Rodney's Ravings: Beware politically biased business confidence surveys

Guest post by Rodney Dickens

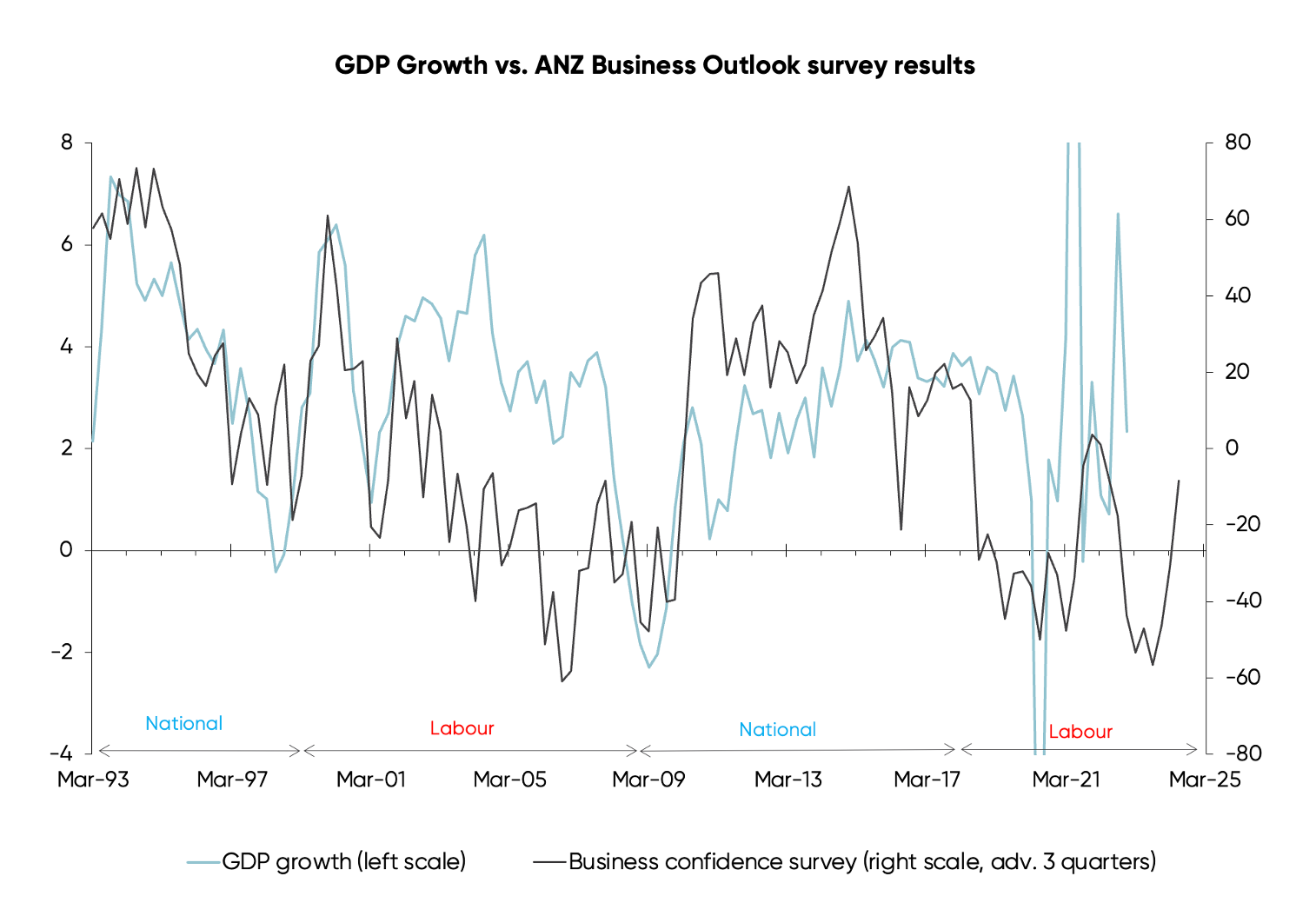

Over the last few months, the results of ANZ’s Business Outlook survey series have pointed to much improved near-term prospects for economic growth.

But the survey has a history of political bias, dating back to 2002 when the Clark Labour government introduced a number of anti-business policies.

It’s likely that some of the shift we’re seeing in the ANZ survey is a result of some respondents ticking the “positive” box in expectation of National-Act winning next month’s election.

Prior to 2002, ANZ’s survey provided useful insight into near-term GDP growth.

This is illustrated in the first chart below. The best fit between the two data sets is with the survey results (in dark grey) leading GDP growth (in blue) by three quarters — so the confidence survey results have been shifted to the right by three quarters.

However, following the introduction of Labour’s anti-business policies in 2002, the survey developed a major political bias which remained for the term of that Labour government.

Things changed after National took office in late 2008, with the survey overstating near-term growth prospects. This remained until there was again a sharp fall in late 2015 when Reserve Bank Governor Wheeler made a public plea for evidence that the major fall in dairy prices was having a significant negative impact on the economy.

Then, when Labour returned to power in late 2017, the ANZ survey swung back to underrepresenting GDP growth prospects.

As such, the growing likelihood of a National-Act election win may be partly behind the rise in confidence as shown with the ANZ survey.

At face value, this would point to at least mild near-term GDP growth.

The ANZ own activity survey — which economists tend to focus on more – has also shown quite a bit of bias since 2002, although not as much as that shown by the business outlook survey.

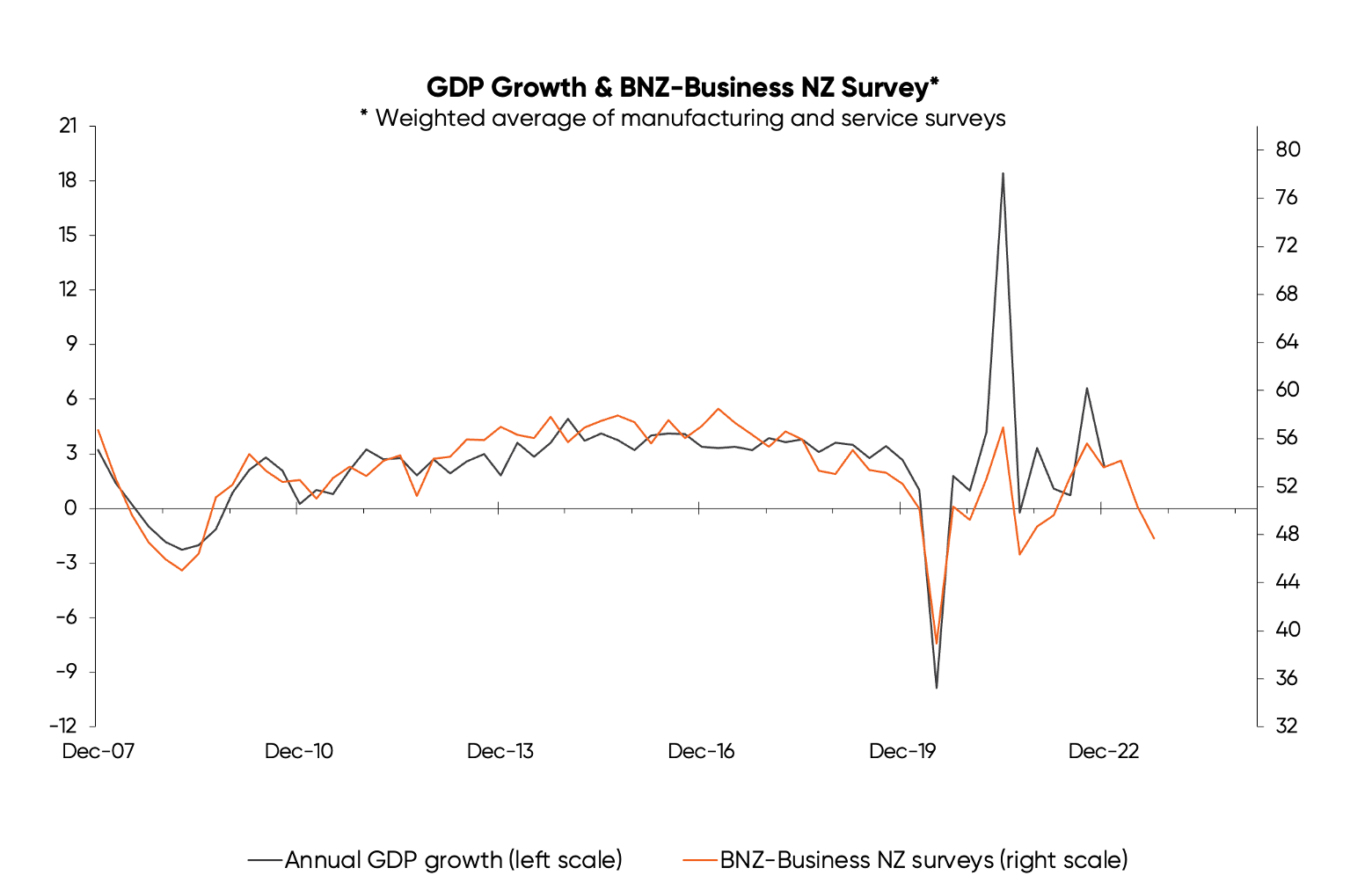

Also pointing to the fact that at least part of the rise in ANZ’s survey results is due to some respondents using it politically, the BNZ-Business NZ survey and the ANZ consumer confidence survey remain in recessionary territory, although they may be slower to reflect what is happening at the margin.

The BNZ-Business NZ survey is a weighted average of surveys across services and manufacturing. The BNZ-Business NZ survey has not shown political bias since it started, with results having fallen in recent months in contrast to the rising ANZ business survey, as shown in the second chart below.

The NZIER quarterly business survey has also not risen but is only available up to the June quarter and was surveyed mid-quarter so is a bit out of date.

Economic growth prospects may have improved, but it is doubtful they have improved as much as the ANZ survey suggests.

It would be helpful if ANZ economists acknowledged the potential political bias in the survey to enable the public to better understand what it is signaling, but despite clear and at times massive political bias in the survey they generally interpret it literally.

Unfortunately, if economic growth prospects are improving like the ANZ survey suggests the Reserve Bank would need to squash the recovery because more economic pain is needed to break the wage-price spiral and fix inflation.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.