New Zealand banks need to do right by their customers, and it starts with dropping mortgage rates

Post by David Cunningham - Chief Squirrel

I’m sure I don’t need to remind anyone that our country is deep in a cost-of-living crisis.

Those with mortgages are struggling. Collectively we’re all having to tighten our belts.

And in the lead up to election day, our politicians are scrambling to come up with policies to support everyday Kiwi who are being stretched to their absolute financial limit.

And yet amidst all of this, New Zealand banks are thriving – bringing in record profits.

Banks margins have grown massively since the cost-of-living crisis began, by just over 15%. And every other week it seems, they’re pushing home loan interest rates still higher and higher.

People have rightly questioned how the banks can justify these ongoing increases, when wholesale interest rates have remained stable since the Official Cash Rate was raised to 5.50% on 24 May 2023.

It’s why there’s a market study into competition in personal banking underway.

Taking a step back for a moment – let’s look at the facts...

Eighty per cent of New Zealand banks’ revenue is generated via what’s known as their interest margin.

That’s the difference between the interest they pay households and businesses on their savings, (or on what they borrow from the wholesale markets, including the Reserve Bank); and the interest they charge when they lend money out to homeowners and businesses.

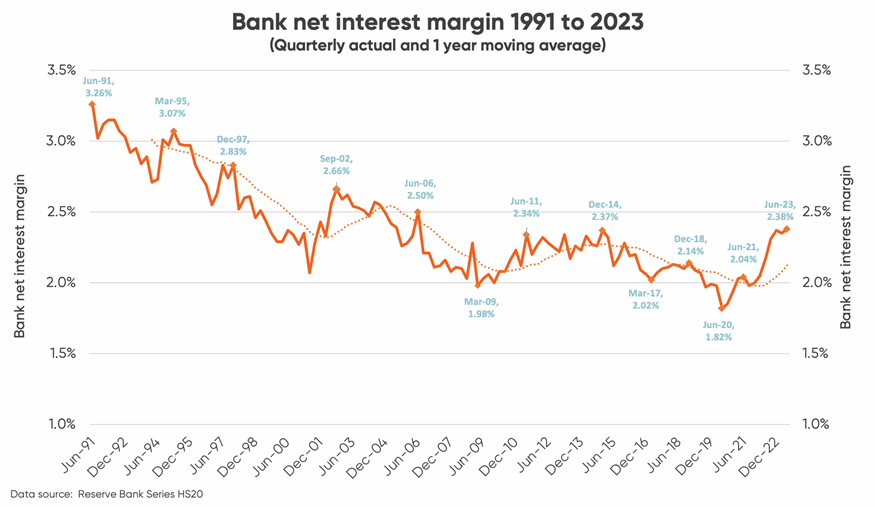

The below graph tracks the banks’ interest margin over the last 32 years:

You’ll note that after trending downwards for decades, over the last two years – just as New Zealand’s cost-of-living crisis has emerged – that interest margin has grown rapidly.

Collectively, the banks have managed to expand their interest margin from 2.04% to 2.38%, which has equated to a roughly 17% lift in their overall profit margin on their lending.

In just two years!

And on the $660 billion of interest-earning loans the banks collectively manage, it’s a whopping $2.24 billion of extra revenue they’re bringing in every year.

Or $43 million every week

$6 million every day

$0.25 million every hour

$4,269 every minute

Or $71 each and every second

So, what’s the driver behind what the banks are doing with home loan rates?

It’s actually not a what, but a who.

His name is Matt Comyn – and he’s the Chief Executive of the Commonwealth Bank of Australia, which owns ASB here in New Zealand.

In mid-August, he came out bemoaning the “unsustainable” (i.e. low) returns the banks are having to put up with on loans within New Zealand’s housing market. Here’s the exact quote:

The mortgage market in New Zealand is even more challenged [than Australia], where pricing conduct is difficult to reconcile. We've pulled back on volume growth in New Zealand given the unsustainable returns.

Really? Cast your mind back to that graph we looked at earlier. The interest margins the banks are earning hardly look unsustainable to me.

Prior to joining Squirrel, I spent 30 years in banking, including four as Chief Executive of The Co-operative Bank, so I know a thing or two about how the banking system works.

When the banks set interest rates for deposits and loans, they’re not thinking about those rates in isolation – they’re thinking about what it means for their interest margin overall. That’s just Banking 101.

What happening here is a practice called price signalling

It’s extremely common in oligopolies, like the banking sector, where there are a few large players and extremely high barriers to entry.

Mr Comyn’s comments were targeted at the major bank CEOs in Australia, and therefore indirectly at the four big Aussie-owned banks here in New Zealand.

The signal he was sending? “Our prices need to be higher”.

Then it just takes one competitor to lead the charge – in this case, it was ASB – so everyone else can follow suit.

And that’s exactly what’s happened in the weeks since.

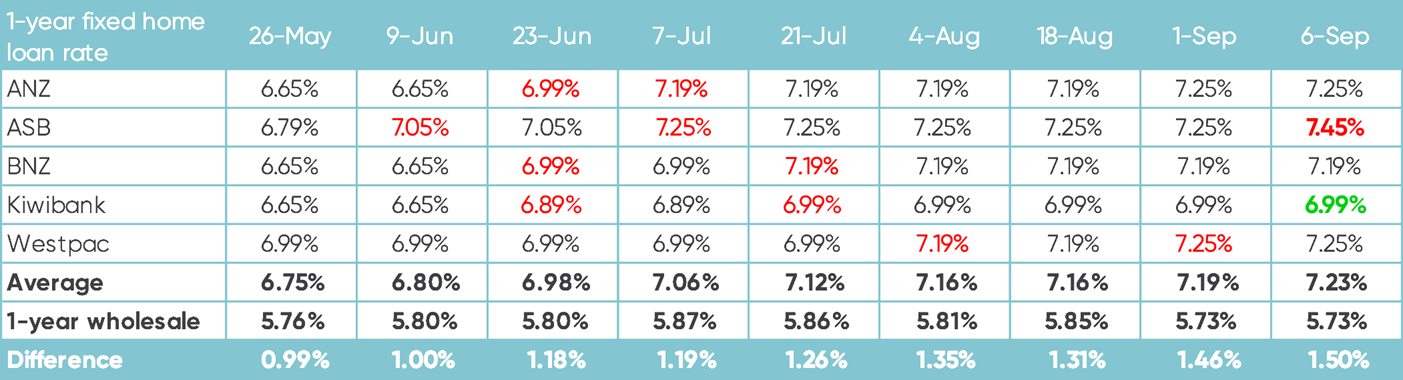

Here’s how it’s played out with the popular one-year fixed home loan interest rate:

Data source: interest.co.nz. Red text denotes an interest rate increase.

Using the wholesale one-year rate as the benchmark (noting that bank funding costs are, on average, well below this), the margin has lifted from about 1.0% after the last Official Cash Rate change on 24 May, to 1.5% now, on average across the big banks.

And we can also calculate the bank’s individual margins… At one end of the spectrum, we’ve got ASB earning 1.72%, and at the other we’ve got Kiwibank earning 1.26%.

I’d welcome a move by our Australian-owned banks to take a leaf out of Kiwibank’s book – and give New Zealanders a bit of a break

Our banks have a social responsibility to do what’s right by New Zealanders – and right now, everyday homeowners are suffering, to bank shareholders’ benefit. At Squirrel, we see it day in and day out.

The average mortgage interest rate Kiwi are paying on our home loans has risen from 2.8% in 2021, to 5.3% now – on a $500,000 mortgage, that means $12,500 more in interest payments each year.

And with mortgage rates as they are now, that average still has further to climb to over 7%, and that would mean a further $8,500 in interest payments each year.

All without factoring in any further moves by the banks to expand their interest margin.

My challenge to our four big Aussie-owned banks is this: put your home loan rates back down.

A rate of 6.99% for the one-year fixed home loan term would be a good start. It’s time for our big banks to do right by Kiwi.

*Figures accurate as at 6th September 2023.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.