How Launchpad is helping boost Kiwis into homeownership faster

Every day we talk to frustrated first home buyers with excellent stable income but to get a deposit up to 20% in today’s housing market takes years. It’s a common story. You’re ready and can afford to take on a mortgage but the bank won’t let you. Kāinga Ora isn’t an option for higher earners due to income caps and house price caps. It just isn’t fair, right?

That’s where we saw a gap, so we're filling it

Squirrel is in a unique position that we are both a broker and a lender, enabling us to do what other brokers or lenders can’t. We engineered the Launchpad process to enable first home buyers to shoot into home ownership faster. And we can’t wait to help as many first home buyers as we can.

Here is a common scenario we see regularly:

- Jane and Steve, a professional couple, are wanting to buy a house costing $840k;

- They have household income of $150k a year, a great credit record and $50k saved towards a deposit;

- They are currently paying $550 a week in rent, and that is likely to increase around 2% per year;

- They qualify for a Launchpad loan that could see them obtain funding of $790k made up by a $118k personal loan at 9.95% and repaying over 5 years, plus a $672k mortgage at 3.2%1 that is interest only for the first 5 years. The blended rate at drawdown for the lending in this example is 4.23%.

1 This rate can range from 2.99% to 3.49% depending on term(s) selected.

Jane & Steve now have some options to consider:

Option 1: keep on renting while they save up for a 20% deposit; or

Option 2: take on the Launchpad loan and get into their own home quicker.

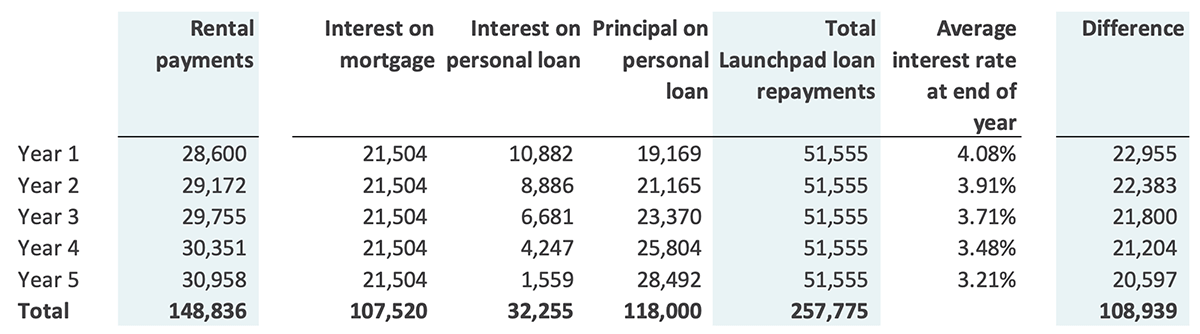

To help Jane & Steve decide, here’s a very basic comparison of the rental costs and borrowing costs they would likely incur under these two options over a 5 year period:

Over 5 years, they could either:

- Simply pay $148.8k in rent. Without having any mortgage repayments their expenses will be at least $109k lower than the home ownership option. If we assume that $109k is the total amount they are able to save and ultimately have that available for a deposit in 5 years time – that would give them a deposit of $161k after 5 years i.e. the $50k from 5 years ago plus the $109k they have ‘saved’ by not having a Launchpad loan over the last 5 years. If they obtain an 80% LVR (loan-to-value ratio) loan, the $159k deposit would allow them to purchase a house worth $795k (in 5 years’ time); OR

- Take out a Launchpad loan now, buy the house and over the next 5 years (assuming they pay off the loans per the scheduled repayments set up on Day 1) they will pay interest of circa $140k and repay principal of $118k. It's interesting to see that the interest cost is actually around $9k less than the $550 per week in rent they would have paid over that period.

Worth noting is that the blended interest rate automatically drops as they get more equity in their home – that’s because they are repaying the higher cost personal loan first and getting a higher proportion of their total borrowings from the mortgage loan component of the Launchpad loan.

It's also worth mentioning that the personal loan can be repaid early, with no fees for early repayments. That gives Jane and Steve the ability to lower the average interest rate they are paying even faster if, for example, they receive lump sums from bonuses or gifts etc. or have increased earnings.

Rent or buy?

The value of the house they purchase obviously has a bearing on whether they are better off renting and saving or taking out the Launchpad loan and getting into home ownership sooner. We clearly can’t predict what the house value might be in 5 years – but the scenarios are: that the house value is the same, it is lower, or it is higher.

Scenario 1: at the end of that 5 year period, if the house value hasn’t changed:

- Under option 1, they would be able to buy that same house with a $168k (20%) deposit; or

- Under option 2, they will have an LVR of 80% (and equity of $170k).

Under this scenario, it is pretty much neutral whether they are better off waiting for 5 years to come around and jump into the market then or buy in now. They will have to save a little longer though as they’ve only managed to accumulate a $159k deposit in this example.

Scenario 2: at the end of that 5 year period, if the house value has gone down 5%:

- Under option 1, they could now buy that house with a $160k (20%) deposit; or

- Under option 2, they will have an LVR of 84% (or equity of $128k which is down from the $170k of equity they have contributed to date).

Under this scenario, their equity in the home will have reduced by $42k over the 5 years and they will probably have been better off to rent, save and wait to purchase the house.

Scenario 3: at the end of that 5 year period, if the house value has gone up by 5%:

- Under option 1, they will need a $176k (20%) deposit to buy the same house; or

- Under option 2, they will have a LVR of 76% (and equity of $212k)

Under this scenario, option 2 clearly shows that they are better off taking the Launchpad loan and getting into home ownership sooner. Note under this scenario, the deposit required to buy that same house under option 1 has increased, meaning it is probably another year or so before Jane and Steve will save enough for the deposit on that house.

Which scenario do think is more likely?

The boring bit:

This blog post is intended as a guide for illustrative purposes only and is not intended to provide financial advice. It does not include a full analysis of the affordability of this loan nor the sundry costs associated with home ownership. Interest rates are indicative and subject T&C’s and are subject to change.

To talk to one of our Squirrel mortgage advisers, please call 0800 21 22 30 or you can find more information about the Launchpad loan here.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.