Everything there is to know about investing with Squirrel Money

If you’re familiar with the Squirrel brand, then you’ll know about the other side to our business: peer-to-peer lender Squirrel Money.

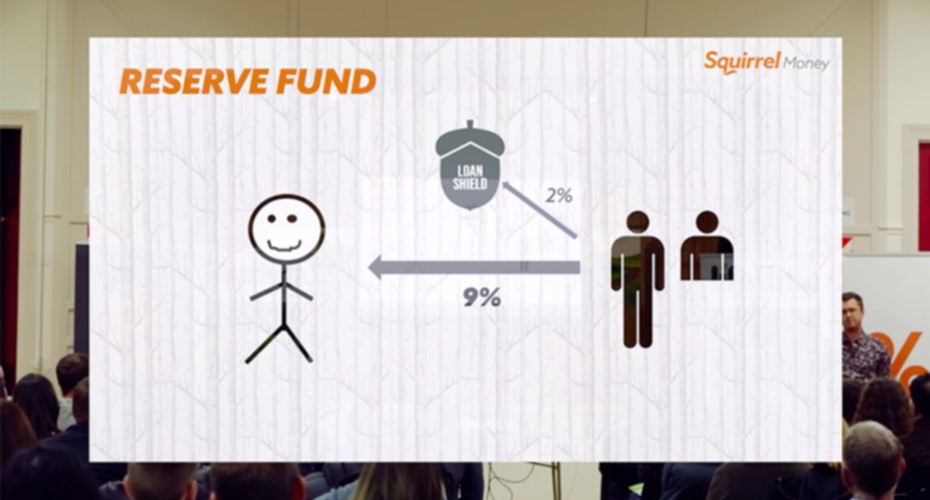

If you're not that familiar with it, the concept is simple: we use funding from people keen to invest, and lend it to people who want to borrow. Investors are receiving return interest rates between 7% - 9% p.a. and borrowers are getting competitive interest rates which start at 8.95% p.a. for a secured loan. Squirrel Money is able to offer fair rates to both sides, because there are no fat cats in the middle taking a big chunk. It’s a lean operation with an entirely online based platform so there aren’t massive overheads to cover.

Spreading the word

Earlier this year, chief Squirrel JB travelled the country with two other industry leaders Sam from Simplicity and Ralph from Lifetime, to share their latest financial innovations for building and managing wealth. What they presented is actually nothing new, although these options are fairly new in New Zealand.

The old "what goes on tour stays on tour" doesn't apply here. (As far as you know). What we can tell you is JB gave a 15 minute presentation on everything there is to know about investing with Squirrel Money, and you can view it here. Complete with his original stick figure drawings and voice over. This video is a must-watch for all potential investors.

Learn about how peer-to-peer lending works, the different models, and why Squirrel Money is different. The elephant in the room (aka risk) is out in the open, and most importantly how the risk is managed, and of course the benefits of investing.

If you’ve got questions, give the team a call and they'll be happy to chat anything through. 0800 21 22 33 or email money@squirrel.co.nz.

Read our Terms of Engagement, where we give you more information about us and our services. You can also read our Investor Agreement document, that has all the information you need to know when investing into Squirrel Money.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.