In theory, what’s not to love about the idea of building more warm, dry, energy efficient homes in New Zealand?

Better health outcomes? Awesome.

Lower living costs? Awesome.

But with only 13% of new homes in 2020 built to Homestar standards (it’s tough to find more recent numbers than this) it would seem for many the added effort, and expense, just doesn’t feel worth it.

So, we wanted to get an understanding of exactly how Homestar builds stack up from a financial perspective—for builders and owners alike. Does it pay to do the right thing?

We partnered with the New Zealand Green Building Council (NZGBC), and commissioned Infometrics to do a deep dive into the financial benefits of building to the 6-Homestar standard.

Here’s what we found.

(If you’re keen to check out the full report, Analysis of Financial Benefits of Homestar, you can give it a read here.)

For buyers: a small uplift = a big payoff

According to the report, houses built to the 6 Homestar standard have the potential to save homeowners anywhere from $62,800 to $98,800 over 30 years—depending on their location—through a combination of reduced energy bills and discounted interest rates.

Even factoring in a 0.5–1.5% increase in build costs, buyers are still financially better off within 2–3 years.

That means, for owners who are smart and diligent about how they reinvest those savings, buying a Homestar-rated home could see them become mortgage free roughly two to three years earlier.

Why builders and developers should sit up and pay attention to the healthy homes conversation

I attended the 2025 Housing Summit last week, and one thing was abundantly clear: change is coming — and fast.

Hon. Chris Penk (Minister for Building and Construction) spoke candidly about moisture and overheating being New Zealand’s next major building challenge, likening it to a slow-moving leaky homes crisis.

He acknowledged that ventilation standards are overdue for an update, and that changes to the Building Code are very much on the table.

Beyond that, a few key policy shifts stood out:

- A move to centralise the building consent process through a national portal — aimed at consistency and speed

- Plans to make Kāinga Ora’s house plans available to the wider sector (still under consideration)

- And an indication that the unconsented 70sqm granny flat policy will proceed in 2025 (exact timing still to come)

While Homestar uptake remains relatively low, the commercial upside for developers and builders is getting harder to ignore.

There’s no doubt that buyers want healthier, more efficient homes—recent research from Kantar shows that a massive 75% of Kiwi are concerned about the cost of living—and that demand is starting to influence both sales cycles and finance terms.

Although we’re starting to see more and more builders integrate Homestar features into both turnkey and spec builds, there’s still a huge untapped business opportunity out there, to:

- Differentiate with a product that’s backed by data and market demand

- Accelerate buyer conversion with products that allow them to access lower-cost loan solutions like ANZ’s Healthy Home Loan, which offers discounted mortgage rates.

- Position for growth by aligning with where the market — and regulation — is heading

As one of New Zealand’s leading non-bank construction lenders, Squirrel is focused on helping responsible builders move faster with capital that supports quality, not just compliance.

We co-commissioned this research with NZGBC because we wanted independent data — and now we’ve got it. Better-built homes aren’t just good for the planet. They deliver better outcomes for buyers and builders. At Squirrel, we’re proud to back the people building that future.

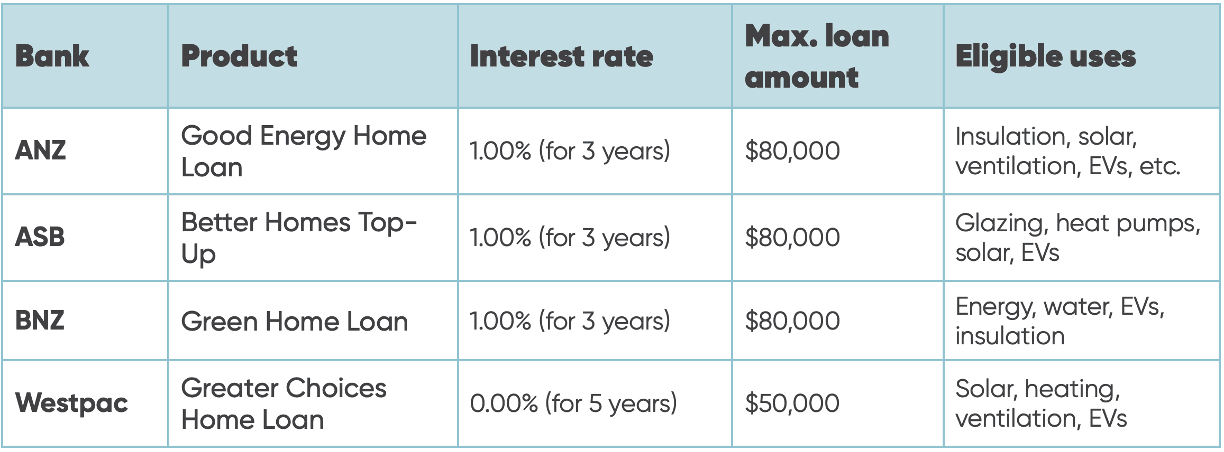

Below is a table showing a snapshot of the green mortgage and loan options that are currently on offer among the big banks (as of 12 May 2025).

*Note: All require 20% equity (owner-occupied) and verified installation quotes. Terms and eligibility may vary.*

The message is clear: warmer, energy-efficient homes don’t just tick the right boxes in terms of health outcomes, they provide better financial outcomes too.

And at Squirrel, we’re ready to help fund the shift towards better builds.

Keen to talk smarter lending solutions for your build? Get in touch. We’d love to help.