Rodney's Ravings: Seldom has residential building been more important

Guest post by Rodney Dickens

Residential building normally plays a pivotal role in economic cycles. And over the next 12 to 18 months this will be particularly the case, as there's likely to be a huge fall in building activity.

Residential building made up just 6% of total economic activity or GDP in the last year. While only small, if there is a 25% fall in building activity, as often occurs during downturns, it will deduct 1.5% from total economic activity.

And it will happen at a time when the existing housing market is also making a negative contribution to economic activity.

Residential building has always interested me, in part because it's volatile, and it's an industry I do more work on than probably any other economist. Having developed a reliable approach to assessing prospects for the industry, I have many clients within it, including some who regularly provide me with feedback.

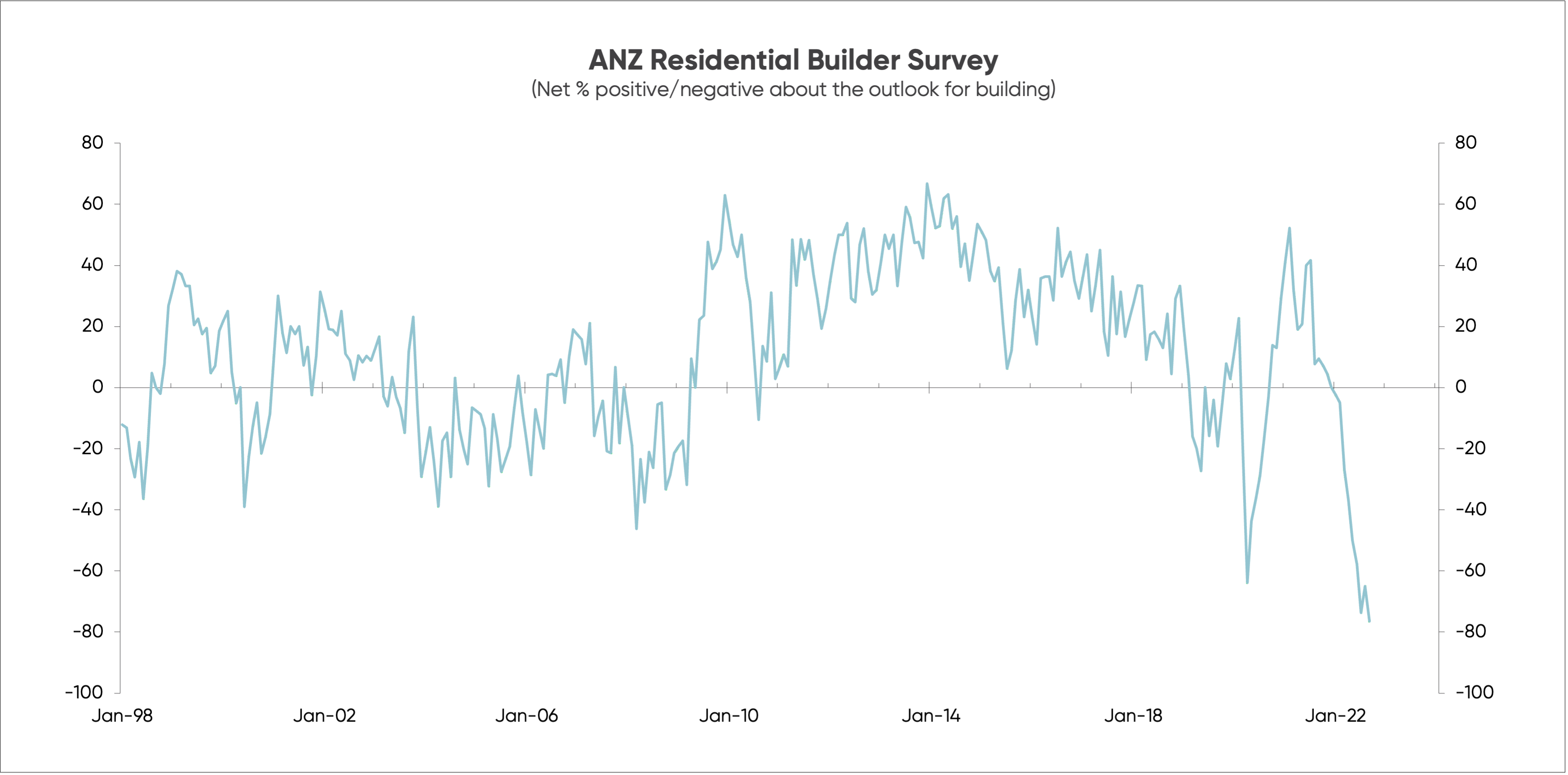

The feedback I've been getting from those clients of late is like that provided by the ANZ survey of residential builders, which last month reached a new low - as you can see in the chart - with a net 77% of builders surveyed feeling negative about the outlook for the industry.

This should come as no surprise to anyone who's been following the drivers of residential building growth, and what they've been doing lately.

Most importantly, over the last 18 months we've seen the sharpest ever increase in mortgage interest costs. Add in low population growth, banks ending their special low rates for people building, existing house prices falling, a much larger supply of existing housing for sale, banks tightening lending criteria for builders, and a potential oversupply of townhouses in four main centres.

It's little wonder the ANZ survey is extremely negative, as are industry anecdotes in general.

Prior to the Covid experience in 2020, which saw most surveys tumble temporarily, there have been four instances since 1998 where the ANZ survey has shown industry sentiment at 35% net negative or worse - with each case followed by sizeable falls in residential building activity.

In those four cases the worst readings for the survey averaged 40% net negative, and the subsequent falls in the GDP measure for residential building (including new housing and alterations) averaged 24%.

With the survey currently at -77% it implies a much larger fall in residential building is on the way; justified by the severely negative state of the drivers.

A fall of 25% or more in residential building activity seems highly likely over the next 18 months or so.

By contrast, in the August Monetary Policy Statement the Reserve Bank predicted only a 6% fall in residential building activity over the next two years. This is tiny in comparison to normal cyclical falls, which are often more than 20%. It's also contrary to what the drivers, the ANZ survey and industry anecdotes predict.

It's not unusual for the Reserve Bank to be well off the mark, but it will be particularly important this time. If it keeps hiking the OCR aggressively (as it plans) the disparity between what it expects for residential building and GDP growth, and what actually transpires will become massive.

A 40% fall in residential building that deducts 2.4% directly from GDP will be possible.

The more the Reserve Bank charges ahead blindly with OCR hikes without considering the carnage already in the pipeline, the more likely there will be a serious case for a least a temporary, market-led fall in interest rates.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.