Despite having tracked upwards from the lows of late-2022, consumer confidence survey results remain below average, consistent with the minimal growth we’ve seen in consumer or household spending.

The issue is that these consumer surveys have (as of several years ago) become poor indicators of consumer spending.

And yet they have continued to played a part in overly pessimistic views by most economists regarding New Zealand’s economic recovery last year.

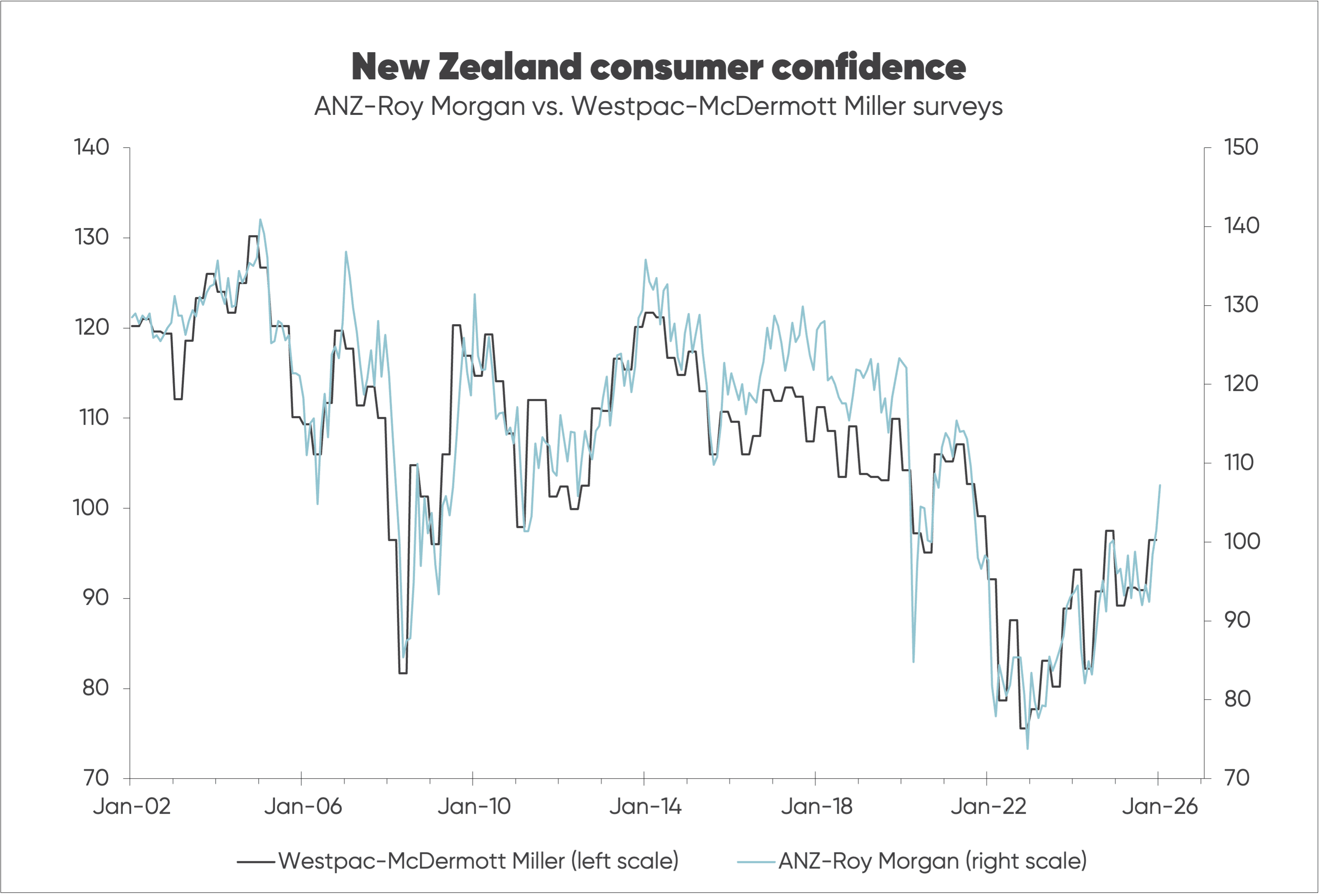

The ANZ-Roy Morgan monthly survey of consumer confidence rose to 107.2 in January 2026, still below the average, since January 2002, of 114.2 (blue line in the first chart, below).

The ANZ-Roy Morgan survey tracks closely with the quarterly Westpac-McDermott Miller survey (grey line, first chart) which, at 96.5 for the December 2025 quarter, was still well below the average of 107.2 since January 2002.

That said, it’s likely to rise this quarter given the rise in the ANZ-Roy Morgan survey.

It is best to check how such surveys track with the economic indicator they are supposed to provide insights about.

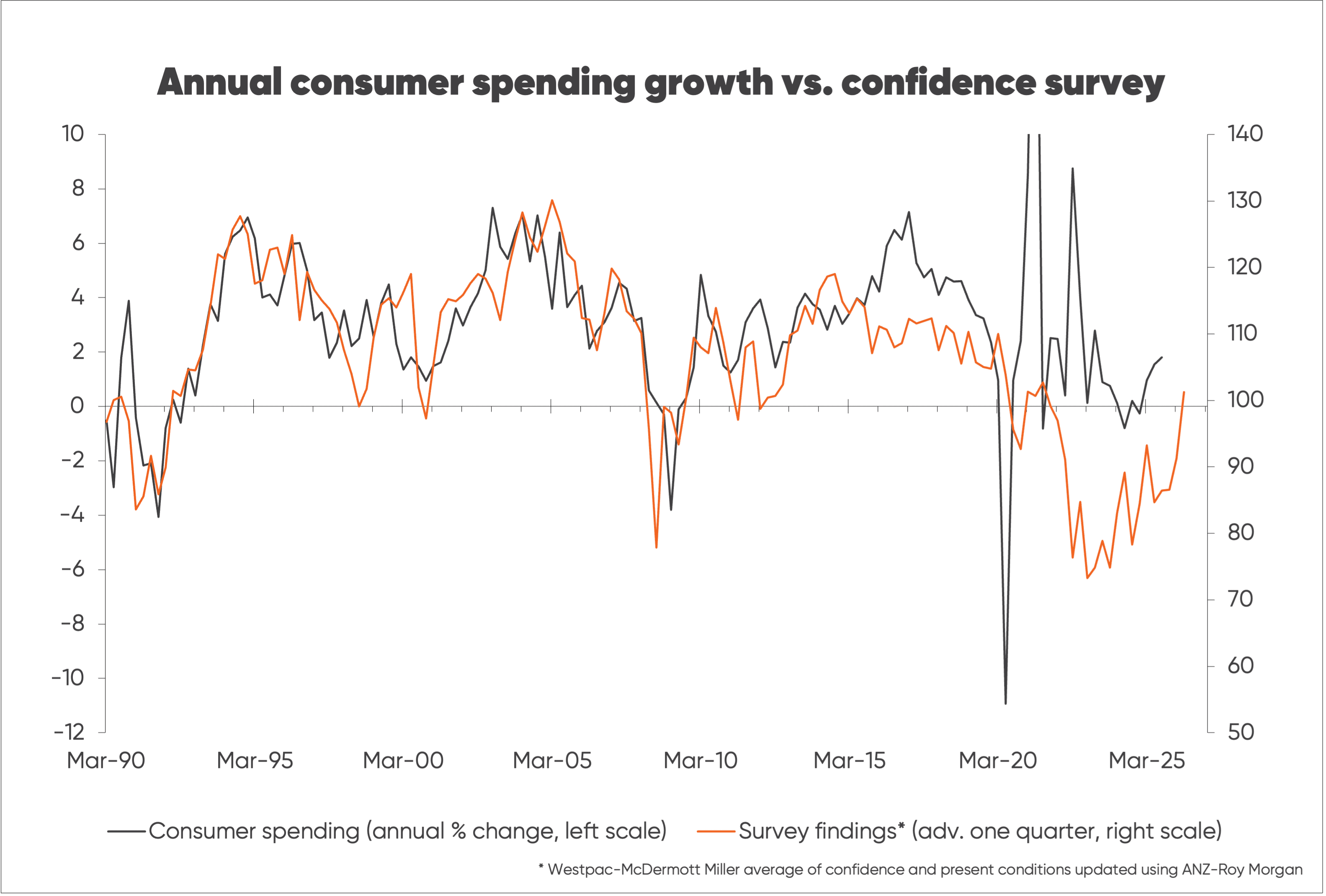

The second chart shows that, prior to 2015, these consumer confidence surveys were a pretty reliable guide to annual growth in the volume of consumer spending. The peak correlation at 0.78 (compared to a maximum possible of 1) is with the survey advanced or leading annual growth in spending by a quarter.

After 2015, however, the relationship broke down—to the extent that by late-2022 the survey pointed to spending falling significantly, when it actually grew moderately instead.

Then, as consumer spending growth deteriorated rapidly in the first half of 2024, the survey, while still way too pessimistic, pointed to an improvement in growth.

Although it was far from booming, the volume of consumer spending in Q3 2025 – the latest quarter for which data is available – was up 1.8% on a year earlier. This was dramatically stronger than the moderate fall the consumer survey predicted.

As to why consumer confidence surveys have become so unduly pessimistic—I don’t know.

It happened well before Trump-mayhem became a factor, and it doesn’t seem to be a product of local politics that plagues the ANZ business survey.

My best guess is that the issue centres on who gets surveyed (such as a shift in the mix of the survey sample).

Whatever the cause, I expect further improvement in consumer spending growth this year as the boost from sizeable falls in interest rates filters through to the economy.

The January rise in the ANZ-Roy Morgan consumer survey may reflect this, but it’s outlook is still pessimistic. Until the consumer surveys return to having a stable fit with consumer spending growth, the recommendation would be to interpret with caution.

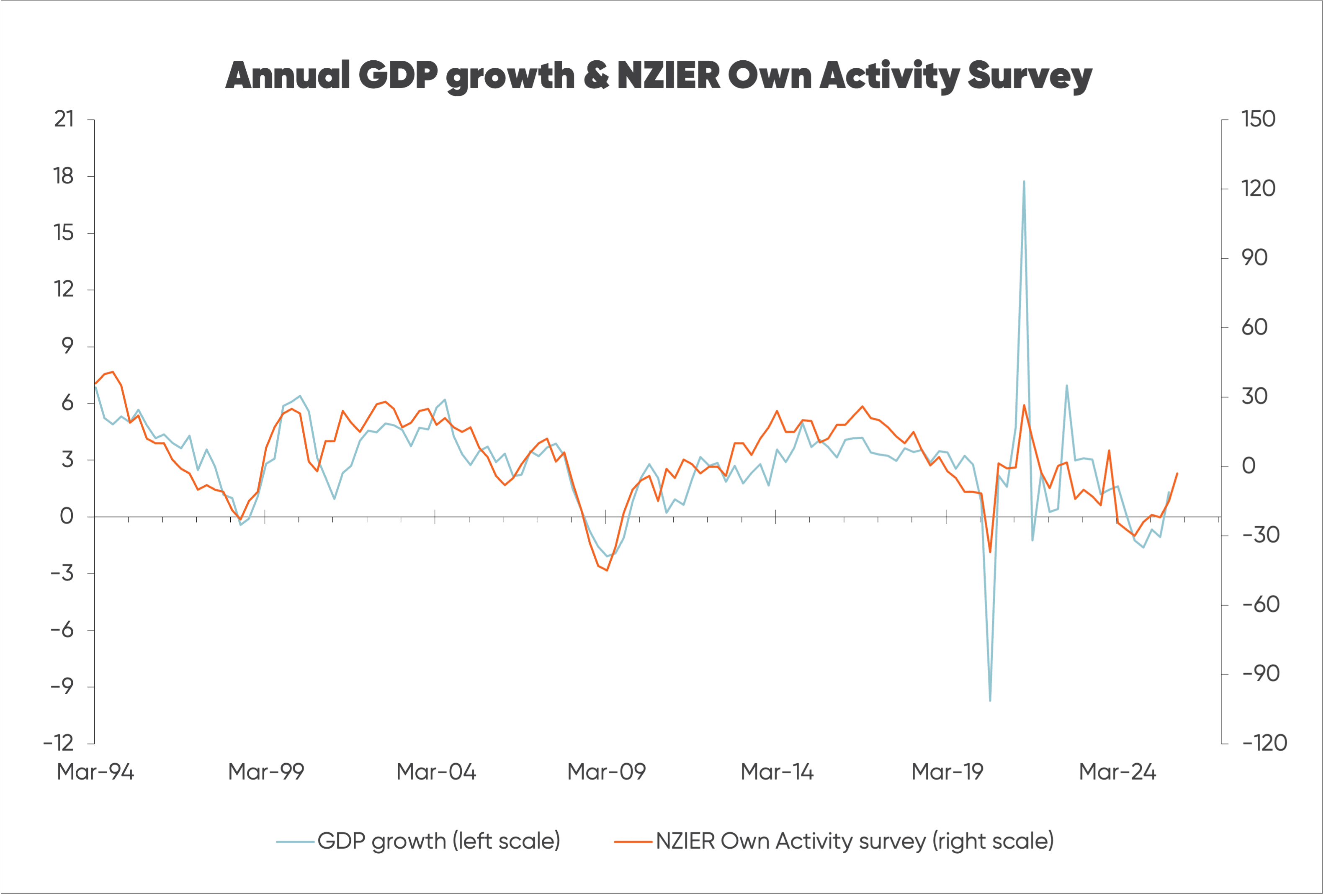

By contrast, the more useful business surveys—like the NZIER quarterly survey of firms’ own activity—point to improved GDP growth, consistent with what should be expected given the stimulus in the pipeline from the fall in interest rates (see the third chart, below).

About the author: Rodney Dickens, Strategic Risk Analysis - Managing Director

As far as economists are concerned, Rodney’s about as seasoned as they come. Having started out his career at the RBNZ—including a stint on its Monetary Policy Committee—he’s held roles as Head of Research and Chief Economist inside several of New Zealand's big banks and leading financial institutions, and worked for the Bank of England. He launched Strategic Risk Analysis in 2006, regularly reporting on the state of the economy, housing market and interest rates.