interest. These loans tend to have a duration of a few years, out to a maximum of 7 years.

Business Property Loans Investment Class

The Business Property Loans investment class focuses on construction of residential properties, typically turn-key lending. This is where the builder borrows the money, and has a confirmed, deposit-paid buyer on completion. These loans tend to be 9-12 months duration, with a maximum term of 2 years. This investment class offers a return of 5.00% p.a. (variable), with returns paid monthly on interest-only terms.

Three important features of investing with Squirrel using our peer-to-peer platform:

We have a Reserve Fund in place for each of our investment classes.

If the borrower misses a repayment, then the Reserve Fund attempts to step in to make the expected payment to the investor. When the borrower catches up, that payment goes to the Reserve fund to square things up. The key to this is that the investor should continue to receive their returns as scheduled – subject to the Reserve Fund having sufficient funds available to it to meet its current and expected future demands. You can find out more about this here.

Our secondary market supports investors offering their investments for transfer to other willing investors.

There is a small cost to this for the original investor, 1% of the value of the investment being sold, up to a maximum of $50 per investment.

At Squirrel, our peer-to-peer lending is match-funded.

That means every loan has a suite of investors who are locked into that loan until it is repaid (noting the option of using the secondary market to transfer investments). That means we do not have the same liquidity risk that finance companies typically carry as they often have a mismatch between the term of their investments and the term of their lending.

Squirrel is a peer-to-peer market service provider licensed by the Financial Markets Authority. You can find out more about investing with us here.

JB (the Squirrel Chief) and Dave Tyrer (Director of P2P) jumped online for some webinars, talking all about investing through Squirrel and answered lots of questions. Have a watch below.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.