Why you should buy a house

There’s a lot of chatter around at the moment. “Have house prices peaked?” “Are house prices too expensive?” “Should I wait to see what happens?”

They are fair questions. After all, we’ve experienced a significant surge in prices over the past few years. Auckland has been in the driving seat. The inexorable rise in Auckland prices has spread its tentacles to the whole country. It had to; the balance was way out of whack, so something had to give.

We can all pick apart the underlying reasons why NZ is one of the highest priced property markets on the planet. To me, the fundamental reason is systemic… the only way to resolve a systemic issue is by concerted government interference. No 3-year term elected government is going to institute the changes necessary to fundamentally change the residential property landscape in NZ.

The world is wealthier, more mobile and better connected than ever before. NZ regularly makes the top ten list of the places where people would migrate to, given half a chance. Just think, if 1% of England’s population decide to up sticks to NZ, that’s over 500,000 people knocking on our door, buying our houses.

When I fly over our magnificent country, I look out the plane window and I wonder over the vast tracts of land that pass beneath us. We have land galore. Trouble is, we can’t use it for housing. The majority is locked up in farming, conservation and Maori land. Imagine if we could build a fresh, new city, capable of housing 500,000 chanting Lions fans. Imagine it. Modern infrastructure, clean energy, business incentives, and lifestyle attractions. Chances of this happening? Nil. Too many interests to protect. Too stuck in our ways.

Most homeowners in NZ have a significant proportion of their wealth tied up in the home. This home is an asset, but it doesn’t build real wealth. You don’t make money on your own home. You have to live somewhere. Invariably, you will sell the home and probably buy another. Most people effectively swap their own house for another. Your home is a form of currency. The way to generate real wealth from property is to buy a second home.

Consider your circumstances when you will be approaching your retirement. What proportion of your retirement earnings will be consumed by rent payments? It’s an altogether more attractive option to be in a position where you own your home. The uncertainties around the future of National Super make this an even more important consideration.

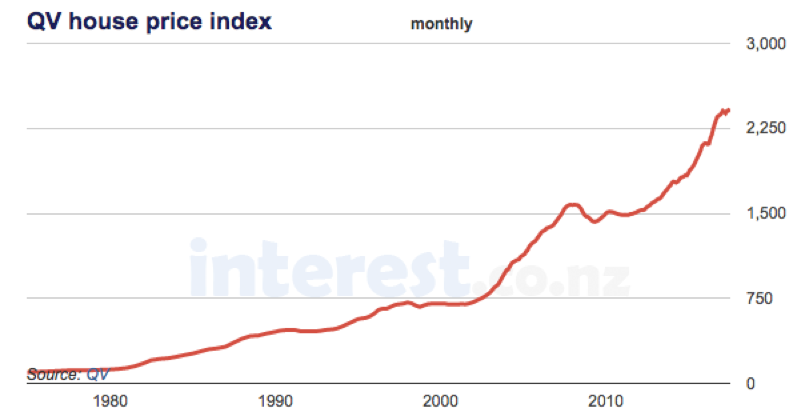

Current house prices are high. Nobody disputes that. But, back in 1980, house prices were also “high”. But, back then we had high interest rates, high oil prices, high inflation, high unemployment – hardly an encouraging environment to invest in real estate. But people did. Those that bought houses in the 1980’s (and onwards) are now sitting on considerable equity positions. Sure, their “currency” remains relatively flat, but where would they be if they didn’t buy?

You can use our mortgage calculators to calculate how much money you can borrow to buy a house, as well as what your repayments would be.

The real risk in housing is not in the decision to buy a home, but rather in the decision to not buy a home.

Look at the QV House Price Index since 1980. Notice a trend?

Forget Fear Of Missing Out (FOMO). Think about Fear Of Kicking Yourself Later.

Top Reads:

- NZ Mortgage Rates and Housing Insights 2018

- Getting Started - First Home Buyers

- Mortgage Interest Rates

- Mortgage Calculator NZ

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.