An update on our P2P Investor platform - April 2020

We're continuing to share the latest platform news for investors and anyone that's interested, so here's the tee.

New Lending

New lending continues to be pretty slow as you’d expect during the lockdown period. We’ve seen investment orders queuing up to relatively high levels. For anyone thinking about investing over the next 5 weeks, the best spots to target are:

- Home Loan investments are available now, returning 4.00% p.a. variable over 7 years. You can see a case study on the loan available at present here.

- Business Property Loan investments available now, returning 5.00% p.a. variable over terms less than 2 years. You can see a case study on the loan available at present here. There is only about $150k left to invest for this first loan.

- Approximately $300k of 5 year loans returning 7.50% p.a. fixed will be progressively available between now and the end of May. Reminder that it’s first in, first served, so placing investment orders now would see you higher in the queue.

Retail Partners

We’re continuing to work with retail partners and have signed agreements with three additional partners for Personal Loans during the lockdown targeting our core ‘home owner’ market. We continue to focus lending into this market as we believe the credit risk is generally better when compared with debt consolidation and the standard personal loan markets.

Personal Loans arrears, hardship, and the Reserve Fund

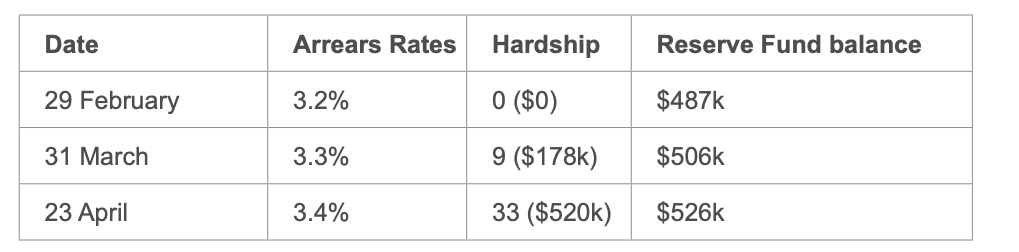

During the lockdown period so far, we've seen our arrears move up marginally to 3.4%. The number of hardship cases is now 33 and appears to have slowed for now with very few having arrived this week.

It’s worth noting that Centrix, one of the major credit reporting agencies we use are showing that the level of arrears across the market is unchanged during April to date, so what we’re seeing is consistent with the market.

There is a long way to run yet though. We expect we will see waves of borrowers who need support. The first wave is well underway, the number of hardship enquiries we’ve had over the last week has been very low, so it’s possible we’re seeing the back end of the first wave. The second wave will kick in when the Government subsidy runs out in June, and the third wave again when the 6 month mortgage repayment deferments are removed in October.

It’s still too early for us to be able to forecast with any accuracy, and we continue to monitor the forecast unemployment rate. We think this will be the key indicator for us, and consensus estimates from major economists continues to be around 9 – 10%. If this plays out, then the Personal Loans Reserve Fund is well placed to support investors for this period and ensure all principal and interest payments are made.

In contrast, we’ve heard that some other P2P lenders have started to suspend repayments on loans that are in a hardship position. This is the value of the Squirrel Reserve Fund model starting to play out.

Home Loans and Business Property Loans

We continue to be in a good position with the loans that have been passed through to our investors. There have been no additional requests for support, and our Reserve Funds for these investment classes are in place and have had their first contributions deposited. As a reminder, Squirrel has a $100k facility in place for each of these Reserve Funds to ensure they have liquidity over the first few years.

If you’re looking for investments backed by first mortgages on residential property, then we’d encourage you to take a look at these two investment classes. We believe there is great value to be had with returns of 4.00% p.a. variable for the Home Loans investment class, and 5.00% p.a. variable for the Business Property Loan investment class.

It's tax time

Lastly, if you're an Investor and need to get your RWT Certificate, here's a refresher on how to get it:

- Log into your account

- Go to your investments tab

- Select the appropriate financial year from the drop-down listing

- Click the 'View RWT Certificate' button

That's all for now! Got any feedback on what you've read? Get in touch, we're all ears.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.