Rodney's Ravings: The Reserve Bank is a major source of instability

Guest post by Rodney Dickens

If the Reserve Bank (RBNZ) made quality monetary policy decisions, it would contribute to a more stable economic environment than would be the case otherwise.

It would moderate booms that fuel inflation and reduce the need for painful recessions that cause business failures and losses for many investors.

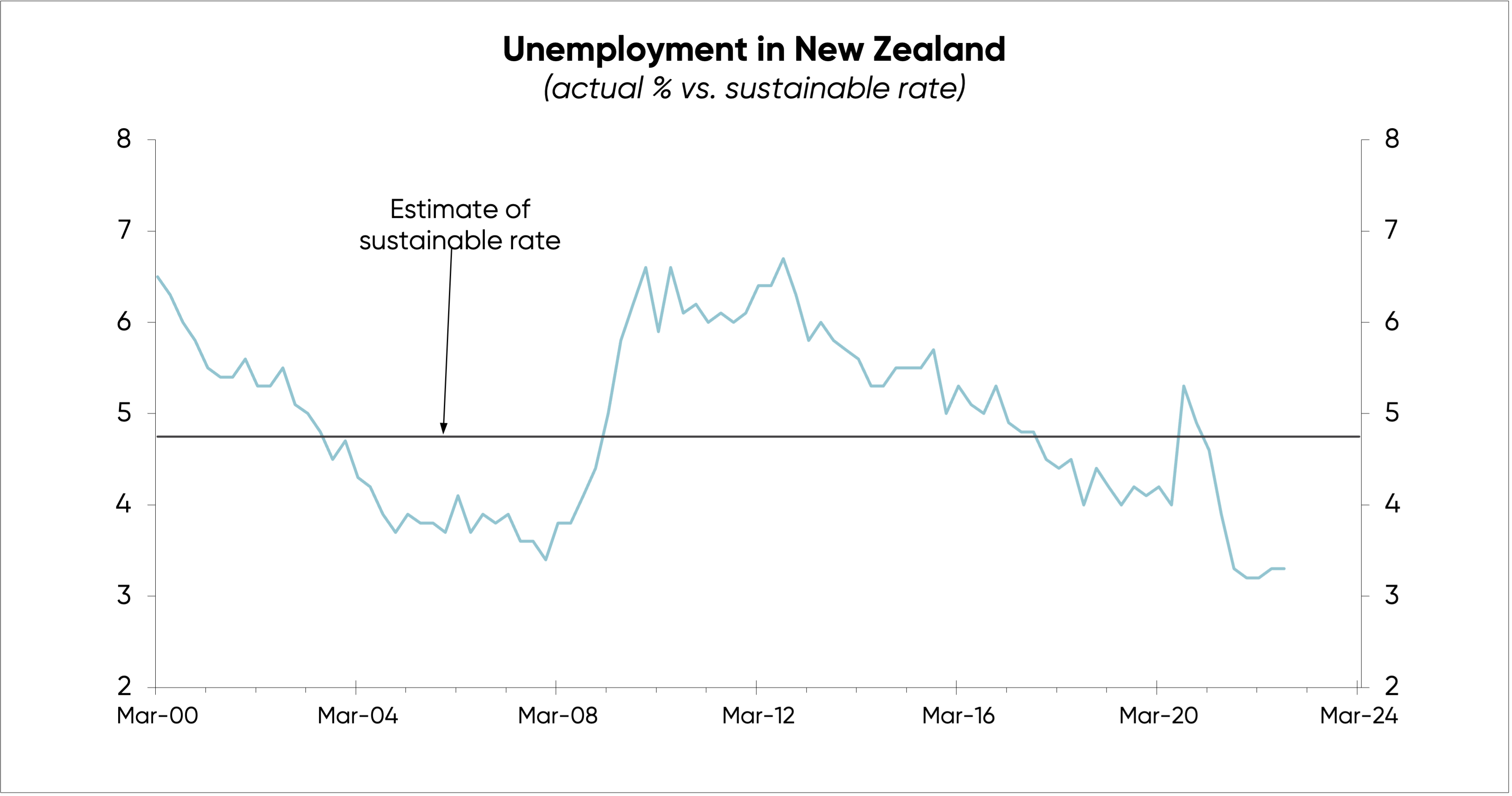

The success of the RBNZ in this mission – operating monetary policy that contributes to a more stable economic environment – can be judged by how close our unemployment rate sits to the lowest rate consistent with the RBNZ’s inflation target.

My best estimate of this figure, the unemployment rate that means balanced bargaining power between employers and employees, is 4.75%.

There needs to be a moderate unemployment rate to avoid giving workers excessive bargaining power. This is because of divergences between where job seekers currently live and where jobs are, between the skills job seekers have and those sought by employers, and social welfare policies that reduce labour mobility. In economics, it's called structural unemployment.

The below chart illustrates the major over and undershoots of the unemployment rate, relative to that estimate of the lowest rate the RBNZ needs to aim for to achieve its inflation objective.

Even prior to the Covid-driven spike to unemployment in 2020, the RBNZ had allowed the unemployment rate to fall below a level consistent with its inflation target. And now, overly-stimulatory policy in response to Covid has seen it fall to the sort of lows we experienced in the mid-2000s, when the RBNZ last allowed an inflation problem to develop.

The under and over-shooting of the unemployment rate is largely a result of the RBNZ’s reactionary decision making. It stimulates economic growth for too long, unable to see the inevitable consequences for inflation – and then tightens monetary policy excessively and keeps it tight for too long (as it is in the process of doing again), causing a painful recession.

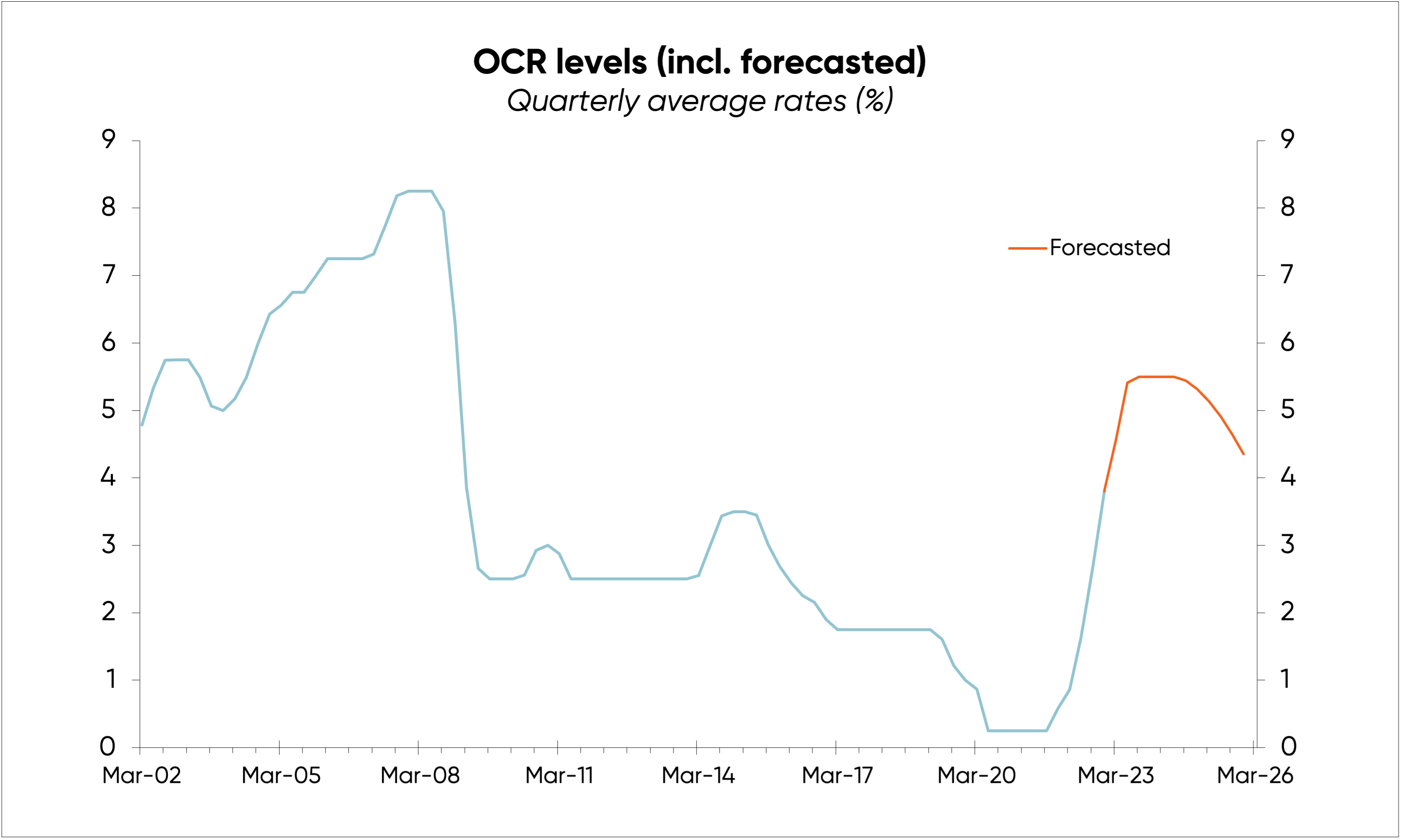

This year has brought with it the sharpest increase in interest costs since the RBNZ was tasked with keeping inflation low. And with seemingly little understanding of the scale of the economic fallout already in the pipeline, the RBNZ plans to hike the OCR a further 1.25% to 5.5% by September next year based on its forecasts (as shown in the chart below).

Global factors like climate policies, the fallout from Covid, and from Russia’s invasion of Ukraine, have contributed to the current high levels of consumer price inflation. However, a significant inflation threat was inevitable because the RBNZ was far too slow to realise it had overstimulated economic growth, not just in response to Covid but even prior to Covid.

Despite repeating the mistake made by Governor Bollard in the 2000s (when overly-stimulatory monetary policy allowed the unemployment rate to fall to a level that made recession inevitable) the Minister of Finance has reappointed Adrian Orr as RBNZ Governor for another five years.

This increases the likelihood the RBNZ will continue with reactionary decision making, hike excessively and cause an even worse recession than the one needed to fix the underlying inflation problem the RBNZ fuelled in the first place.

Rather than acting as a source of economic stability, the RBNZ is a major – if not New Zealand’s largest – source of economic extremes.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Limited, www.sra.co.nz

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.