Shoot into home ownership faster with Launchpad

Feeling frustrated because you've got good income but not enough deposit for your first home? Launchpad helps buyers onto the property ladder with as little as 5% deposit.1

Apply now

Launchpad has several benefits

- Buy with as little as 5% deposit

- Competitive interest rates

- Best of all, it’s a leg up onto the property ladder

Why can Squirrel offer Launchpad when others can't?

Well the short answer is, because we made it happen. Every day we talk to frustrated first home buyers with excellent stable income but to get a deposit up to 20% in today’s housing market takes years. It’s a common story. You’re ready and can afford to take on a mortgage but the bank won’t let you. Kāinga Ora isn’t an option for higher earners due to income caps and house price caps. It just isn’t fair, right?

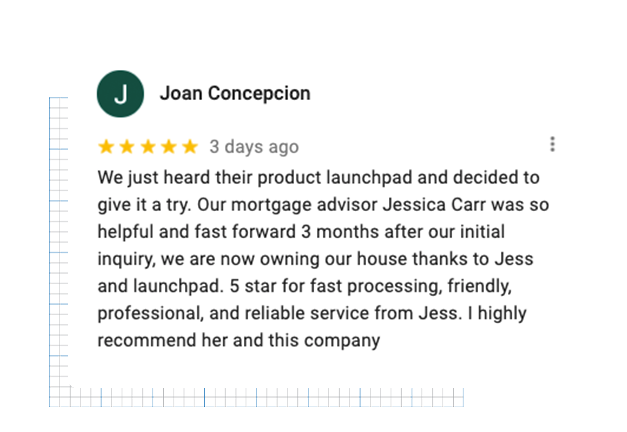

That’s where we saw a gap, so we're filling it. Squirrel is in a unique position that we are both a broker and a lender, enabling us to do what other brokers or lenders can’t. We engineered the Launchpad process to enable you, the buyer, to shoot into home ownership faster. And we can’t wait to help as many first home buyers as we can.

Who's eligible for Launchpad?

While we're able to be more flexible than the banks, sadly we can't lend to everyone. To apply, you'll need to be able to tick these boxes:

- First home buyer

- 5% genuine saved deposit (includes KiwiSaver)

- On PAYE or a fixed-term contract for at least a year2

- Intending to live in the property

- Buying in a metro location

As a rule of thumb, if you're buying within 10km of a Macca's and it's not a lifestyle block, the property is likely to be eligible location-wise.

Your deposit amount will depend on the house price. Here's a guide:

|

House price |

Maximum LVR |

Minimum deposit |

Launchpad Loan |

|

$1,100,000 |

91% |

$100,000 |

$1,000,000 |

|

$1,000,000 |

92% |

$80,000 |

$920,000 |

|

$900,000 |

93% |

$60,000 |

$840,000 |

|

$800,000 |

95% |

$40,000 |

$760,000 |

|

$700,000 |

95% |

$35,000 |

$665,000 |

For properties with a price above $800,000 you'll need more than 5% deposit because the maximum Equity Loan amount we are able to lend with Launchpad is $120,000.

How does it work? Well, we did some creative thinking for this one. The loan is in two parts which are set up in a way that helps you pay it off faster:

The Base Loan (80%)

This is the bulk of your loan, set up with your choice of a floating or fixed interest rate. Payments start off as interest-only so you can focus on paying off the smaller, more expensive Equity Loan first.

Interest rates:3

- Floating: 8.84%p.a.

- 1 year fixed: 8.09%p.a.

- 2 year fixed: 7.59%p.a.

- 3 year fixed: 7.29%p.a.

- Repayments: Interest-only (first 5 years)4

- Term: 30 years

The Equity Loan (up to 15%)

This part of your loan is peer-to-peer funded. It's a bit like getting help from your parents, but without any awkward conversations. You can make extra payments on this loan whenever you like at no extra cost, to get rid of it faster.

- Interest rate:3 9.95%p.a.

- Repayments: Principal and interest

- Term: 5 years

- Maximum amount: $120,000 (meaning if the house price is above $800,000 you'll need more than 5% deposit)

Let's take a look at a real life example

Brooke and Jamie find a house for $800,000. They have a combined income of $160,000 and have saved up a 5% deposit of $40,000. This is how their launchpad loan works:

|

House value |

$800,000 |

|

|

|

Deposit |

$40,000 |

|

|

|

LVR |

95% |

|

|

|

Equity Loan |

$120,000 |

9.95%p.a. interest rate |

$2,547 monthly repayment |

|

Base Loan |

$640,000 |

8.84%p.a. floating interest rate |

$4,805 monthly repayment* |

|

Total Loan |

$760,000 |

9.02%p.a. interest rate |

$7,352 monthly repayment* |

*Repayments based on being interest-only on a 5 year term at the interest rate specified. This is a hypothetical example only. Interest rates are subject to change.

2. A mortgage adviser will be in touch

We'll take a look at the details provided in your chat about whether Launchpad is right for you.

3. We'll run some calculations.

Providing everything stacks up, we'll send you an indicative offer with details outlining next steps.

4. You'll start the house hunt

Once you've found a place you like, we'll get a formal approval for you to proceed. We'll then make sure the property is suitable and run a credit check.

5. Approval for funding

As long as everything is shipshape, we'll give you the green light and process the funding. The $1,000 establishment fee can be paid at this point or we can absorb it into the loan.

6. We'll sit down and decide your loan structure

We'll have a meeting with you to set up the mortgage structure in the best way possible to work with you and your lifestyle.

Who is Launchpad for?

Launchpad helps first home buyers who are on a strong income and can afford the mortgage, but haven't saved up a big enough deposit to get approved by the main banks. These people might be earning too much to be eligible for the Kāinga ora Government scheme, or are looking to buy a house that's over the price cap. We see clients in fall into this category all the time, so we decided to create a solution that helps as many people into homeownership as we can.

What if i'm self-employed?

If you're a fixed-term contractor, you'll need to have a minimum of 12 months left to run, and two years history in a similar role/profession. Unfortunately if you're self-employed, you won't be eligible for Launchpad. That said, there are lots of options at our disposal, so give us a ring and we can help you find the best product for you.

How much do I need to save for a deposit?

At the bare minimum, you need to be able to show you've saved 5% of the house value. Your KiwiSaver can be included in this, but it shouldn't include any gifted funds that you didn't save up yourself. If the property you're wanting to buy is over $800,000 you'll need more than 5% deposit due to the maximum Equity Loan amount for Launchpad being $120,000.

Are there any fees?

As with any financial product, there is a cost involved in setting up the loan and our one-off fee is $1,000. You can choose to pay it up front, or if you don’t have a spare $1,000 lying around, we can simply add it to the loan and you’ll barely notice it. Easy. Other fees and charges may apply should you miss a loan payment.

What happens if I buy at auction?

You'll need to have enough funds in cash to cover the deposit required and this amount can't be borrowed. Your mortgage adviser can walk you through this.

Can I buy any type of property with Launchpad?

The property must be a residential home that you're planning on living in — that includes a house, townhouse or apartment. Size wise, the dwelling must be at least 50 square meters and the maximum land size is 3000 square metres.

Is a builder’s report, and house and mortgage insurance needed?

We may require a builder’s report but it’s not a prerequisite. House insurance is required and mortgage insurance is recommended.

Why do I need more than 5% deposit when the property costs more than $800,000?

The maximum Equity Loan that we are able to lend for Launchpad is $120,000. This means that the maximum LVR (loan-to-value ratio) for properties over $800,000 gets smaller as the property price increases. At a property price of $900,000 you'll need a 7% deposit minimum, at a property price of $1,000,000 you'll need a minimum deposit of 8% and so forth.

1Loan approvals are subject to Squirrel's full lending criteria. T&Cs apply.

2Individuals who are self-employed are not eligible.

3Interest rates are subject to change.

4The loan will convert to principal and interest after the initial five year period.