Aussie bankers should be losing sleep over NZ’s housing market – but not for the reason they’d have you think

Post by David Cunningham – Chief Squirrel

It’s not often you get a good laugh reading the Australian Financial Review (AFR) — but earlier this week, one of its lead headlines made me chuckle.

It read “Why the New Zealand housing market keeps Aussie bankers awake at night”.

The by-line went on to say…

“The New Zealand home loan market is a worrying case study of how savagely bank lending margins get whittled away when demand for credit is weak.”

So, where’s the joke in that?

It’s the fact that bank margins in New Zealand are at record levels right now — higher than they’ve been in about 10 years.

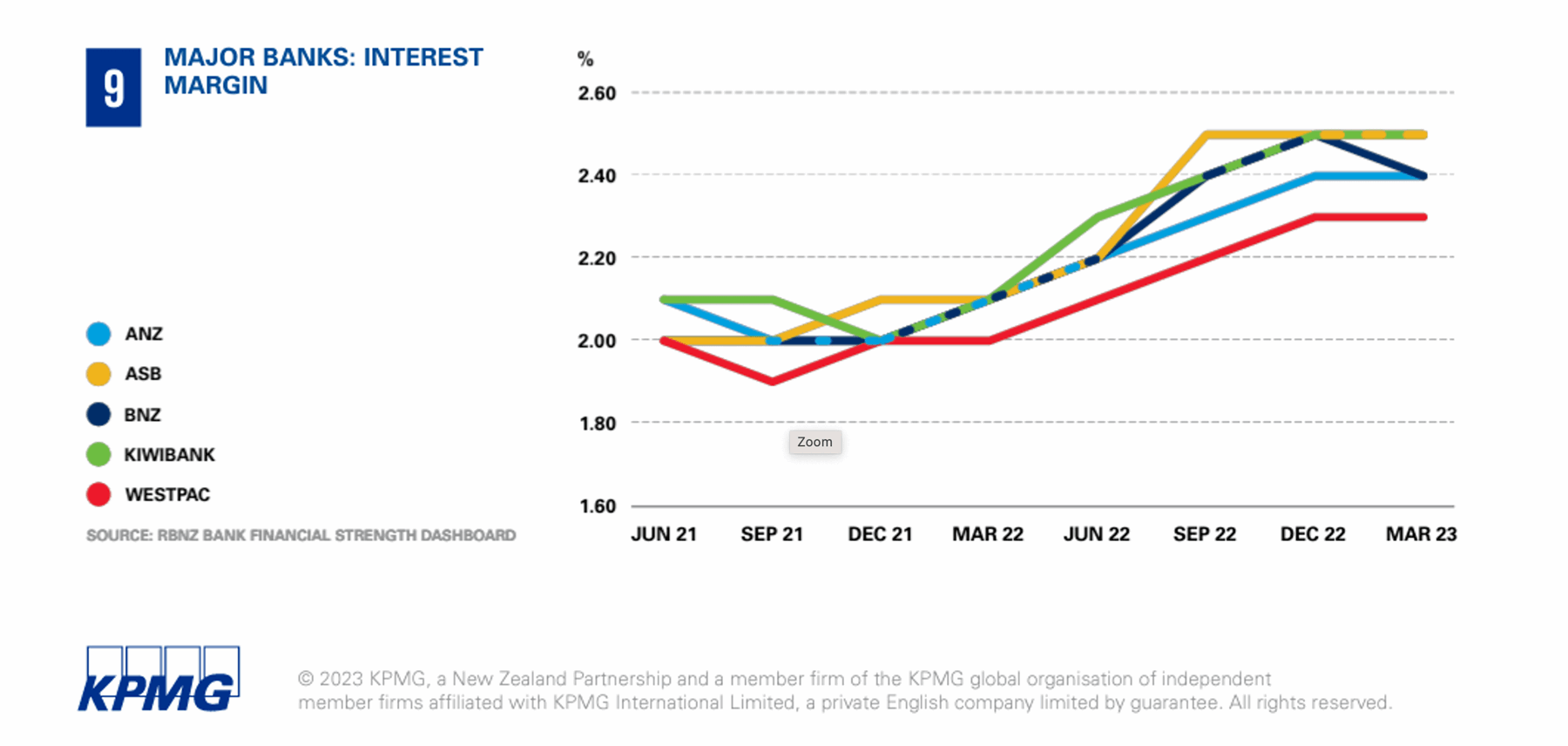

The below picture, courtesy of accountancy firm KPMG, shows just how much bank margins have grown in the last couple of years.

So where on earth did the AFR get that headline from then?

The article was based on comments from Matt Comyn, CEO of Commonwealth Bank — ASB’s parent company across the ditch.

He’s reported as saying that “the mortgage market in New Zealand is even more challenged [than in Australia], where pricing conduct is difficult to reconcile”.

According to Comyn, ASB has pulled back on volume growth in New Zealand given “unsustainable returns”. That’s my emphasis, by the way.

But in my opinion, the picture Comyn is painting here is completely disingenuous.

The fact is that bank interest margins, profits and return on equity in NZ are stronger than they’ve been in a long time.

Comyn’s comments wilfully ignore the point that banks derive their income from more than one source — interest margin across both loans (like mortgages) and deposits.

You can’t and shouldn’t look at one in isolation from the other — and of course, Mr Comyn knows this. It’s Banking 101.

And it’s also how Commonwealth Bank delivered $10.2 billion of profits in the latest financial year.

Let’s take a quick look at how it works — starting with fixed-rate mortgages.

Through the first half of 2021, the 2-year fixed home loan rate was 2.5%, while the 2-year wholesale interest rate was 0.1%. That’s a margin of 2.4%.

Right now, the respective rates are 6.8% (home loan) and 5.5% (wholesale). That’s a margin of 1.3% — so, about 1.1% less than at the start of 2021.

That’s got to hurt, right? Not exactly.

Because, at the same time, the bank margin on deposits has skyrocketed.

On funds held in Kiwi transaction accounts — about $40 billion — the bank margin has lifted by roughly 5.5%. On the $75 billion Kiwi have stashed in savings accounts, it’s grown by about 2%. And there’s been margin expansion in the $115 billion bank term deposit portfolios, too.

All up, that expansion in deposit interest margins (which are gargantuan right now, by the way) is worth close to $5 billion, much of which has gone straight to bank profits.

So yes, home loan margins have shrunk — perhaps some small consolation for Kiwi mortgage borrowers — but the banks are more than making up for it in the deposit space.

If I were still a bank CEO here in New Zealand, I’d certainly be tossing and turning at night. Not because margins are low, but because they’re eye-wateringly high!

Headlines like this only tell one very small part of the story — and there are huge implications for New Zealand mortgage holders

The assertion that home lending in New Zealand is delivering unsustainable returns is exactly why last month our banks were still hiking fixed mortgage rates for Kiwi home loan borrowers.

And the particularly galling thing is that banks are consciously expanding margins in the face of a pending Commerce Commission inquiry.

If that’s not raising the middle finger, I don’t know what is.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.