Rodney’s Ravings: Why the world is in for a prolonged inflation battle

Guest Post by Rodney Dickens

Central banks play a major part in driving economic cycles in most countries

Unfortunately, they have a habit of mucking up and, in recent years, have made a right mess of things.

Getting out of this mess is likely to require a protracted period of high interest rates, assuming the fallout isn’t so severe that it triggers a mini financial crisis.

So, how did we get here?

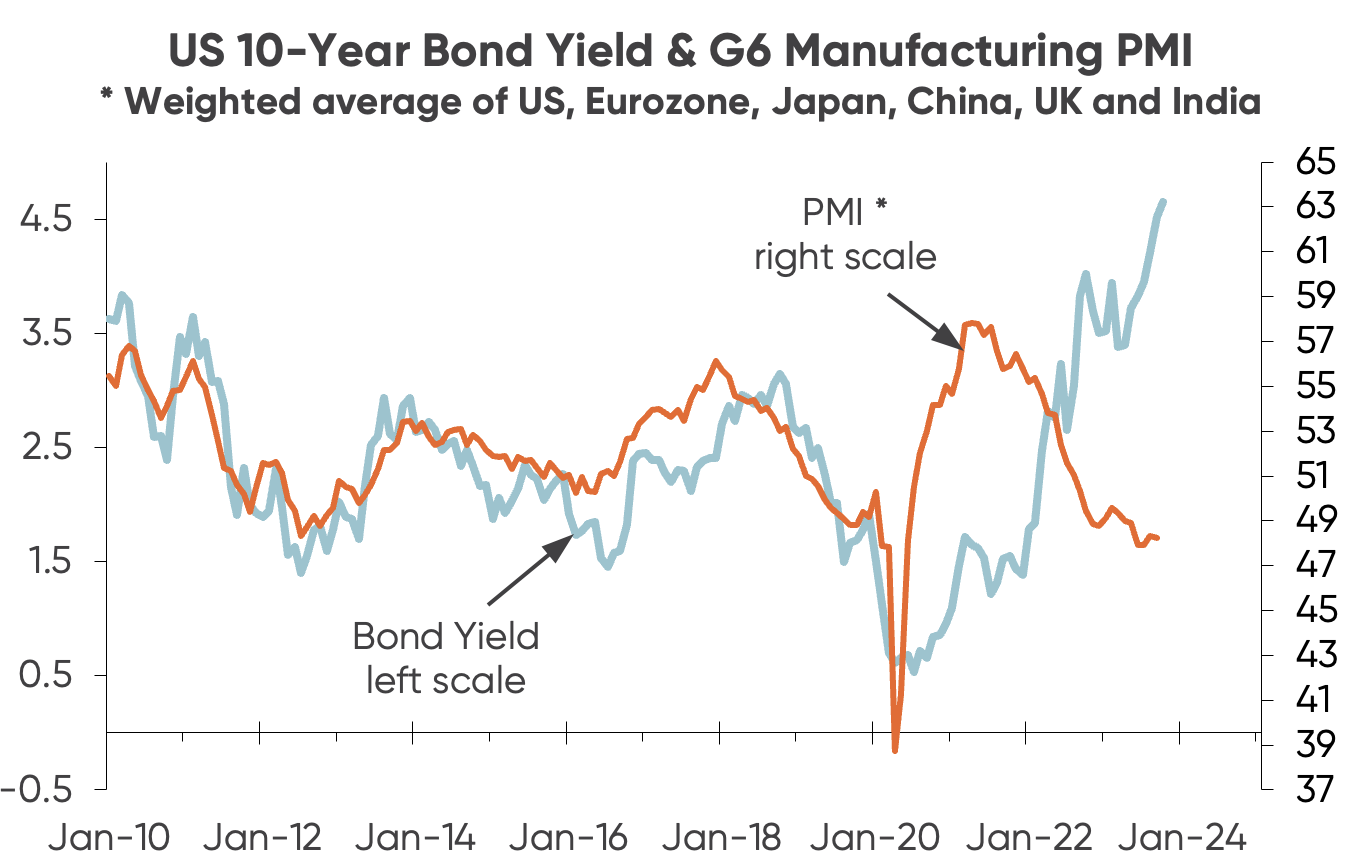

The US 10-year bond yield is a benchmark international interest rate, and prior to the pandemic it had quite a close link with Manufacturing PMI (or Purchasing Managers’ Index) results which is a useful leading indicator of global economic growth and international trade.

As the chart below demonstrates, if prospects for global growth improved (or deteriorated), the bond yield subsequently increased (or fell). There was also feedback in that if the bond yield increased or fell, it contributed to better or worse economic growth, respectively.

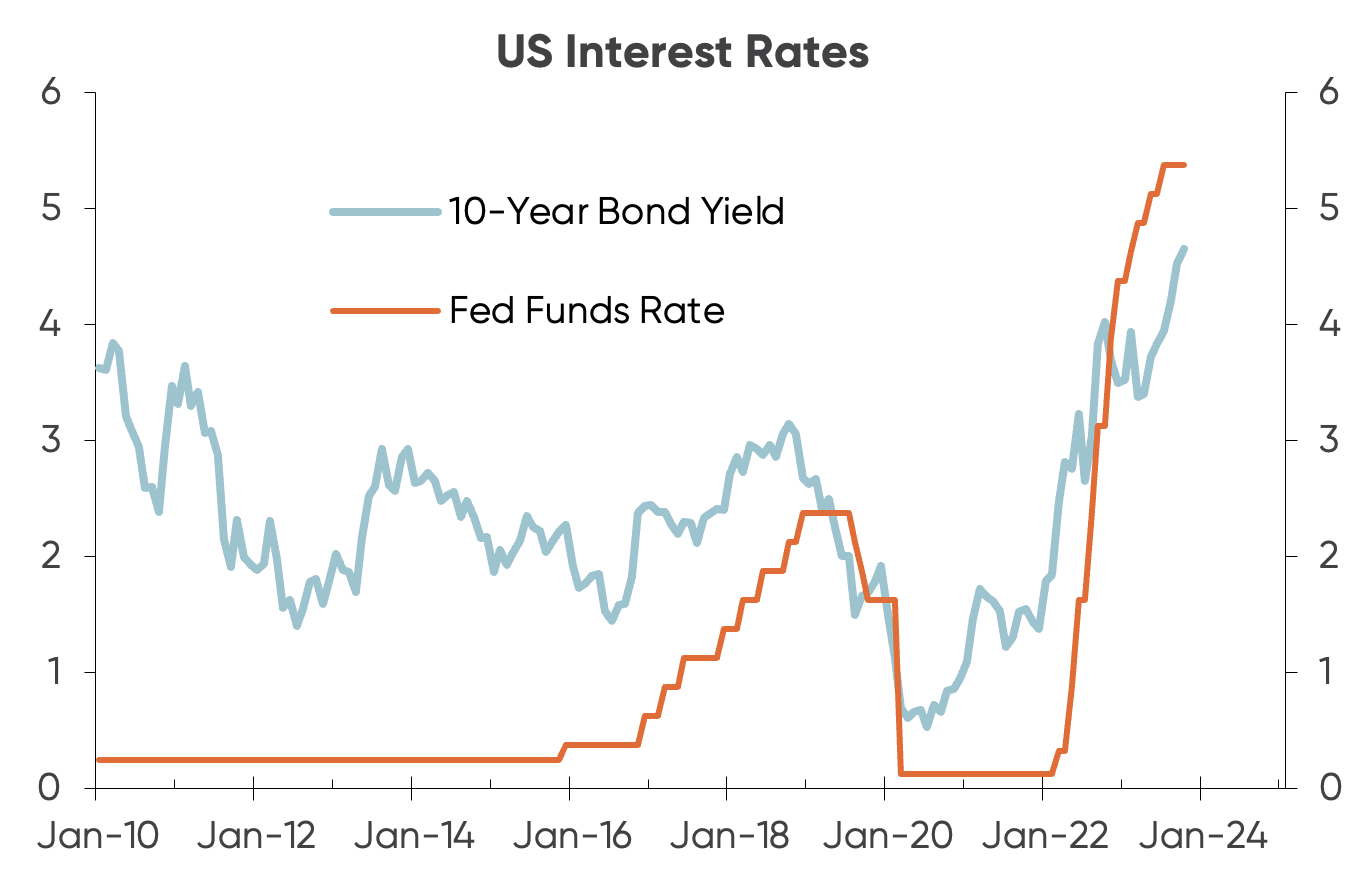

In response to Covid, both the bond yield and leading indicator collapsed. And because central banks kept official interest rates low for an extended period after Covid, the bond yield was slow to rebound — taking a long time to catch up with the leading indicator. The second chart shows how this played out in the US, as an example.

The 10-year bond yield is based on what the money markets expect the Fed Funds Rate (that the Fed controls) to be over the next 10 years.

By keeping official interest rates low and indicating that this would remain the case for some time, central banks like the Fed limited how much the bond yield — and interest rates in general — could rise in response to sharply improved economic growth after Covid.

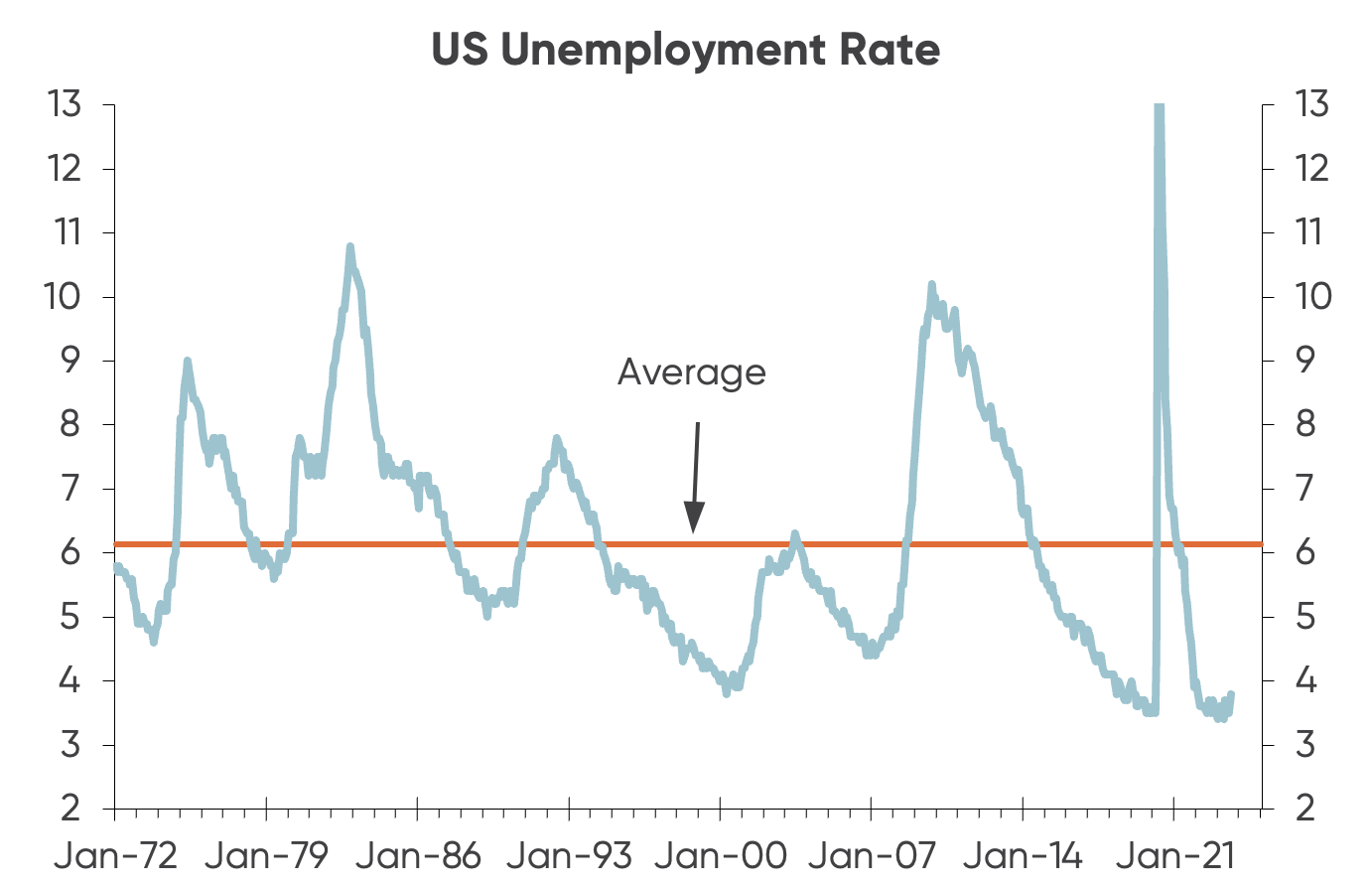

The result was overheated economies, which we saw reflected in unemployment rates falling below levels consistent with low CPI inflation

The third chart, below, again shows how this was the case in the US but the same situation played out in many countries including NZ.

Having played a major part in overheating economies and fueling wage-price spirals, central banks have ‘come to the rescue’ by hiking official interest rates more sharply than ever before, now suggesting that rates will stay elevated for some time.

Unfortunately, central banks (including New Zealand’s Reserve Bank) mucked up so badly in response to Covid and actually even before the pandemic, that lots of economic pain will be needed to break wage-price spirals.

And just as they were much too slow to start hiking rates thanks to their reactionary decision making, it’s likely they’ll be slow to recognise when they have broken the back of inflation and will keep interest rates too high for too long. That’s assuming there isn’t a mini crisis that prompts them to start dropping interest rates sooner.

The final chart above is testimony to the Fed’s failure, and the same applies in most countries including NZ. Reactionary decision making has resulted in the unemployment rate always under or overshooting the rate consistent with keeping inflation low.

Monetary policy is a blunt tool and central banks operate it like a sledgehammer.

This is unlikely to change, meaning that rather than smoothing economic cycles, central banks will continue to make them more volatile.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.