Growing up on a sheep and beef farm, I was often told that farming is the heart of New Zealand’s economy.

The conventional view is that our farming or agricultural sector make up a major part of exports and if not for them, we’d struggle to afford imports.

The belief is that income earned by farmers filters to spending throughout the economy, even to Queen St (most commonly used in reference to Auckland’s Queen St, although according to NZ Geographic there are 110 Queen Streets throughout NZ).

These views are still rolled out at times despite being seriously outdated.

Because the truth is, the economy parted company with this “backbone” almost 20 years ago.

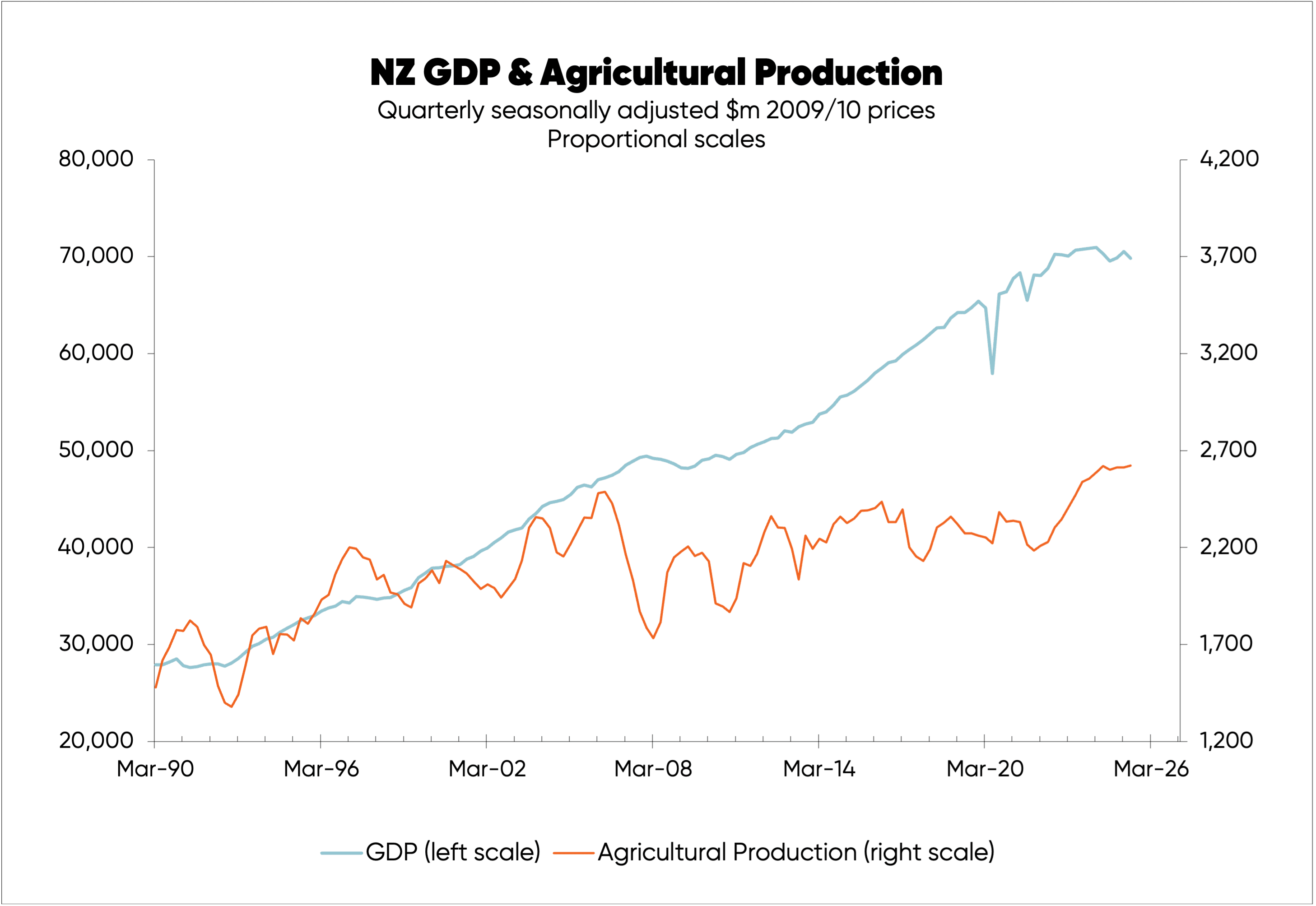

Since peaking in the 2006 September quarter there has been only a 5% increase in agricultural production up to the 2025 June quarter, while overall economic activity or GDP increased by 48% (see the first chart, below).

Clearly, economic growth isn't as reliant on agriculture as many would think.

So, if it’s not agriculture, what is behind our economic growth?

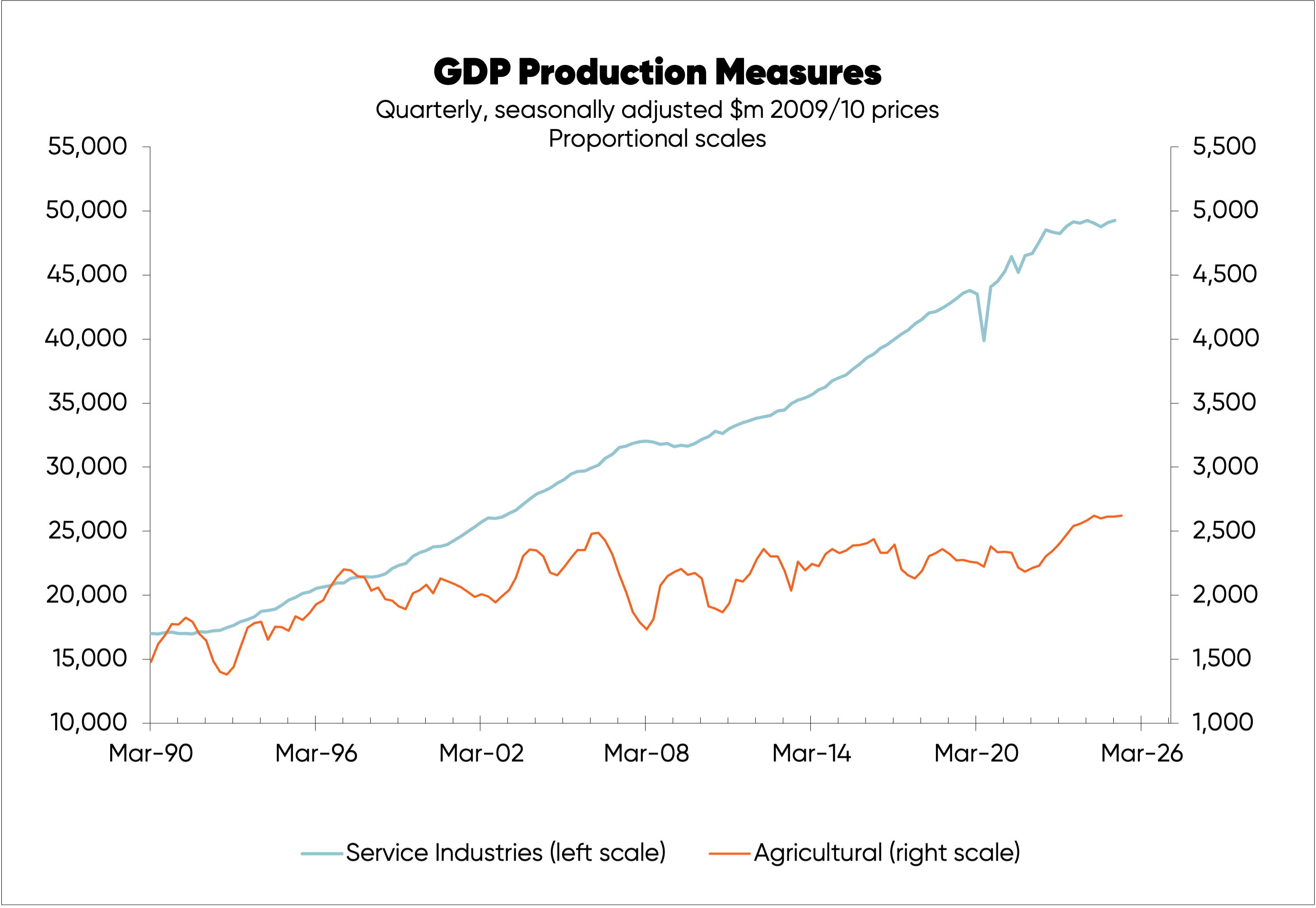

Service industries are the big one, with production increasing by 64% from the 2006 September quarter to the 2025 June quarter (see the second chart).

In the 2025 June quarter the volume of service industry production was $49.3b or 76% of GDP versus $2.6b for agricultural production or 4% of GDP.

Growth in developed economies—including even the NZ economy, with its strong farming roots—is driven most by far by service industries.

All industries play a part, but it has long been a stretch to claim farming is the backbone of the economy.

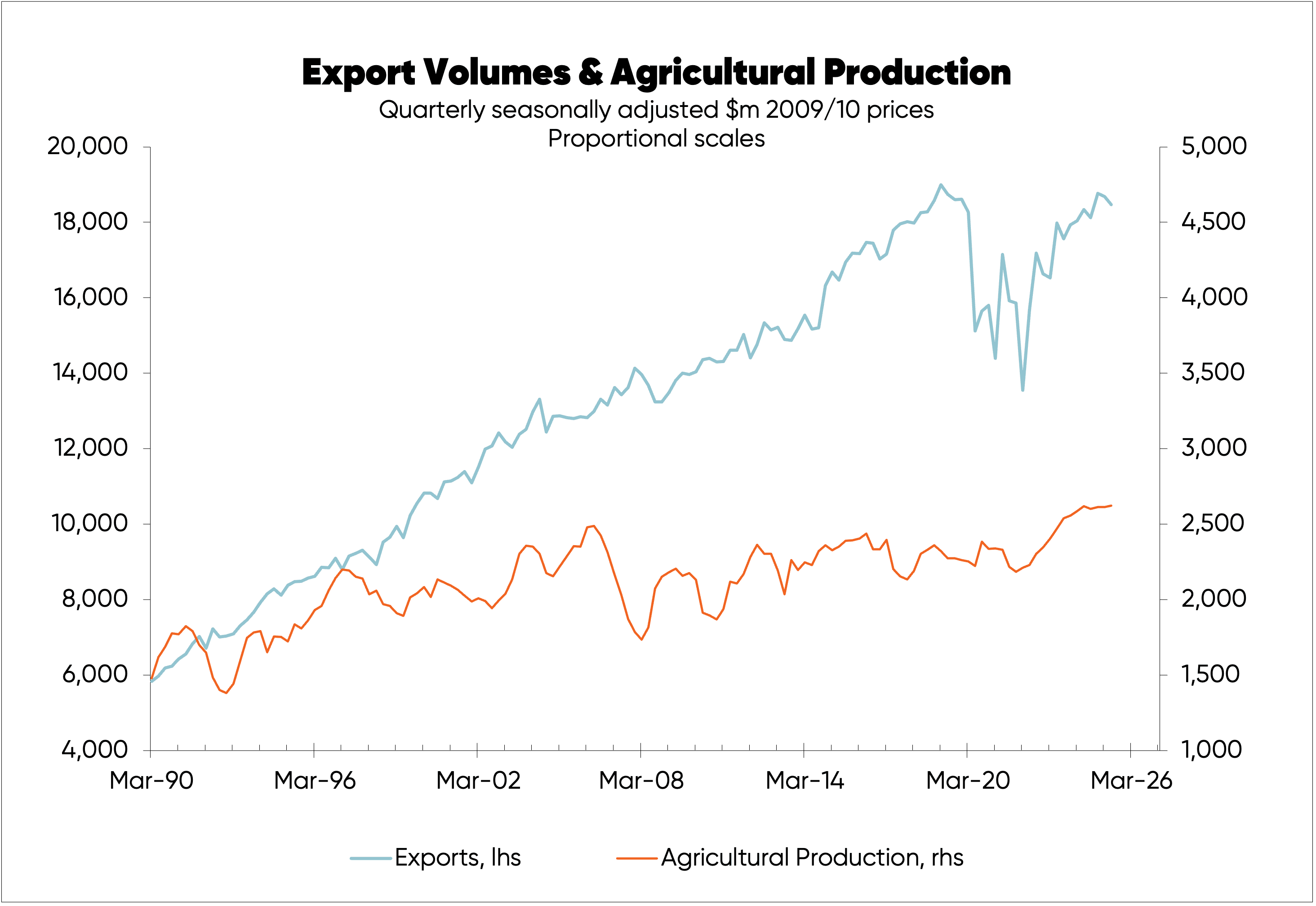

Agriculture isn’t even the backbone of growth in NZ exports anymore.

Since 1990 the volume of agricultural production grew 77% while the volume of exports - goods and services - rose 216% (see the third chart).

Growth in exports was helped by tourism and a range of primary industries including fishing, forestry, wine, kiwifruit and various other horticultural products.

But traditional farming can no longer lay claim to being of huge importance in paying for growth in imports.

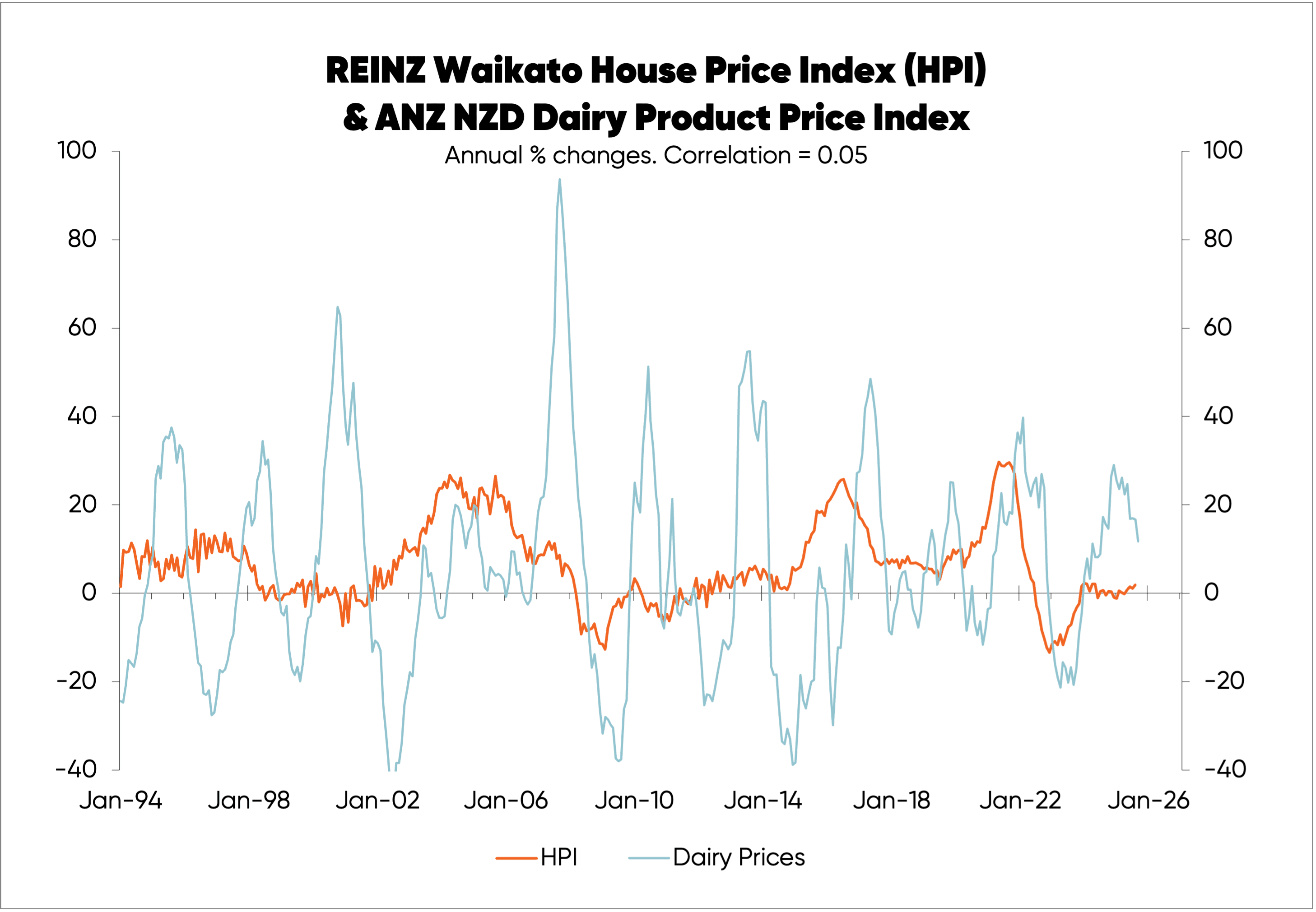

The idea that farming incomes have much impact on Queen St spending is now a myth.

What happens on New Zealand’s Queen Streets—even those in regions where agriculture plays a larger part—is driven most by interest rates, population growth, and female participation rates in the labour force.

For example, in 2015 when dairy product prices fell significantly and some economists predicted house prices would fall in regions like the Waikato, the fall in dairy farm incomes was followed closely by a large rise in house prices.

In Hamilton—Waikato’s main urban centre—it’s Queens Ave rather than Queen St, but the same applies. The fourth chart shows no link in general between dairy product price inflation and house price inflation in the Waikato.

Even with dairy farmers having cut spending (which they no doubt would have) house prices surging in the wake of the 2015 fall in dairy farm incomes, thanks to by falling interest rates and strong population growth.

With just over 12,000 dairy farms nationally, falling dairy farmer spending was swamped for the likes of housing and consumer spending by falling interest rates, and net migration adding 50,000+ to the NZ population.

From both an historical empirical perspective, as shown in the charts, and from a conceptual perspective, it no longer makes sense that what happens to farm incomes is a significant driver of what happens on any of our 110 Queen Streets.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.