Job done: Why the monetary policy tightening cycle is over

In a nutshell:

- Mortgage interest rates are likely to fall modestly over 2023, and more substantially over 2024 as inflation is reined in.

- Recent rises in shorter term fixed mortgage rates will start to reverse during May.

- There is a world of pain still to come from many Kiwi homeowners. On average, they’re not even halfway through the pain of higher interest rates.

- The increased interest on a new half million dollar home loan today compared to two years ago is equivalent to almost $30,000 of pre-tax income.

I’m going to start this article with a bold statement: interest rates in New Zealand have peaked for this economic cycle.

It’s a big call, given most economists are picking yet another 0.25% Official Cash Rate (OCR) hike later this month, on 24th May, and financial markets are also already pricing that same size increase into fixed rates.

And after all, we’re only 0.25% off the Reserve Bank’s (RBNZ’s) forecasted peak OCR – so would they really stop now?

Well, I think they will.

And here’s five reasons why I think the OCR, and mortgage interest rates, have peaked.

1. Inflation outcomes the world over, whilst still high, are falling – and in fact, they’re often surprising us by coming in well under expectation.

Case-in-point was New Zealand’s inflation result for the March 2023 quarter.

The market expectation was that it would stick somewhere around 6.9%. The RBNZ, meanwhile, was expecting 7.3%. The actual result was 6.7%. That’s a massive undershoot, especially against the RBNZ’s forecast.

While we haven’t won the battle yet, inflation in almost all Western economies is falling: Australia, Canada, the United States and Europe are all seeing their inflation stats tracking downwards.

2. There is a ‘world of pain’ still to come for many Kiwi homeowners

We’ve been hit with 11 OCR hikes in the last 18 months – skyrocketing from 0.25% in October 2021 to 5.25% now – and yet the impact of those hikes is still less than halfway through its transition through the economy.

This graph from Westpac’s Economics team shows this perfectly.

* The effective mortgage rate is an estimate of the average interest rate borrowers are paying on all outstanding mortgages and accounts for the fact that most borrowers pay fixed rates that are only periodically renegotiated rather than paying the interest rates that are currently on offer.

In short, when mortgage costs were at their lowest, the average rate being paid by the one-third of Kiwi with a mortgage was 3.2% per annum.

Today it’s 0.9% higher, at 4.1%. And it’s got another 1.6% to go.

So, if we’re hurting now, there’s a lot more pain to come – and it would take massive cuts to the OCR to reverse this.

In my opinion, forging ahead with any more OCR hikes at this point would be lunacy. And I don’t think the RBNZ is run by lunatics.

To further illustrate the point, in April 2021 the 2 year fixed mortgage rate was 2.6%. Today it’s around 6.6%. On a $500,000 home loan, that’s another $384 per week to find, which adds up to about $20,000 per year.

Without a pay rise of almost $30,000 p.a. (pre-tax) that money’s only coming from one place: reducing household spending elsewhere.

Economics 101 says that if demand goes down as a result of us all spending less, the downturn will ripple through the labour market and wage growth, and ultimately dampen inflation.

The Reserve Bank needs to allow time for these transition mechanisms to do what they will inevitably do. There’s no prizes for kicking someone when they’re down.

3. The markets are pricing interest rates to fall

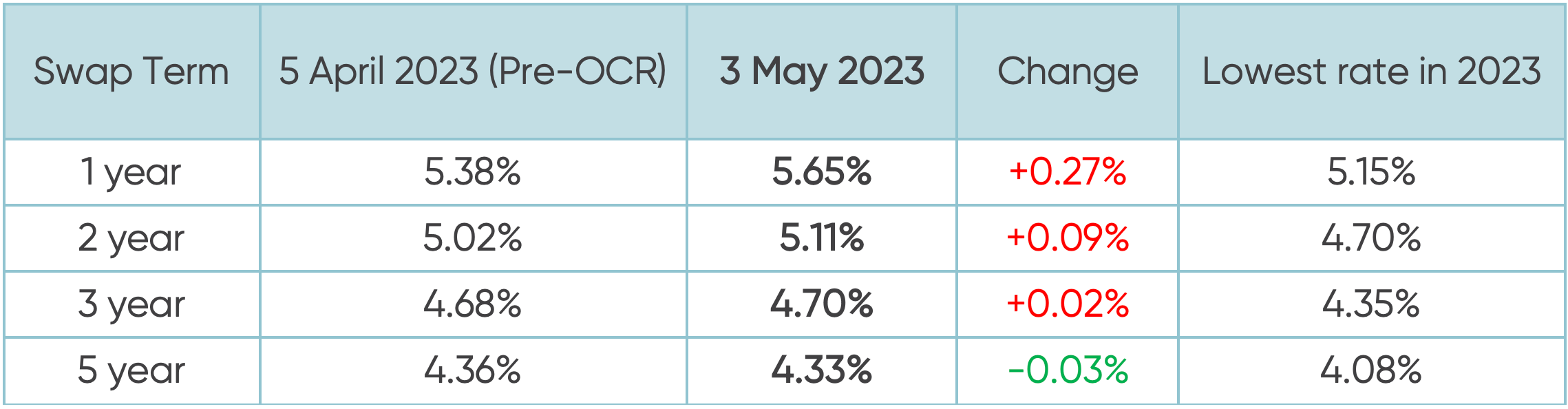

The table below outlines current swap interest rates, which are the major decider of fixed mortgage rates out in the market.

You can see in the bolded rates (from 3rd May) that the yield curve is now strongly inverse, meaning that longer term rates are sitting much lower than shorter term rates.

In other words, interest rates are expected to fall.

Other than the one-year term, which is heavily impacted by movements in the OCR (like April’s surprise 0.50% hike and the 0.25% many are expecting next) markets are pricing interest rates to start coming down.

The timing of interest rates falls is of course the big question, but towards the end of 2023 I’d expect to see falls of up to half a percent for many fixed rate terms.

4. Banks have unjustifiably raised fixed interest rates

Following the 5th April OCR hike, many banks raised fixed mortgage rates for shorter terms.

If we look specifically at the two-year fixed rate, most banks pushed through a 0.10% increase, taking it to around 6.6% p.a. which is the highest it’s been for a decade.

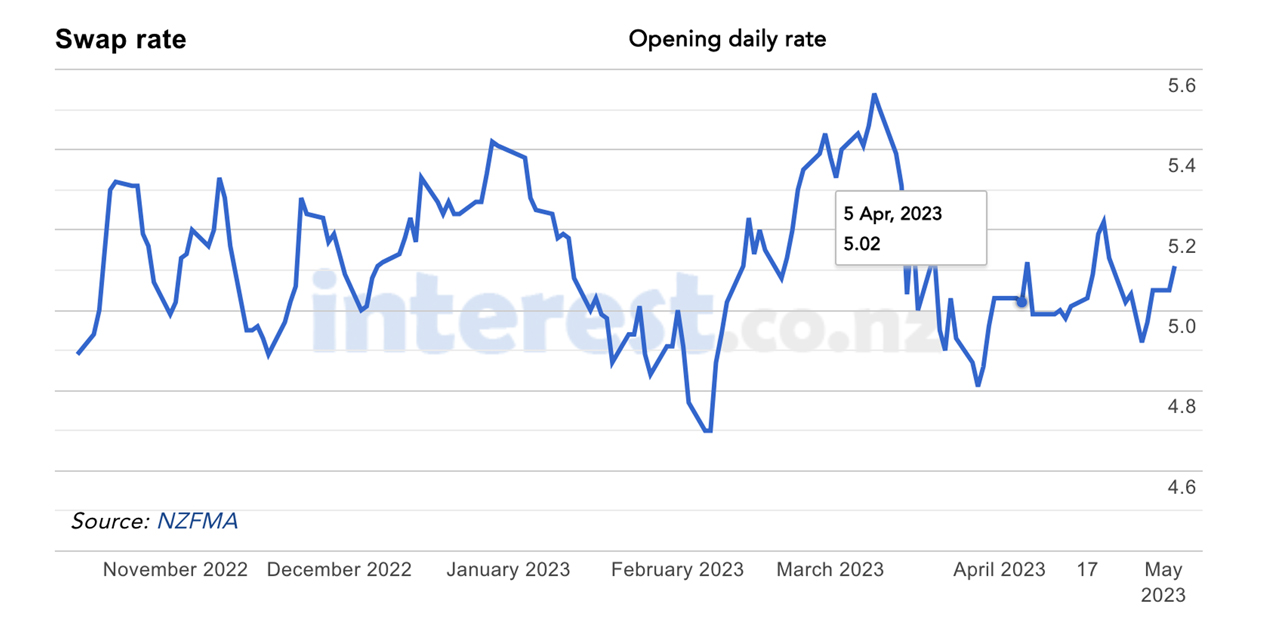

But going back to those swap rates, here’s a picture of how the two-year swap rate has tracked over the last six months.

It’s ranged from 4.7% to 5.54%, with an average of about 5.25%. Right now the two-year swap rate is about 5.1%, below recent averages and well below the peak. And yet two-year mortgage rates in market are at decade-long highs.

This won’t last, and bank competition for business will see the two-year fixed mortgage rate fall. In fact, one of the second-tier banks is already offering rates 0.25% below the major banks for that term.

Chart sourced from Interest.co.nz

5. And globally, we’re seeing mounting evidence that interest rate tightening cycles are coming to an end.

In the United States, most economists are forecasting just one more 0.25% increase in the Fed Funds rate, to a target range of 5.0% to 5.25%. It’s then expected to fall over 2024.

Across the ditch, the Reserve Bank of Australia (RBA) delivered their 11th interest rate hike this week (to 3.85%), but some economists are now calling that the tightening cycling is over.

The monetary policy transmission mechanisms are much slower in New Zealand than Australia due to the prevalence of fixed rate mortgages, so it makes even more sense for our Reserve Bank to watch and wait. To hike rates any further will do more harm than good.

So, where to from here?

- The first thing I’d say is don’t expect big falls in mortgage rates in 2023. That will be the 2024 story.

- Fixed mortgage rates will likely move a bit lower, but it will be a while before one or two-year terms fall beneath the 6% level.

- As a general principle, keep your mortgage fixed term short – definitely no longer than two years, and preferably less if you can. Whilst three-year rates are sitting at around 6% today, remember that for most of the last eight years, fixed mortgage rates were below 5%.

- If you’re hurting as a result of higher mortgage costs, talk to a mortgage adviser like Squirrel. We can offer guidance in reducing the financial impact of higher rates over the next year or two, until they fall back to the likely long-term range of 4% to 5% p.a.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.