Why you should use a (good) mortgage broker

Buying a home is a tricky business. There are so many considerations to take into account. Sometimes you might feel as if you’re about to take a giant step into the abyss. You hope for the best outcome and pray that nothing bites you in the proverbial.

There are many counter-parties that contribute to a successful property buying experience. Real estate agents, valuers, building inspectors, councils, solicitors, banks… the list seems to go on forever and it can end up costing you a pretty penny. Then there’s the process. How does it all work? Who does what? What are the timelines? Managing this process and pulling it all together is time consuming and often confusing; especially for first home buyers.

The housing market is a competitive environment. Often buyers feel pressured to make hurried decisions in order to achieve a purchase. It’s a whole lot of money you’re parting with and you have every right to ensure you are making an informed and correct decision.

Finance is a biggie. Most buyers will require loan funding to secure their dream. The world of mortgages is a complex beast, with rules and regulations aplenty. Loan to value restrictions, strict credit criteria, interest rates, etc make the mortgage journey a hazardous one. Gone are the days when your friendly bank manager simply handed you the loan to buy the house.

Enter the Mortgage Broker, the caped crusader of the home buying universe. A good broker will work with you from the outset of your house hunting journey. They will advise you on the best course of action, given your circumstances. They know the rules inside out, and can figure out how to make the finance work best for you. A good mortgage broker will be a sounding board for your house ideas – they have reviewed countless buying opportunities and know what to look for and what to avoid. They will provide advice on pricing and buying strategy. They will recommend other professionals to assist you in making a sound property decision. Most importantly, a good mortgage broker will act as the lynch pin, the glue, that holds the whole process together. They’re basically the project manager, ensuring the whole thing works seamlessly so you have the keys to the door come settlement day.

A good mortgage broker provides a valuable service. What’s really amazing is that this service comes at no charge (for most). That’s hard to beat.

Do you know a good mortgage broker? We do.

Keen to hear more about how a mortgage broker can help you?

We narrowed it down to 50 reasons.

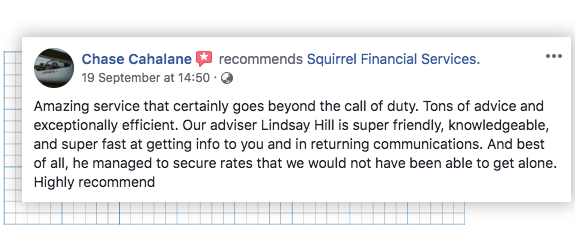

Check out what others have to say about us.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.