Search results:

Auckland Central housing and the million dollar mindset

There is a state of disbelief that house prices in a number of emerging Auckland city suburbs are hitting $1m. I can only think this is because we think $1m is a lot of money. It isn’t.

Credit crisis | How the housing life cycle is broken

In one of my recent posts I discussed how the Boomer population was the driving force behind the last boom and the massive increase we saw in house prices over the past 10 years in particular.

Mortgage rates | OCR unchanged at 2.50%

As expected the official cash rate (OCR) remained unchanged today. Better still, Big Al (the "Gov") left the door open to not start pushing rates up until later in the year.

Is 2010 a good time to buy property?

If buying a property is one of your goals in 2010 then an obvious first step is to get a mortgage pre-approval in place or figure out what you need to get one done.

How the market is mispricing mortgage rates

In previous posts we have shown you how to save tens of thousands in mortgage interest by leveraging short-term rates and repaying your mortgage faster. In this post we show you that long-term rates are overpriced, and that whilst mortgage rates will increase, it won't be nearly as fast as the media banter would suggest.

Why short-term mortgage rates are best

The Reserve Bank has committed (as much as it can) to holding rates low for the foreseeable future and why wouldn't they?

Don't panic about rates!

Stop, breathe deeply, think. If you haven't fixed yet ... don't panic.

What rate is best? Post-OCR rate update

On March 12, the Reserve Bank decreased the official cash rate (OCR) by 0.50%, from 3.50% to 3.00%.

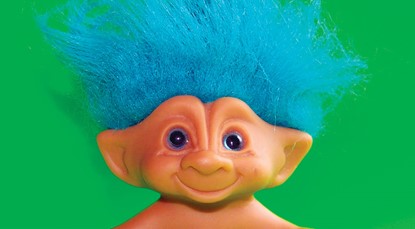

Have you seen a bank troll lately?

It is official: you are just a number, albeit a fairly long number 014450-00867845-00.