Dwelling sales reported by REINZ edged above average in March and are expected to have risen further last month based on stronger Barfoot & Thompson’s Auckland sales numbers, recorded in May. The rise in sales is finally starting to eat into the surplus of property for sale, and CoreLogic’s House Value Index has nudged higher in the first four months of the year.

Conditions in the housing market should continue to improve over the next several months as the boost from a moderate fall in interest rates filters through.

Meanwhile, US President Trump is also doing his best to provide something of a boost to New Zealand’s housing market

A range of industry anecdotes point to Trump’s trade war having a sizeable negative impact on international trade.

This includes reports of a 33% fall in active ships at America’s main port (Los Angeles), mostly thanks to tumbling Chinese imports but also as a result of tariffs imposed on other countries.

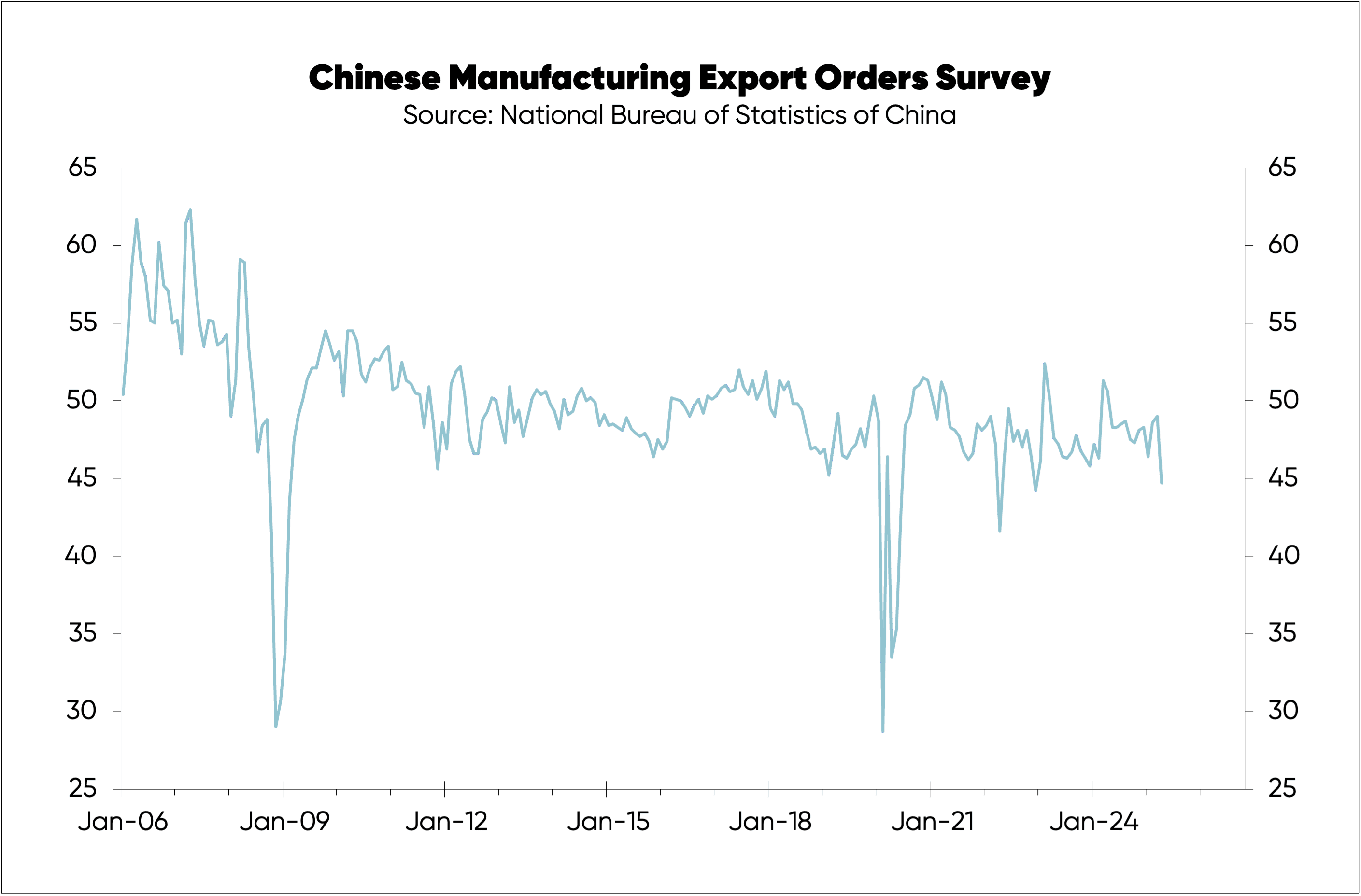

The Chinese manufacturing export orders survey also fell to 44.7 in April (see the first chart, below).

As it stands, the fall is not much more than experienced during regular spikes and tumbles, but is likely to have further to go this month, with Chinese exports to the US expected to fall dramatically.

This will be offset to some extent by urgent attempts by China to send exports elsewhere, including the domestic market.

If there is not a quick resolution of the US trade war it will have a sizeable negative impact on global economic growth

It’s unlikely to be anything like what we saw during the GFC or Covid—where the Chinese export orders survey fell below 30—but it should be enough to encourage central banks (including the RBNZ) to cut official interest rates more than would have been the case without the trade war.

The RBNZ has a couple more OCR cuts in the pipeline already, but this could become several given its tendency to overreact to global developments.

The surprise (but, welcome, to many) resignation of Adrian Orr as RBNZ governor makes it harder to assess what the RBNZ will do.

My best guess is that acting governor Hawkesby will uphold the RBNZ’s tradition of overreacting to global developments. This will almost certainly be the case if the trade war results in more of a fall in export prices, which are only showing a hint of falling so far.

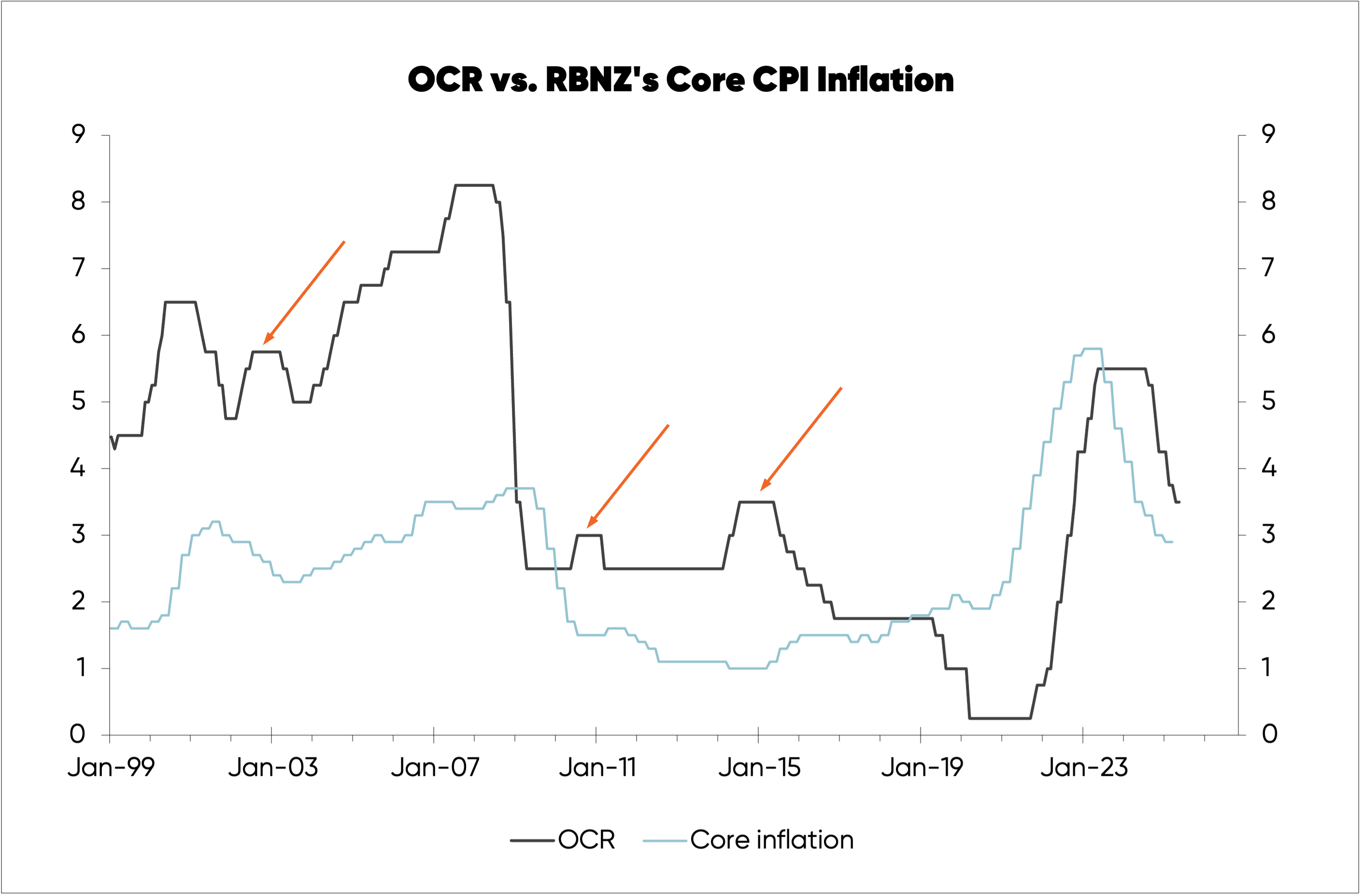

The second chart (below) shows three mini cycles in the OCR where local inflation—as measured by the RBNZ’s core measure of CPI inflation (orange arrows)—hasn’t been the main driver of interest rate hikes.

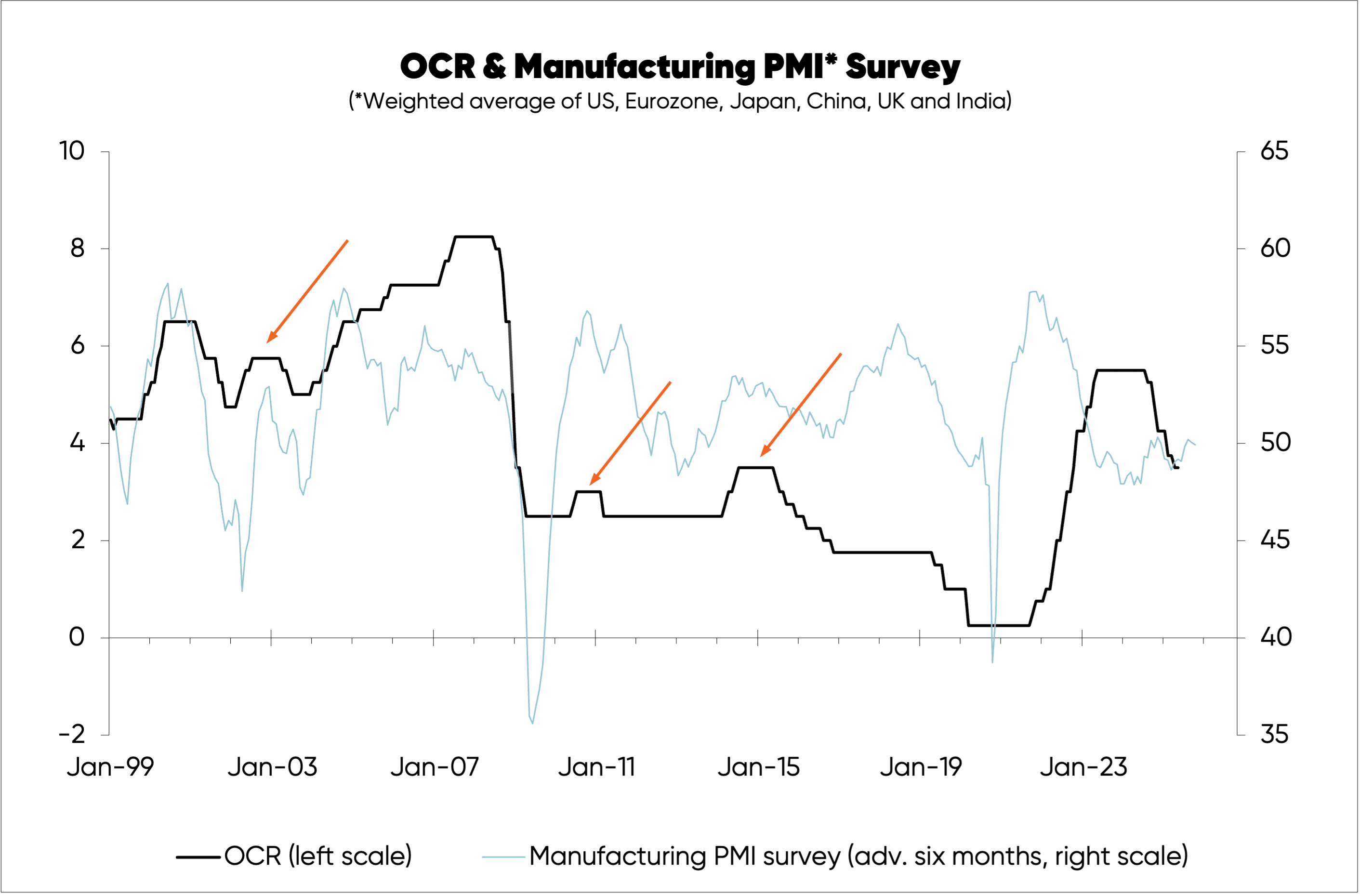

In these instances, OCR increases were most closely linked to a leading indicator of global growth as shown in the third chart that has it advance or leading by six months.

This fits with the tendency for the RBNZ to put too much emphasis on global factors in its forecasts, despite only a modest link between global and local economic growth in general.

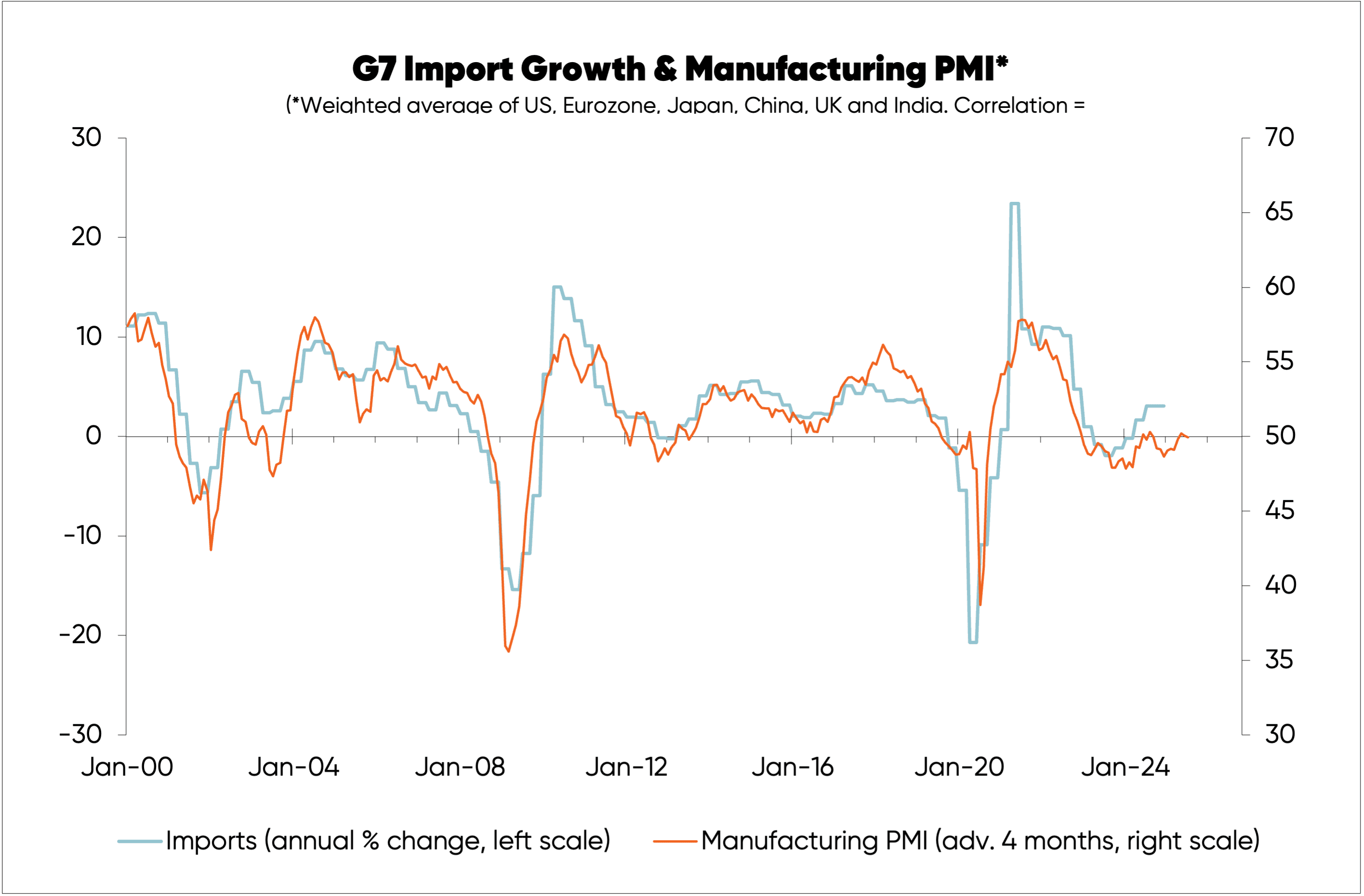

The leading indicator is a weighted average of the manufacturing purchasing manager surveys in the major six countries/regions which is a good leading indicator of growth in imports by the major G7 countries (see the fourth chart).

Perhaps commonsense will prevail and the trade war will abate quickly. But it feels more likely that it will last long enough (and do enough damage to global economic growth) to be at least a minor positive for the NZ housing market.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.