Act now on 3.95% mortgage rate specials | why they won’t last

Most media commentators are hooked on the new ‘rate war’, and the question being asked is if this is the new ‘norm.’ It isn’t, and more than that, you could easily miss out if you procrastinate.

In Australia, mortgage rates have been below 4% for years, so it’s easy to get complacent and presume these rates could continue.

However, this belief is flawed.

For now, ANZ has published that its 3.95% 1 year-rate will end on 2nd December, so that’s a good end date to work to. Although in reality these rates could continue to Christmas.

It’s easy to get carried away with a rate of 3.95%, but it’s not all that different to a rate of 4.05% and these rates are only on short-terms. If you’re familiar with my other blogs you’ll know I’m not a fan of the 1 year fixed term. I much prefer 3 year rates around 4.29% - 4.30% with a healthy cash back. A big cash back can leave borrowers financially much better off than simply a ‘hot’ rate.

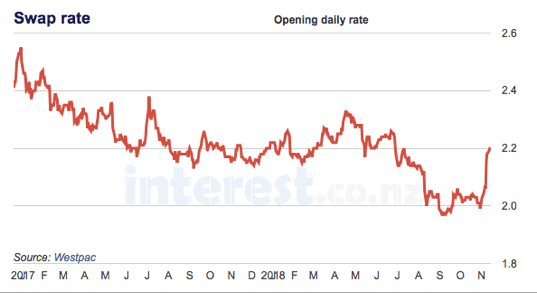

Wholesale Rates have Spiked this week

Whenever homeowners rush to fix their mortgage, wholesale rates that banks fund off, tend to spike. We have seen that this week with bank funding costs increasing by 0.20% at the same time as banks have dropped mortgage rates. In totality, this is about a 0.40% drop in bank margins. Bank margins are now the lowest they have been for five years.

Bank Financial Reporting

There are a few reasons why banks have ended up competing at this time of the year. The first is that three of them (ANZ, BNZ and Westpac) all just started new financial years, so the CFO doesn’t yet have a firm hand on the tiller. The sales team get away with chasing growth for the first quarter until the bank slips behind plan and then they go for margin. The second reason is simply the spring season and more activity. The third is the volume of fixed rate rollovers that come up at this time of the year, and finally the political pressure of just having reported billion dollar profits (or in ANZ’s case $2 billion).

The Little Guys can’t play this game for long

SBS and KiwiBank are reliant of retail bank deposits, which is an expensive form of funding. At the margin, small banks are lending at 3.95% and paying 3.60% on term deposits. This is not remotely sustainable.

What would I do, if?

If you're refixing now, by all means jump on the lowest rate. Personally I like the 3-year rate. It's slightly higher in the short term but I think it will perform better over the next three years. Rates will eventually increase but it doesn’t take an OCR change to increase fixed rates. A mere change in sentiment will start to push rates up.

If you have a fixed rate maturing early next year, I’d break it now and refix to take advantage of the low rates. Because wholesale rates have spiked up, the break fee shouldn’t be prohibitive. You can estimate your break fees here.

If you’re generally frustrated with your bank, then refinancing could be an option. We can get a combination of low rates and a healthy cash back. The easiest way to refinance is jump online and do our online application that takes about 10 minutes to complete. That will give our advisers enough to talk you through your options and what makes the most sense.

If you have less than 20% equity and are missing out on all of these awesome rates, then I’d talk to one of our advisers about this 'hack' that could save you thousands.

The fastest way to take action would be to complete our online application (takes about ten minutes) and we can assess all of the options for you.

At our interest page, you can find the latest interest rates as well as frequently asked questions relating to mortgage interest rates nz. You can also use our mortgage calculators to estimate what your repayments might be. Speak to a mortgage broker Wellington today to stay updated on your specific mortgage rate situation.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.