Season’s greetings from all of us at Squirrel—we hope you’re winding down and eyeing up a well-earned break. We’ll kick things off with the most important news:

A reduction to investment interest rates

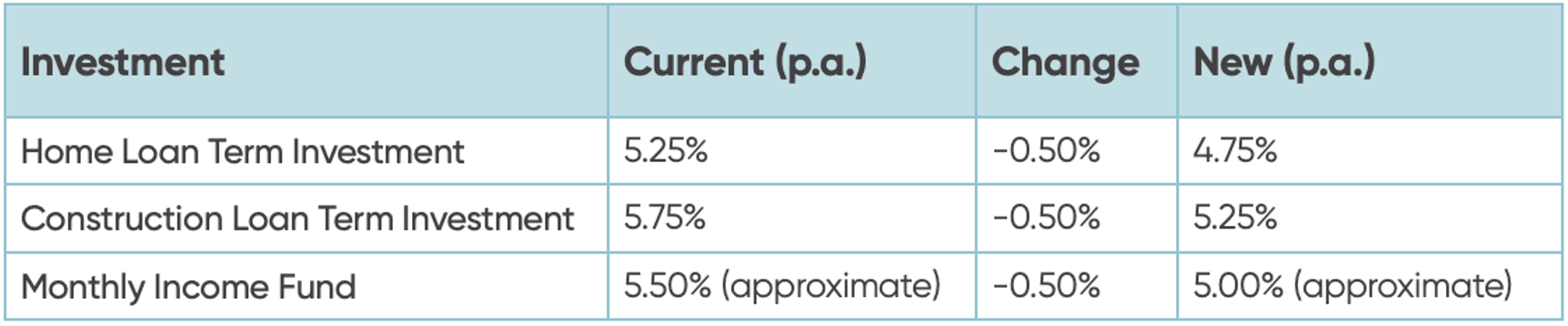

From 23 December 2025, we’ll be reducing interest rates on our Home Loan and Construction Loan Term Investments. This will also flow through to the Monthly Income Fund.

All things being equal, we expect this to be the last move in this interest rate cycle, with these rates likely to hold for the next 9–12 months.

What’s driving the change?

Over the past 18 months, the Official Cash Rate (OCR) has dropped by 3.25%.

Over that same period (including this change), Squirrel investment rates will have come down by 2.25%.

We didn’t rush this decision. Since the OCR announcement in late November, we’ve been watching the market closely – and it’s playing out much as we discussed in our May webinar, particularly when it comes to the Depositor Compensation Scheme (DCS).

In essence, a lot more money has flowed into the non-bank deposit takers. That’s pushed deposit and lending rates down, and to stay competitive on the lending side, we’ve needed to follow suit. When lending rates move, investment rates have to move too.

If you’re curious, a quick look at the deposit rates offered by non-bank lenders on interest.co.nz tells the story pretty clearly.

Investor demand is still running hot (really hot)

Despite settling record volumes of loans, wait times to get invested via term investments are still longer than any of us would like.

Investor demand continues to outpace supply.

Our Managed Funds are feeling it too. They’re holding more cash than is ideal – including funds sitting in the investor queue – which does take a little shine off returns at present.

Behind the scenes, we’re working hard to increase the volume of good-quality loans coming through. We’re committed to maintaining our lending standards and will not write poor quality loans simply to meet investor demand.

At the time of writing this, we still have around 40 loans settling before Christmas, which is keeping our credit and operations teams flat out.

A quick pulse check on the property market

We’re starting to see a bit more life in residential property transactions. Developers are moving completed stock faster than they were earlier in the year, which is encouraging as we head into 2026.

That said, we’re not convinced by forecasts of 5% house price growth next year.

There’s still plenty of stock on the market, and we haven’t seen a meaningful lift in net immigration yet.

Lower interest rates alone probably won’t do the heavy lifting without those other pieces falling into place – and I’m not convinced higher house prices are good for the NZ economy anyway!

Holiday mode (almost) activated

We’ll be running a skeleton crew through to 5 January 2026, when we start gearing back up for the year. We may be a little slower to respond than usual, but we’ll get back to you as soon as we can.

As always, if you have any feedback on what’s working well or what we could be doing better next year, get in touch at dave@squirrel.co.nz.

Finally, thank you for investing with us this year.

We hope you feel we’ve delivered on what matters most – strong, well-managed, risk-adjusted returns.

From all of us at Squirrel, we wish you, your family and loved ones a relaxing and safe holiday break. See you in the new year.