Regular income is easy with auto withdrawal

Whether you’re a newbie or seasoned investor, using your investments on our P2P platform is an easy way to generate a regular income for yourself.

Just a reminder that we can’t offer financial advice on how you should structure your investments, however we can provide some facts on how the platform works.

How does auto-withdrawal work?

Most of our investors have invested a chunk of money over time. This results in having investments in a range of different loans, with different repayment dates. During the course of the month, repayments are made which often accumulate in the investors’ account.

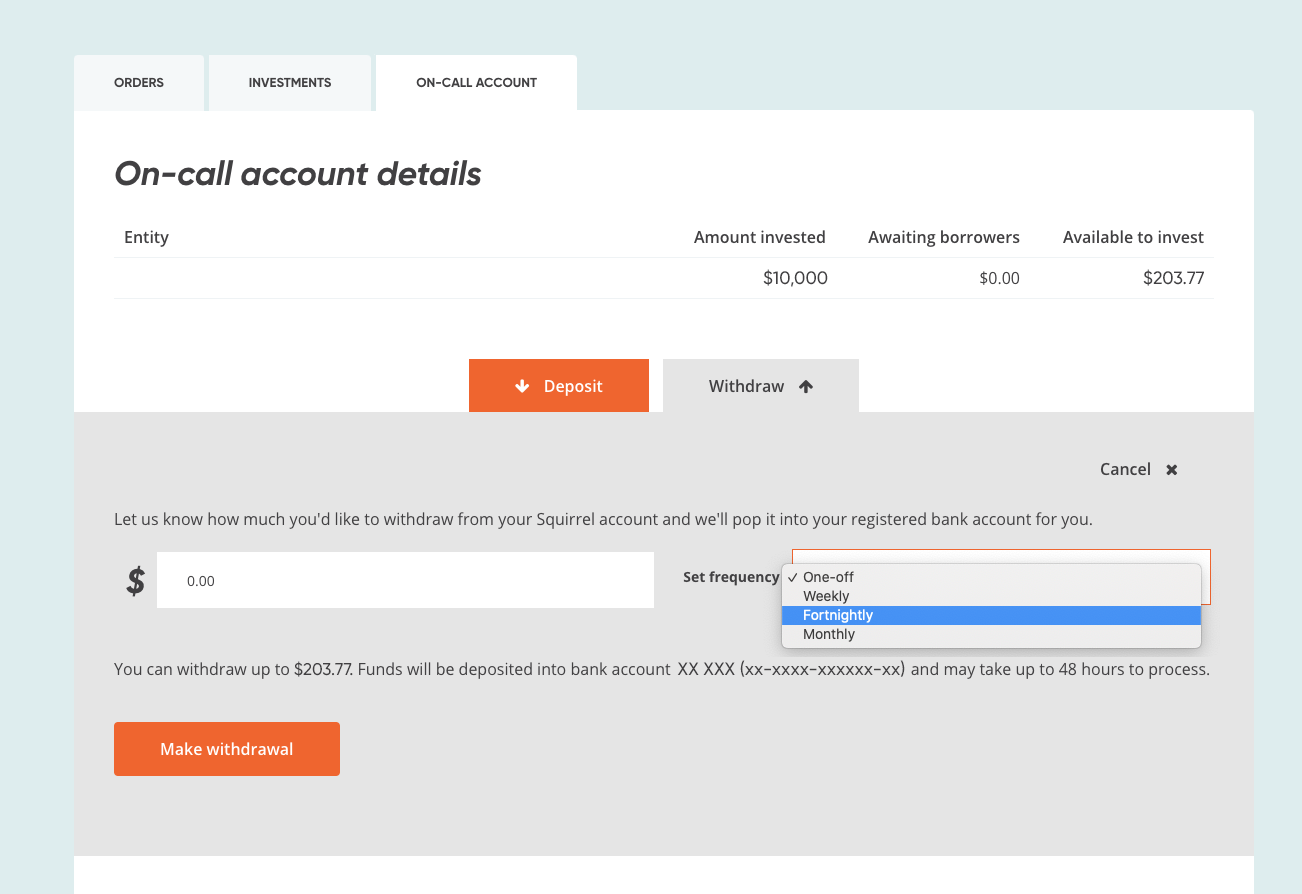

You can schedule to have some of your return paid on a weekly, fortnightly, or monthly basis to your bank account (like having a regular tax paid income). To do this, login and head to the On-Call account tab on our website or in the Squirrel mobile app. Three simple steps:

- Type in the amount of the regular withdrawal you’d like to make

- Adjust the frequency to suit you

- Click ‘Schedule withdrawal’ and you’re done

Assuming there is enough money in your call account on the frequency you’ve set up, we’ll make the payment to you. Normally you’ll see the money in your bank account in the evening of your scheduled day. If you set it up before 3pm on a business day, it will happen that day. If you set it up after 3pm, it will happen the next business day.

Cancelling the auto withdrawal is just as easy. If you head to the withdrawal page once you’ve logged in, you’ll see a green box with the scheduled withdrawal information. Simply click on the ‘X’ in the box, and voila, it’s cancelled. You’ll need to do it before 3pm on the day of the withdrawal.

Things to note:

- You can only create a recurring withdrawal request for an amount that is less than or equal to the balance of your on-call account at the time the recurring withdrawal request is created.

- If the balance of your on-call account is below the amount you specified on your recurring withdrawal request on the date of a scheduled withdrawal, the Platform will by-pass your recurring withdrawal request for that date and only try again on the next scheduled withdrawal date.

- To work out the appropriate withdrawal amount and frequency, you should try to estimate your investment repayment flows by checking what repayment amounts are coming into your on-call account and at what frequencies, then select the appropriate option when setting up your withdrawal request.

- If you want to check that you have set your recurring withdrawal up correctly, go back to your on-call account tab, where you will see a ‘Pending Withdrawal’ line for the day you set up the withdrawal, and on the next line there will be a ‘Recurring Withdrawal’ with the next scheduled withdrawal date displayed.

Got questions about withdrawing from your account? Give us a call on 0800 21 22 33 or email money@squirrel.co.nz.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.