Squirrel's secondary market performs for investors

When I’m chatting with new investors, I always make a point of talking through the secondary market. At a high level, it performs incredibly well for investors who are looking to cash out some or all of their investments.

On average, between April and November 2021, Squirrel investors successfully got their cash out within four days of their secondary market listing, regardless of the investment class. What’s more, these transactions are at no cost to the selling investor or the new investor. So, while it’s not guaranteed, using the secondary market means you may be able to get your money out prior to an investment maturing. We also know that just because the secondary market has performed in the past, it doesn't always it mean it will perform that way in the future.

A bit of history

Squirrel was the first peer-to-peer player to put a secondary market in place back in 2016.

Squirrel’s secondary market is purely digital and does all the hard work for investors. All it takes to list your investment is to simply tick a box next to it. We also removed the transfer fee at the beginning of 2021, so it’s free to use.

Since launching our own secondary market, we’ve seen other companies introduce their own but they often come with fees attached, and a manual process.

Let’s crunch some numbers

If you like numbers, here’s some data that shows the period between 1 April 2021 – 30 November 2021. Two things to note:

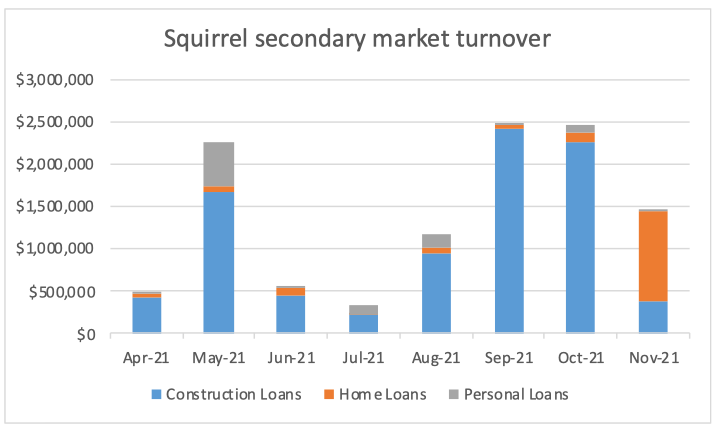

- Construction loans have had by far the largest turnover through the secondary market.

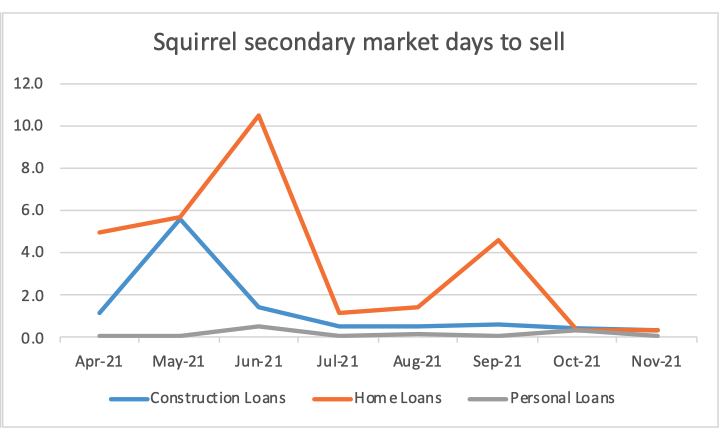

- The weighted average days to sell at 2.0 days is very low.

|

Investment class |

Value of investments sold via secondary market |

Number of investments sold |

Number of orders matched |

Weighted average days to sell |

|

Construction Loans |

$8.760m |

448 |

2,600 |

1.9 |

|

Home Loans |

$1.494m |

534 |

735 |

4.0 |

|

Personal Loans |

$0.988m |

531 |

1,435 |

0.2 |

|

Total |

$11.243m |

1,513 |

4,770 |

2.0 |

If we break the numbers down to a monthly view, you can see peak months show turnover of around $2.5 million across the investment classes. You’ll also see that the time to sell has been trending downwards over the period shown. We take this to mean the Squirrel marketplace is becoming more efficient as it grows.

A fractional platform has its benefits

Like the whole Squirrel platform, the secondary market operates on a ‘fractional basis’. This means if you list a $100,000 investment on the secondary market, you don’t have to wait for an investor with $100,000 to come along and snap it up. You’ll see the value of your investment drop over the course of each day as other investors take ‘bites’ out of it, and you’ll still earn interest on the remaining value of your investment at the end of each business day until it’s gone.

As one investor said to me recently, it’s like watching a bathtub empty.

Loans with a credit event

One of the conditions of the FMA approving our secondary market was that whenever an investment is put up for sale where the underlying loan has had a credit event of any description (most commonly a missed loan payment), that event must be disclosed to any prospective investors.

In that scenario, investors at the front of the investment queue are offered the investment via an email or mobile notification. The message explains the credit event on the loan, and the investor can confirm whether they’d like to take it on. The investor has 24 hours from the time of the notification to make a decision. If no decision is made, the next investor in the queue will be offered the investment.

In our experience to date, this rarely applies to a Home Loan or Construction Loan, but is a little more common with Personal Loans. As always, the investment will continue to be supported by the relevant Reserve Fund.

For the investor selling the investment, this process can slow down the sale as it’s reliant on the new investor accepting the investment rather than Squirrel automatically matching the existing to new investment orders.

Last but not least

We’ve got plans for further enhancements to make the secondary market even more user friendly. Keep watching this space. If you want to dig into the details of secondary market rules, you can find them here.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.