Auto-investing and auto-withdrawal 101

Whether you're a newbie or a seasoned investor, if you've ever wondered how you can get your Squirrel peer-to-peer investments working harder and smarter, read on.

Just a reminder that we can’t offer financial advice on how you should structure your investments however we can provide some facts on how the platform works:

Recurring investment orders

Specifying an investment order as ‘Recurring’ (currently known as ‘Auto-bid’) is a feature that will see the Platform automatically create a new investment order, based on the investment parameters you specify, any time you get sufficient funds into your on-call account. That saves you time and helps to get your money working faster.

We’ve recently tweaked the functionality behind recurring investment orders so that the Platform will now consider any new funds you deposit into your on-call account as being available to the recurring investment order process (in addition to any investment repayments received into your on-call account).

Setting up a recurring investment:

When you go through the steps of creating an investment order, you will have the option to designate the investment order as either: One-off or Recurring (Auto-bid).

If you have a recurring investment order in place, the Platform will check your on-call account each morning and, if the available funds in your on-call account meet or exceed the value on your recurring investment order, it will create as many investment orders as it takes to consume those funds up until the point that the available funds in your on-call account no longer exceed the value on your recurring investment order. For example, if you have a recurring investment order in place with an investment value of $500 and you have $1,200 in your on-call account, first thing in the morning the Platform will create two investment orders for $500 and you will be left with $200 in your on-call account.

Things to note:

- The minimum investment order value of $500 still applies when you create a recurring investment order.

- Once an investment order is created from your recurring investment order instruction, the new investment order behaves just like a manually created investment order and you can cancel it at any time.

- You can only have one investment order designated as recurring at any given time. If you create a new recurring investment order, it will simply supersede any recurring investment order that you previously had in place.

Recurring withdrawal:

Our recurring withdrawal feature allows you to set up an automatic and regular withdrawal of funds from your on-call account to your registered bank account. Essentially setting up an income stream from your Squirrel investments.

Setting up a recurring withdrawal:

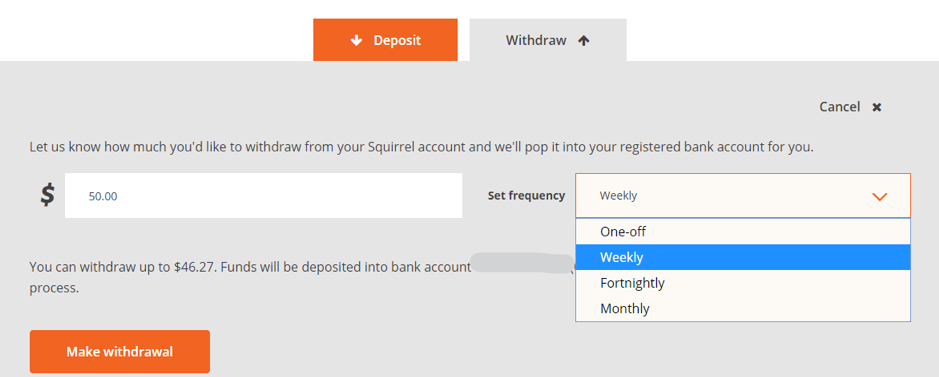

To set up a recurring withdrawal, start by following the normal steps for making a withdrawal from your on-call account. You’ll notice next to the amount you wish to withdraw, there’s a ‘Set frequency’ drop-down box with options for either: One-off, Weekly, Fortnightly, or Monthly.

To create a recurring withdrawal, simply select the amount you would like to withdraw and either a Weekly, Fortnightly or Monthly withdrawal frequency. The Platform will automatically withdraw the specified amount at the specified interval, starting from the date you create the initial withdrawal request (including an initial withdrawal on the day that you create the recurring withdrawal request).

Things to note:

- You can only create a recurring withdrawal request for an amount that is less than or equal to the balance of your on-call account at the time the recurring withdrawal request is created.

- If the balance of your on-call account is below the amount you specified on your recurring withdrawal request on the date of a scheduled withdrawal, the Platform will by-pass your recurring withdrawal request for that date and only try again on the next scheduled withdrawal date.

- To work out the appropriate withdrawal amount and frequency, you should try to estimate your investment repayment flows by checking what repayment amounts are coming into your on-call account and at what frequencies, then select the appropriate option when setting up your withdrawal request.

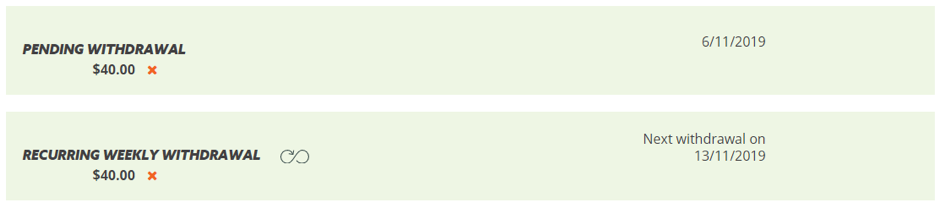

- If you wish to check you have set your recurring withdrawal up correctly, go back to your on-call account tab, where you will see a ‘Pending Withdrawal’ line for the day you set up the withdrawal, and on the next line there will be a ‘Recurring Withdrawal’ with the next scheduled withdrawal date displayed.

You can cancel a pending withdrawal request any time before 3pm on the day of the scheduled withdrawal by simply clicking on the X next to the withdrawal amount. You can cancel a recurring withdrawal request at any time the same way.

This article was updated on 7 November 2019.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.