Why interest rates could be likely to tumble

Post by David Cunningham - Chief Squirrel

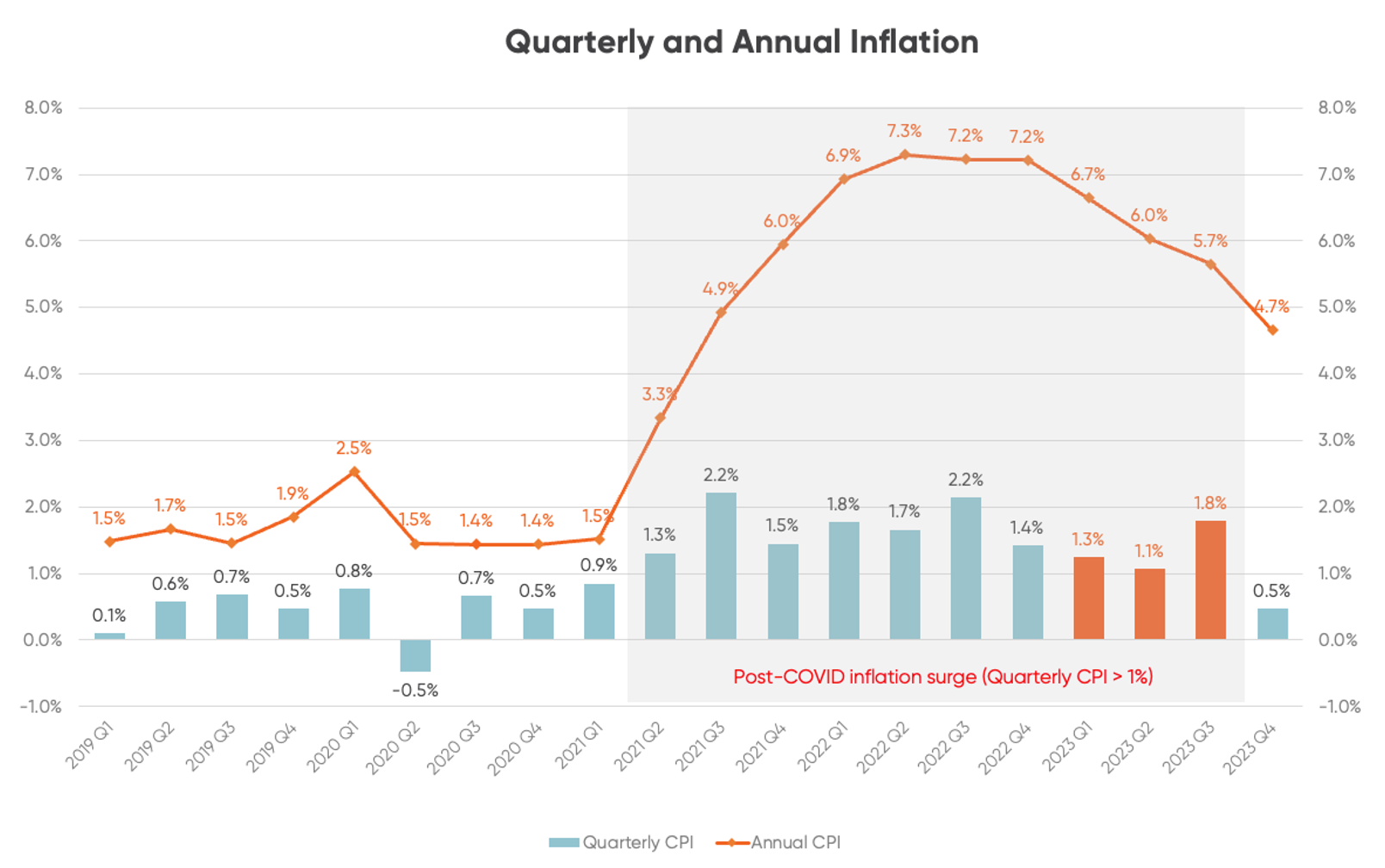

New Zealand’s latest inflation stats mark a big turning point in our battle against the monster.

For the first time in more than two and a half years – or 10 consecutive quarters – December’s numbers saw quarterly Cost Price Index (CPI) inflation sitting below 1%.

It’s the clearest sign we’ve had yet that the pandemic-fuelled inflation surge, felt the world over, is finally coming to an end. In fact, inflation is now falling dramatically in most Western economies.

The chart below tracks New Zealand’s quarterly and annual inflation rate over the last few years.

It’s fair to say that things were going pretty well up until late 2020, when the aftermath of Covid really started to cause havoc – with quarterly inflation averaging around 0.5%, or 2% total per annum.

Data source: Statistics NZ

And actually, if we were to extend the chart back even further – right back to 2000 – it’s the same story, meaning quarterly inflation averaged 0.5% for roughly 20 years before this latest spike.

With a remit to keep annual inflation somewhere between 1% to 3%, that’s not a bad outcome for the RBNZ. Bang on the mid-point of 2%!

So where is inflation likely headed to now?

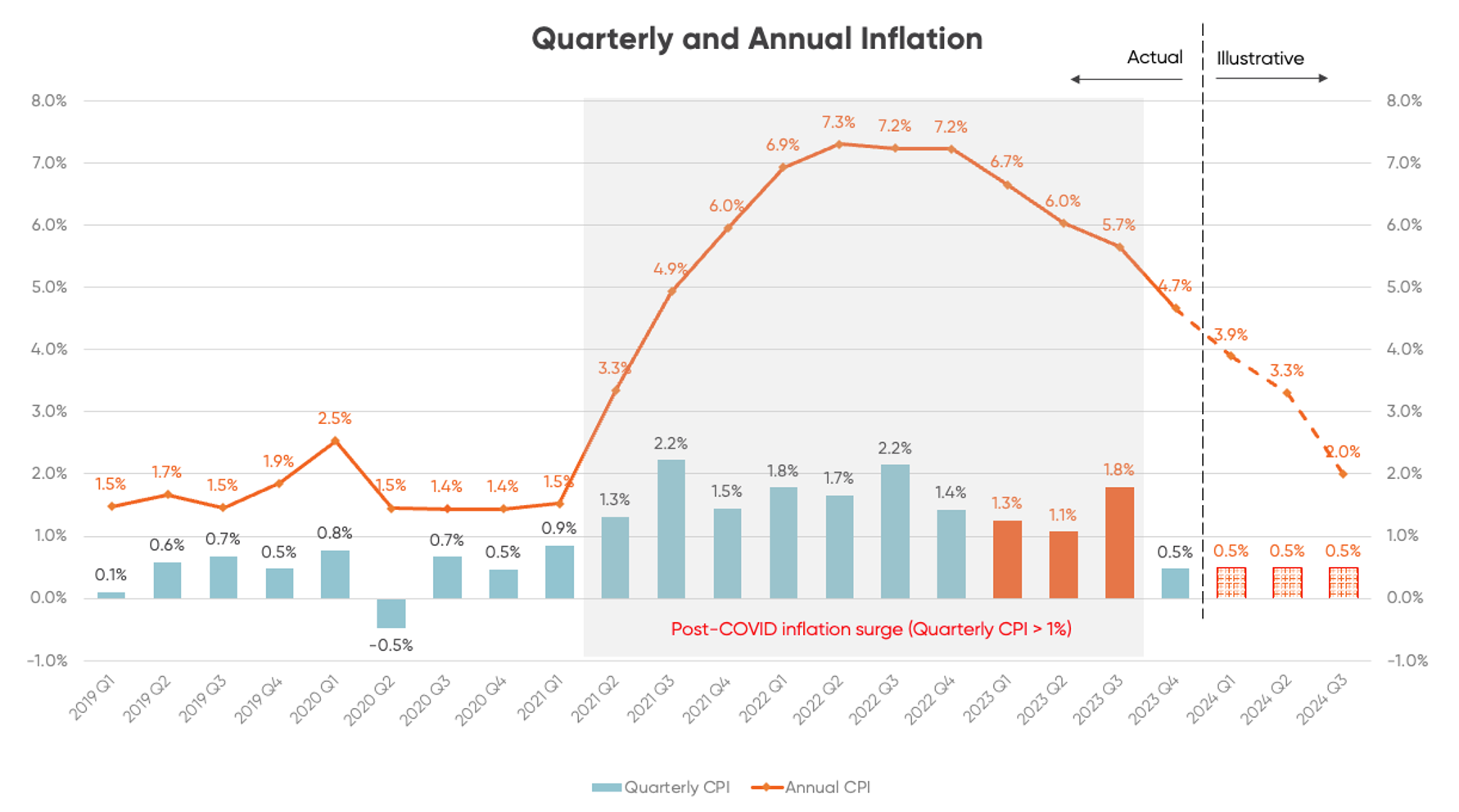

One of the best ways to get a gauge on where annual CPI figures are going is to take a look back at where quarterly inflation stats have been.

We saw some big quarterly inflation numbers in 2023 – 1.3% in March, 1.1% in June, and a massive 1.8% in September (when the Government removed the petrol discount, a.k.a. fuel excise tax reduction).

As we move forward, those numbers will – one by one – start to drop out of the total annual inflation calculation as new quarterly data is released. Assuming actual quarterly inflation remains low over the coming quarters, annual inflation is likely to fall pretty rapidly as those high historical numbers are bumped from the equation.

To demonstrate, the new (illustrative only) data on the right-hand side of the chart below shows how annual inflation would track if quarterly CPI inflation were to return to that 0.5% level that’s been the average for most of the century.

As you can see, those numbers would have annual CPI inflation back at 2% by September this year.

It’s a hypothetical scenario at this stage, but it feels like it could be a reasonably realistic one.

What could this mean for interest rates?

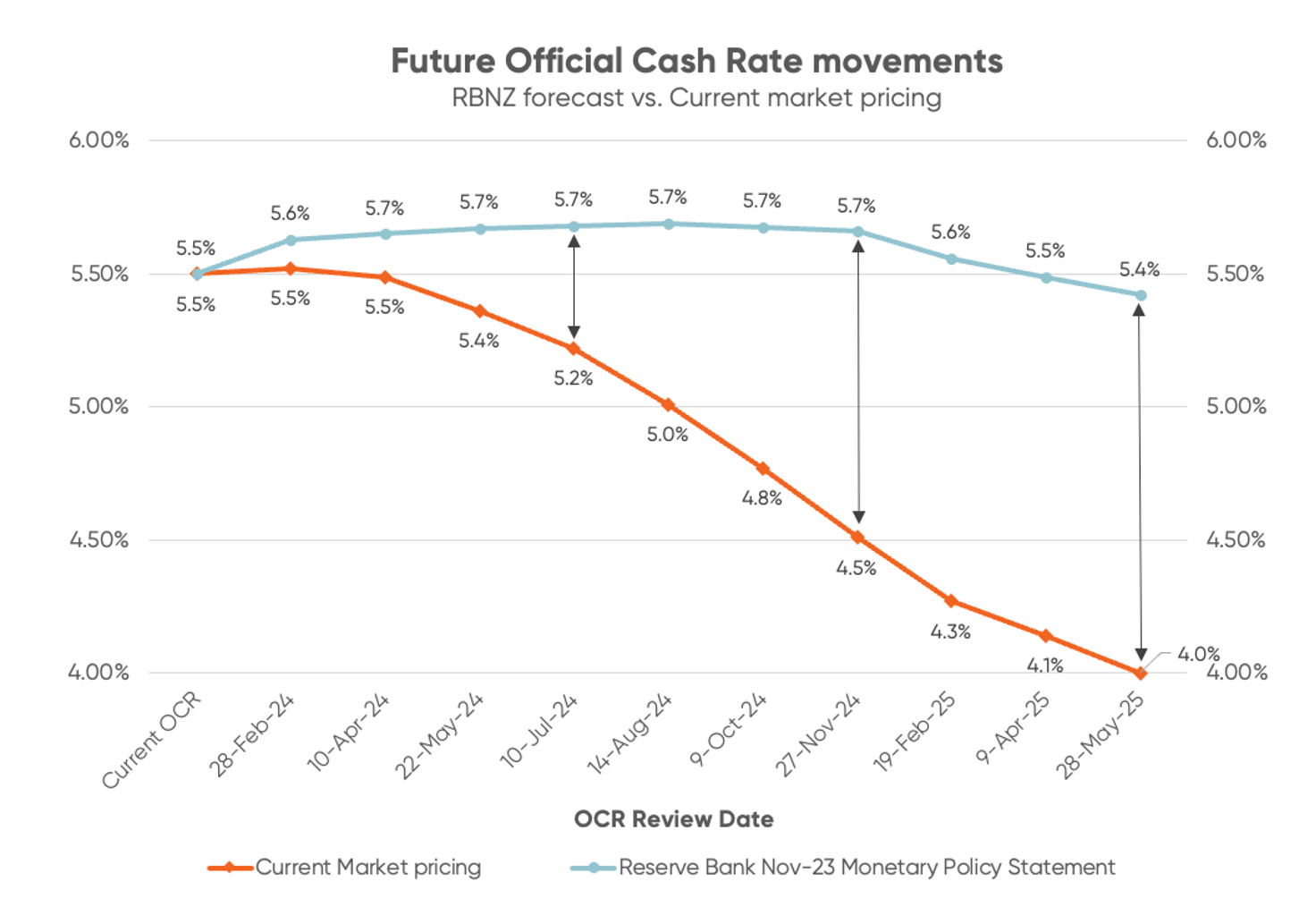

A rapid decline in inflation would likely see short-term interest rates fall significantly over the next year.

It’s exactly what wholesale markets are pricing to happen – despite cautious rhetoric from the Reserve Bank as part of its last OCR announcement of 2023, which suggested that it was likely to be 2025 before OCR cuts start to come through.

Data source: RBNZ, ANZ

For longer-term interest rates, there’s likely to be a continued downward drift as we creep closer to anticipated OCR cuts.

Right now, some economists are forecasting the OCR as low as 3% in a couple of years, implying a lot more downside in longer-term interest rates.

Impact on home loan interest rates

For starters, bank interest margins on fixed-rate home loans – a.k.a. what they charge over and above where wholesale interest rates are at – are currently extremely wide.

The bank margin on one-year fixed home loan rates, for example, would normally sit somewhere between 1.0% - 1.5%, but at the moment it’s up at 2.0%.

That’s just one side of the story, though. We’ve also got to consider what’s happening with term deposits.

The rates currently being offered on six-month and one-year term deposits are hugely competitive – to the point where they’re actually making the banks a negative margin (i.e. a loss) of about 0.75%.

Until those term deposit interest rates fall, there’s limited relief in sight for home loan borrowers. But when it does happen, sooner or later, that will be the catalyst that sets home loan interest rates tumbling down again.

I think it’s pretty realistic to expect the one-year fixed home loan rate to be sub-6% by the end of 2024, and sub-5% by the end of 2025.

The interest rates rollercoaster is in for some serious action!

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.