Unlike past Reserve Bank (RBNZ) governors, Dr Anna Breman—who took up the role this month—has plenty of monetary policy experience.

But, while it'll be good to have someone at the helm who’s not learning on the job (and who only really gets it after conducting some experient that ultimately goes bad), I doubt Governor Breman will be able to fix all the RBNZ’s problems.

The experience with the 2024 recession highlights some of the RBNZ’s shortcomings.

They include inaccurate forecasting, poor analysis, being out of touch with what is happening at the coal face of the economy, and poor judgment.

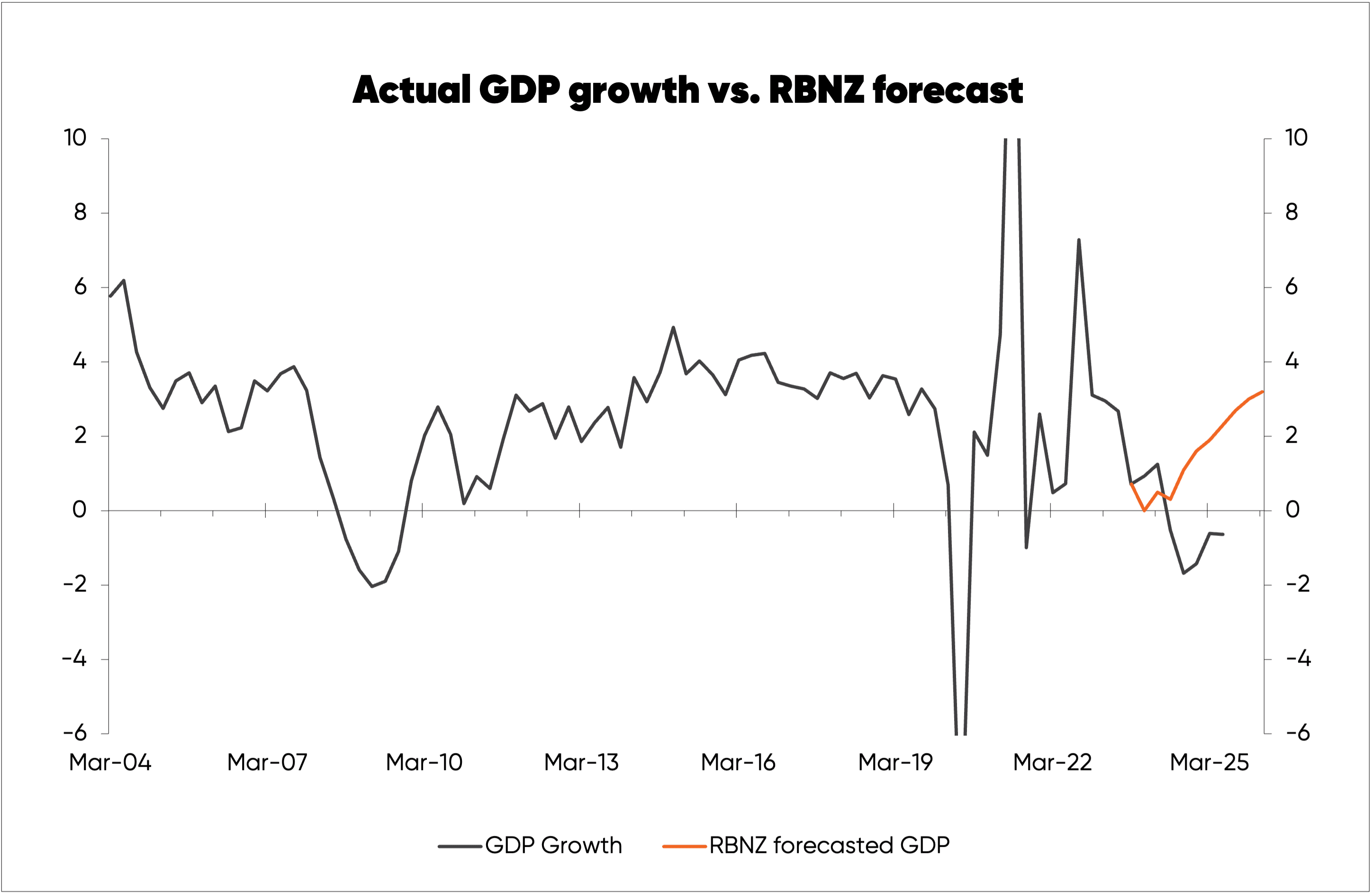

The recession started in the June quarter, but just a few months prior (in February) the RBNZ was predicting no recession and for annual GDP growth to quickly return to 3% (orange line in the first chart below).

Based on the information that was available in February 2024—shown in the second and third charts—the RBNZ should not have been surprised a recession was coming.

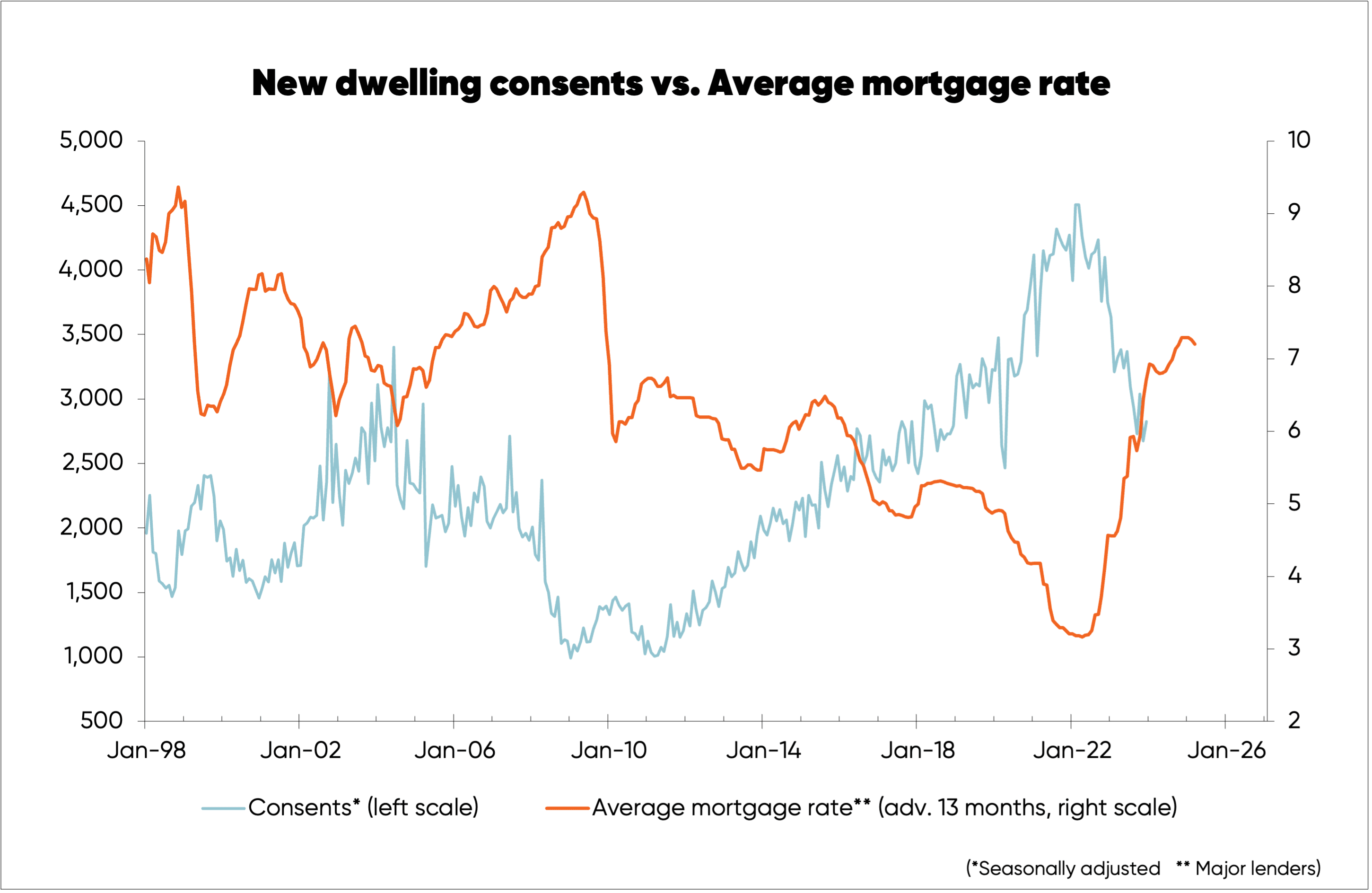

Falling dwelling consents

On 2 February, Stats NZ released its December 2023 numbers around consents for new dwellings. Having fallen consistently from late-2022, December consents were down 37% from their peak, driven by New Zealand’s sharpest ever rise in interest rates.

The graph shows the orange mortgage interest rate line advanced (shifted to the right) by 13 months, reflecting how long it takes for interest rates to impact on consents.

When there are such large falls in new dwelling consents, recessions (i.e. a two or more quarter fall in economic activity) always follow.

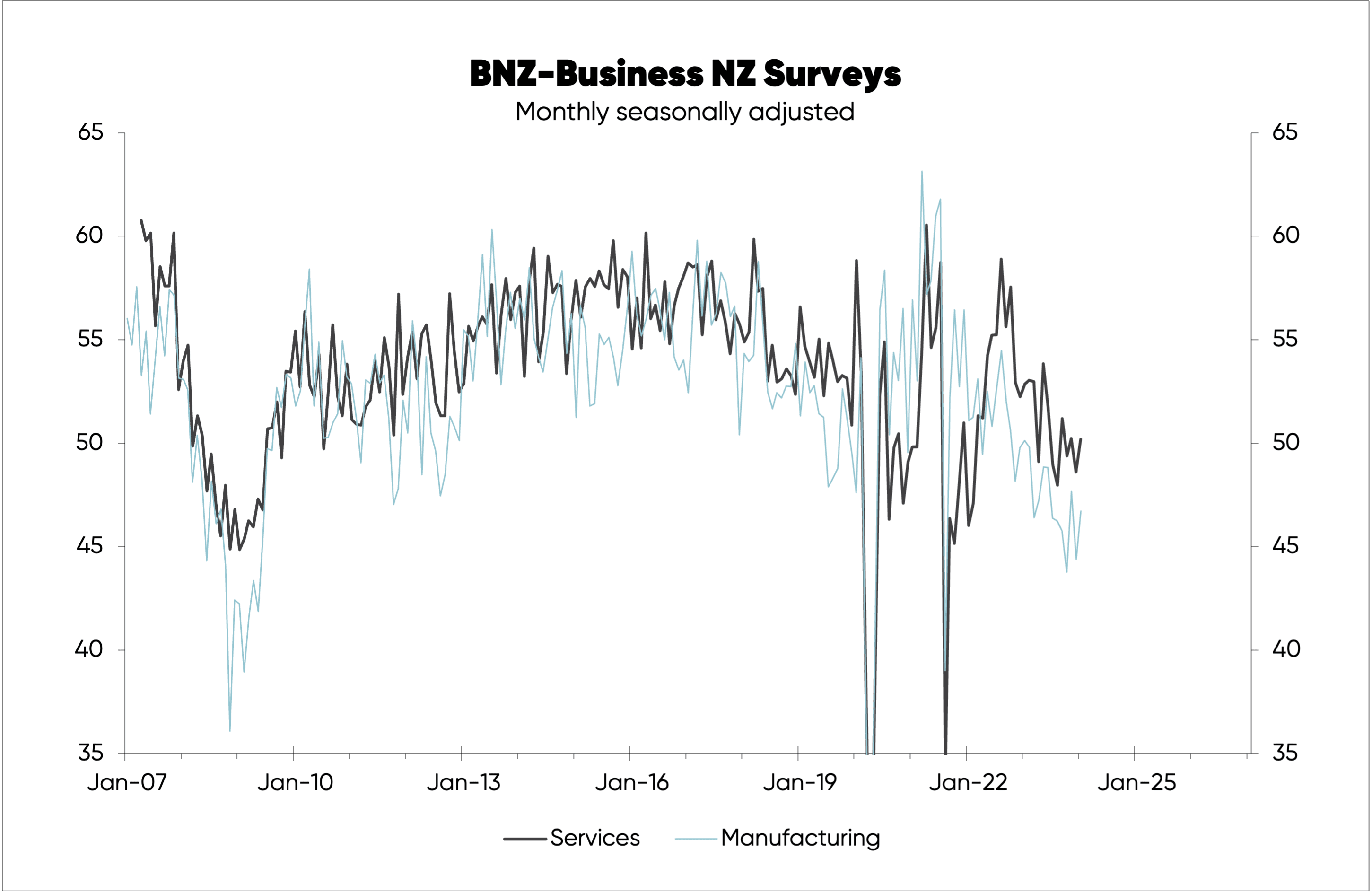

Falling business confidence

In late 2023 the BNZ Business NZ surveys had fallen to recessionary levels. These surveys have been about the most useful of the business surveys in forewarning of recessions.

If the RBNZ was in touch with what was going on in the economy in February 2024, even just based on info that was readily available, it should have seen that a recession was imminent.

Instead, the RBNZ had its head in the sand and didn’t start to cut the OCR until August 2024.

The RBNZ is like an inexperienced person backing a trailer. It is slow to realise it is going off course, then overreacts when it does, causing the trailer to swing wildly.

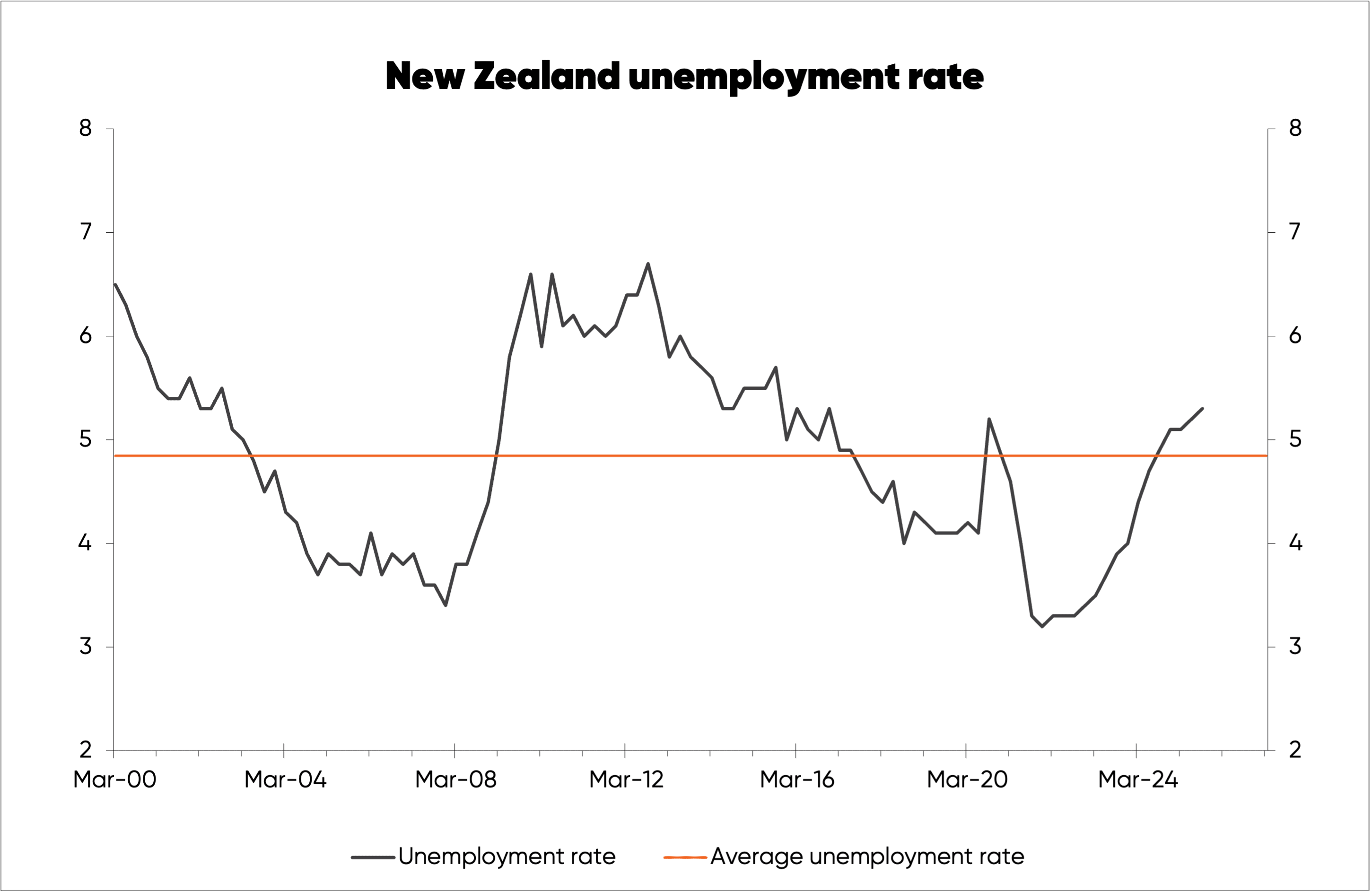

This is best measured by the unemployment rate – a key leading indicator of inflation.

By keeping interest rates too low for too long, as it did after Covid, the RBNZ allowed the unemployment rate to fall too much, the result of an overheated economy.

Once the resulting inflation emerges with quite a lag on the fall in the unemployment rate, the RBNZ overreacts and keeps hiking the OCR until there is a recession.

Forecasting the future is tough. But the RBNZ would be far better at forecasting if it was on top of how the economy works (like understanding the pivotal role housing plays in economic cycles), if it was in touch with what was happening at the coalface, and if it had good judgement.

If it could manage that, it would be much quicker to see when the economy was going off course and there wouldn’t be such extreme cycles in interest rates, economic growth, the unemployment rate, and the housing market.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.