World Asthma Day: How banks are helping to support a healthier New Zealand

In a nutshell:

- Most major banks are very active in supporting homeowners to fund improvements for a healthier and more energy-efficient home.

- These loans generally have really competitive interest rates – and depending on the bank, it could mean over $10,000 in interest savings, compared to a traditional mortgage top-up at current fixed rates.

- Qualifying purchases typically include insulation, heating, renewable energy solutions, EVs, plug-in hybrids and even e-bikes.

- To access the offers, the best bet is to top-up your home loan with your existing bank. A Squirrel adviser can support you through this process.

Today, Tuesday 2nd May, is World Asthma Day.

Here in Aotearoa, we have one of the highest rates of asthma, and death by asthma, of anywhere in the world.

We’re talking hundreds of thousands of Kiwi adults and children living with the condition, someone experiencing an asthma attack every 5 minutes (on average), and two people dying each week as a result of their asthma.

How is it that things have gotten this bad?

Well, it’s probably got something to do with the quality of our housing.

The standard of housing in New Zealand is recognised by the World Health Organisation as some of the unhealthiest in the world. Not a title we can be proud of.

Living in cold, wet and damp conditions isn’t normal – but it’s something we’re pretty used to in New Zealand. More than a third of our homes, including new builds, have visible mould.

And given that we spend up to 90% of our time indoors, it makes sense that if the environment we’re in is unhealthy, we’ll be unhealthy too. Right?

Every day, Asthma NZ sees beautiful, young people who were born healthy, now living with a life-time condition, thanks to the condition of their homes.

Honestly, “nothing else matters when you can’t breathe”.

And with an increasingly overloaded health system we’re wise to do everything we can to keep ourselves healthy.

Keeping our homes warm (minimum 18°C), dry and ventilated is critical to staying healthy – which is why investing in your home, is an investment in your health.

So, what are your options to help get your home healthier?

Our four biggest banks have fantastic loan options on offer, that are designed specifically to help Kiwi homeowners fund improvements to their home (or rental property) to make it a healthier space, that’s better for the environment.

Generally, the sort of healthier home upgrades you can make with these loans includes things like getting a heat pump (or other heating system) installed, double glazing on windows, insulation (ceiling, underfloor and wall insulation) and better ventilation and moisture barrier systems.

In other words, anything that’s going to help keep your home toasty warm and dry, and keep your family healthy.

They can also be used to fund improvements to make your household more energy efficient, and better for the environment – including installing solar energy, or the purchase of an electric or hybrid vehicle.

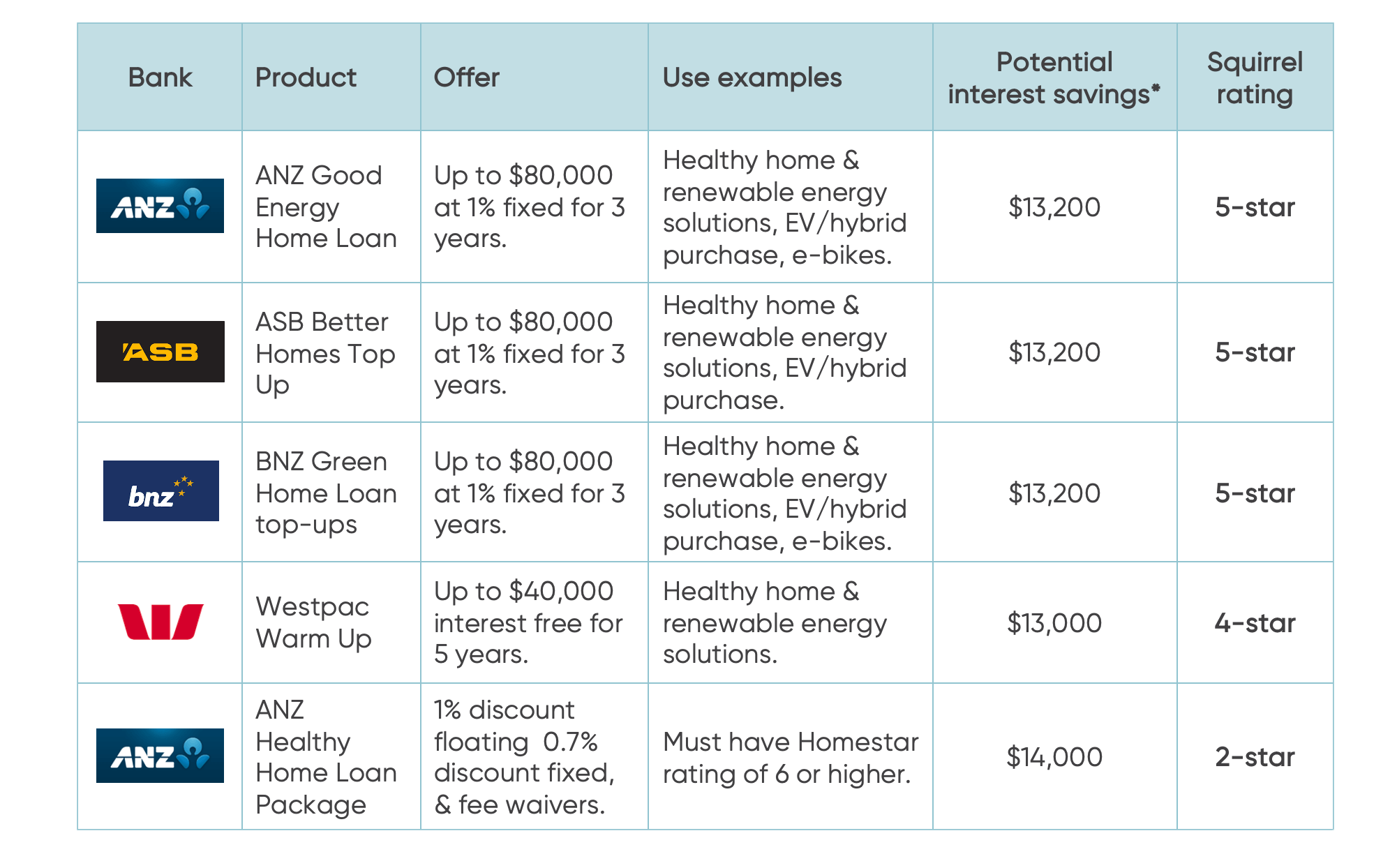

Here’s a bit of a rundown on the detail on what each of the banks offer with their healthy home loans, the major T&Cs, and how they stack up against one another.

Summary of offers

* For comparative purposes only. Potential interest savings are calculated against a standard home loan top-up (of equivalent value) at a fixed interest rate of 6.5% p.a. for maximum loan amount and term, assuming no repayment over the offer period. ANZ Healthy Home Loan Package assumed term 4 years and $0.5m loan at fixed rates. In all cases, the actual value of interest savings will likely be lower depending on repayment profile and actual level of interest rates.

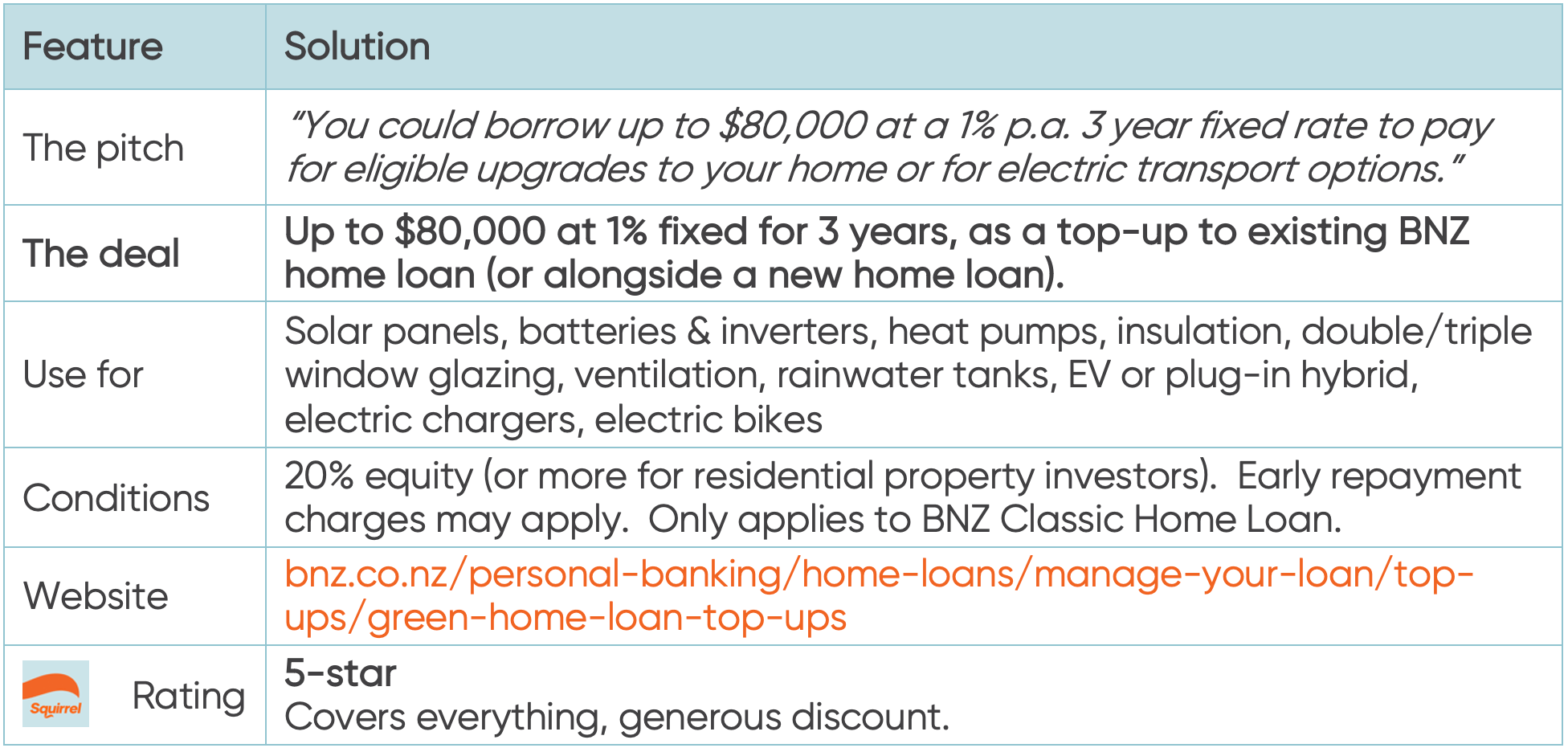

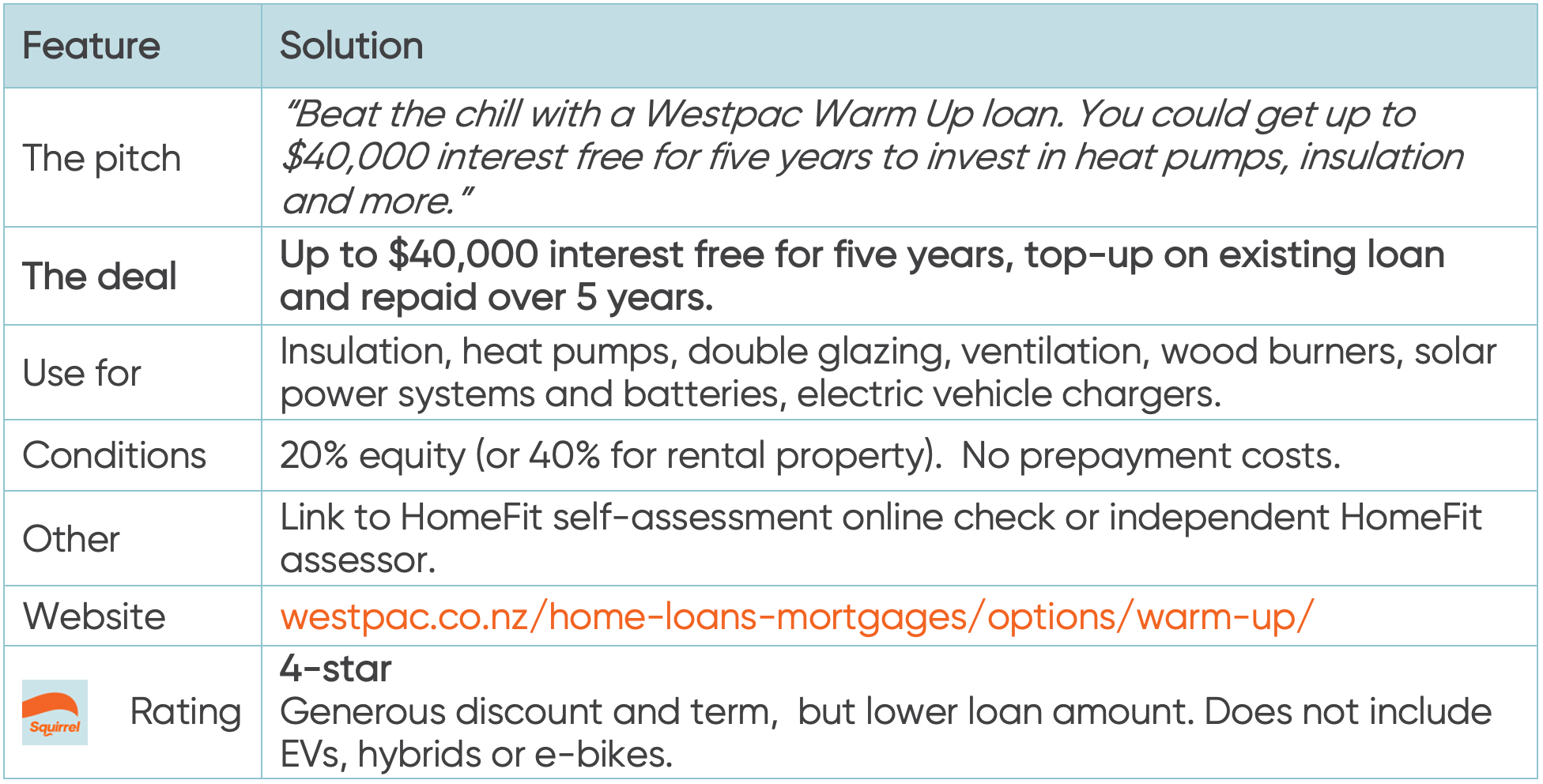

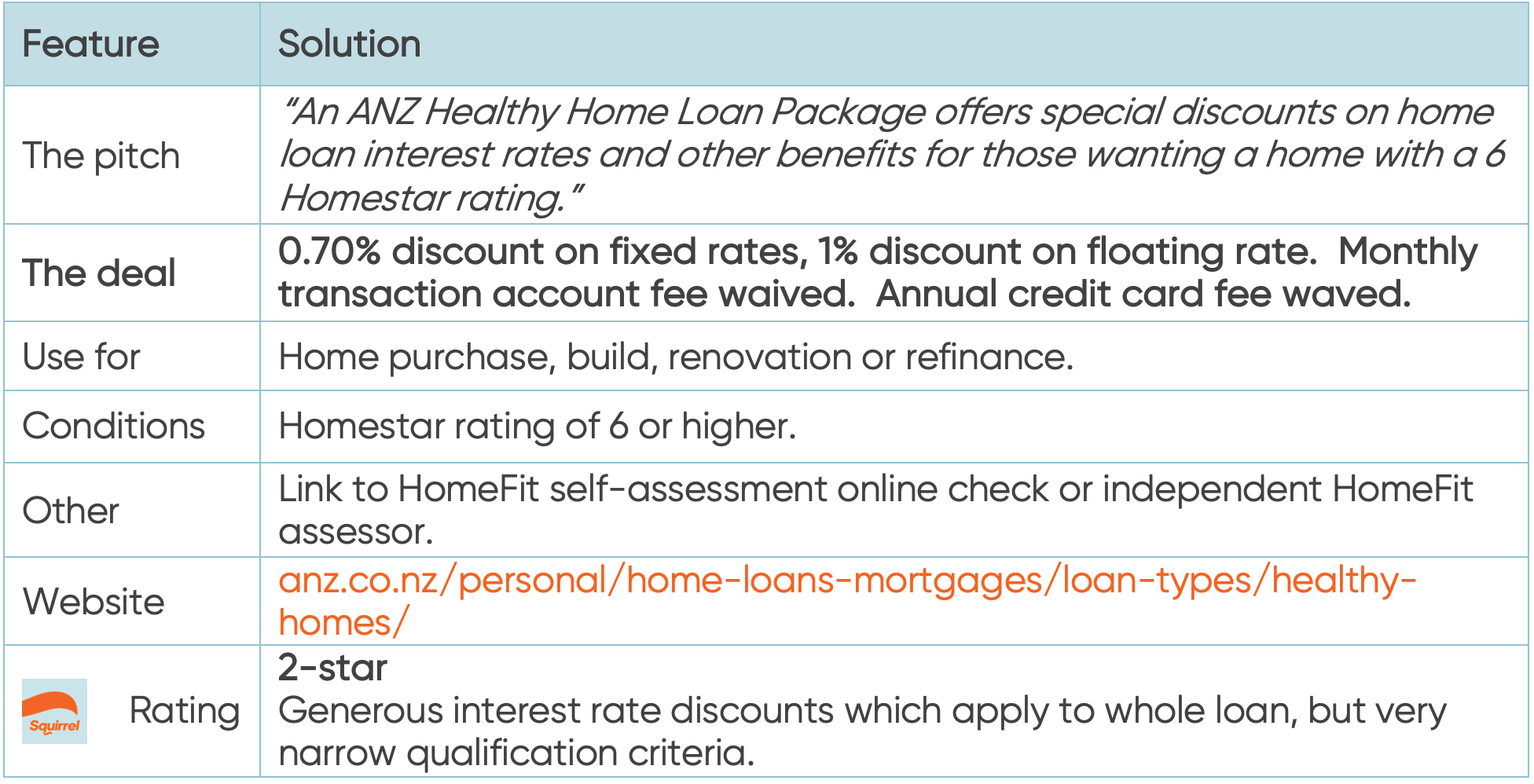

Appendix – the detail

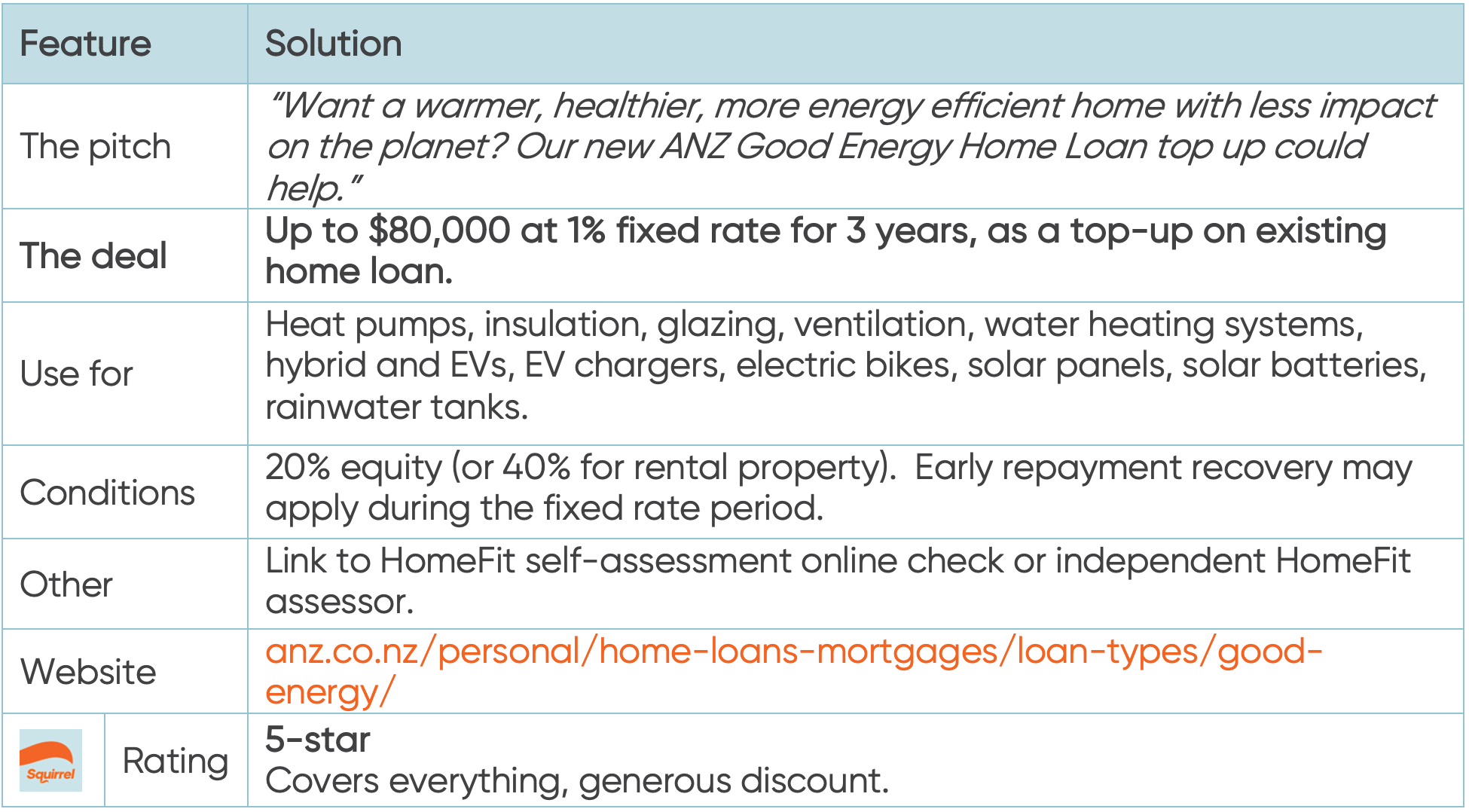

ANZ Good Energy Home Loan

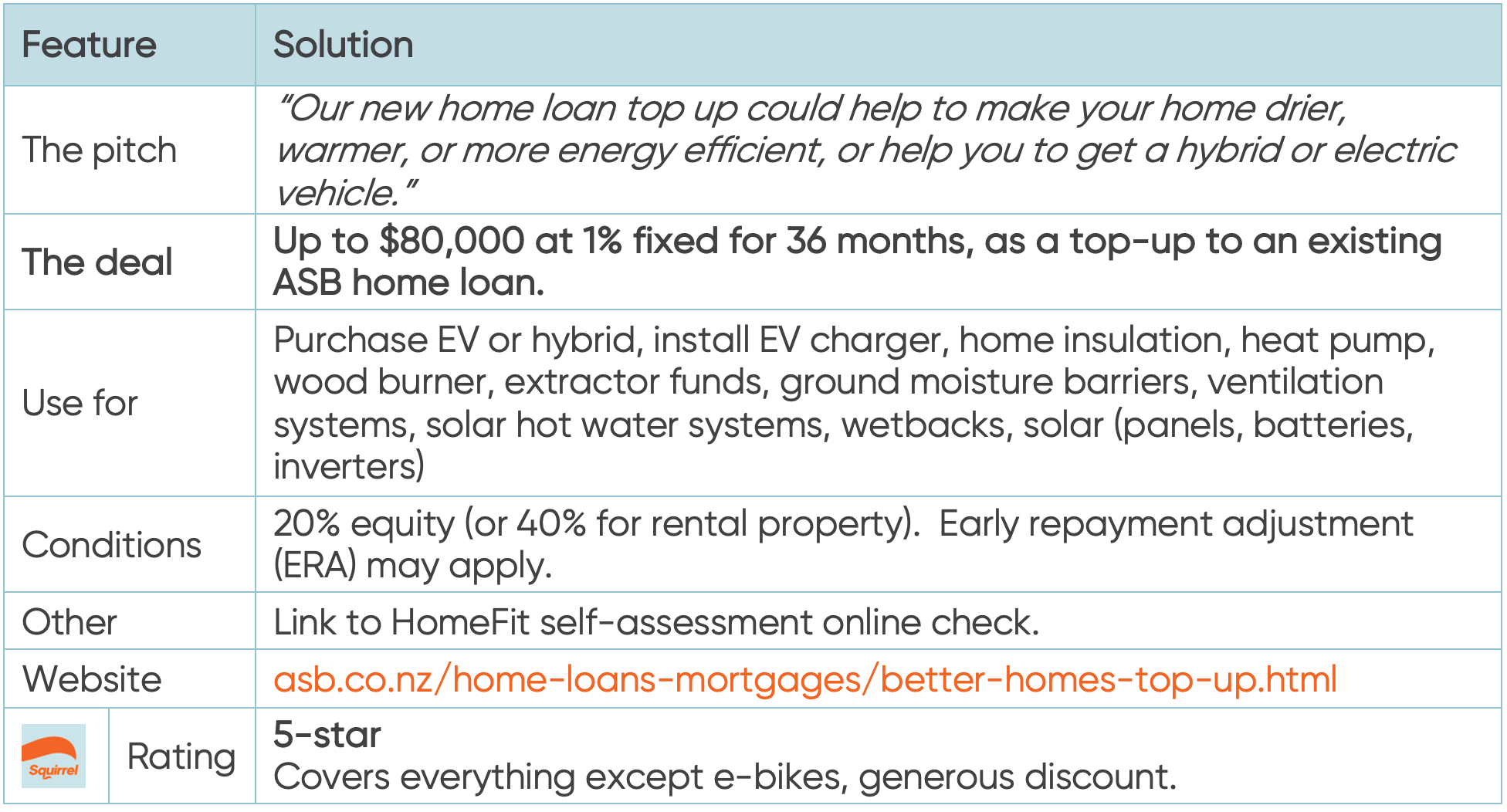

ASB Better Homes Top Up

BNZ Green Home Loan top-ups

Westpac Warm Up

ANZ Healthy Home Loan Package

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.