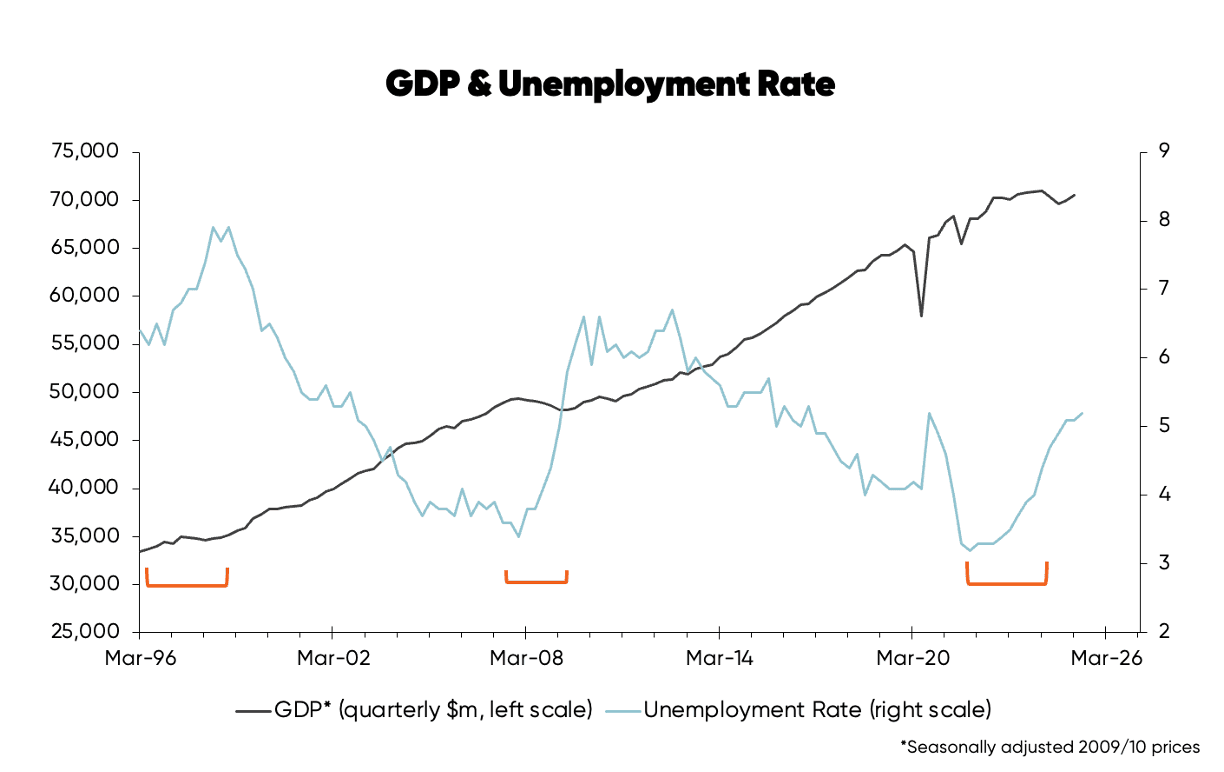

New Zealand experienced a reasonably severe recession in 2024, with economic activity or GDP falling 1.9% from the March quarter to the September quarter.

To put this in perspective, in the 2008/09 recession, GDP fell 2.5% and in the 2007/08 recession it fell 0.9%.

These falls may not seem large, but some industries have been hit much more severely than others. Levels of residential building activity, for example, fells 24%—driven by the large increase in interest rates that culminated in the 2024 recession.

Recessions also have a major impact on unemployment, as shown in the first chart (below). The orange brackets highlight periods of rising unemployment, associated with the three recessions noted above.

There’s no doubt this latest recession has hit hard—and many Kiwi households and businesses are still struggling in the aftermath of the 2024 recession—however, looking forward, there is a silver lining.

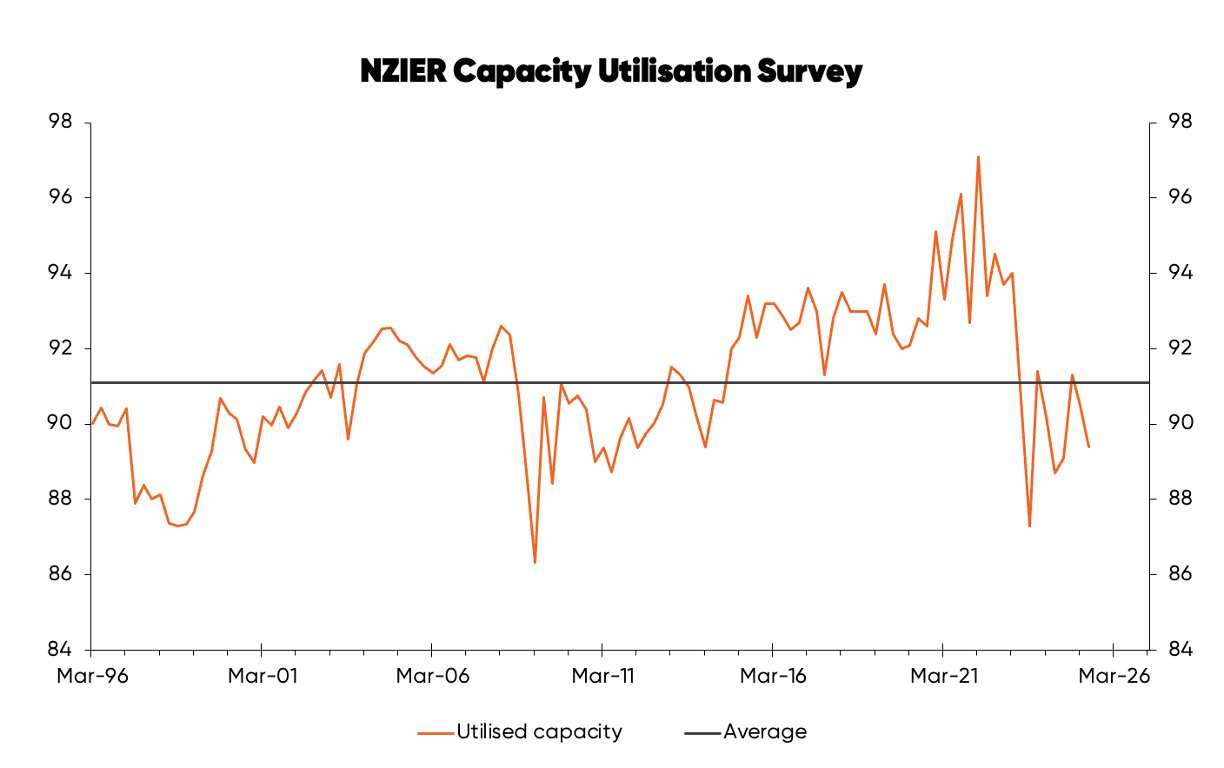

Recessions create spare capacity in the economy—which can be measured by people unemployed who would like to work and whether businesses have spare capacity to increase production.

The chart below summarises the findings from NZIER’s survey into business capacity utilisation, which measures firms’ spare capacity.

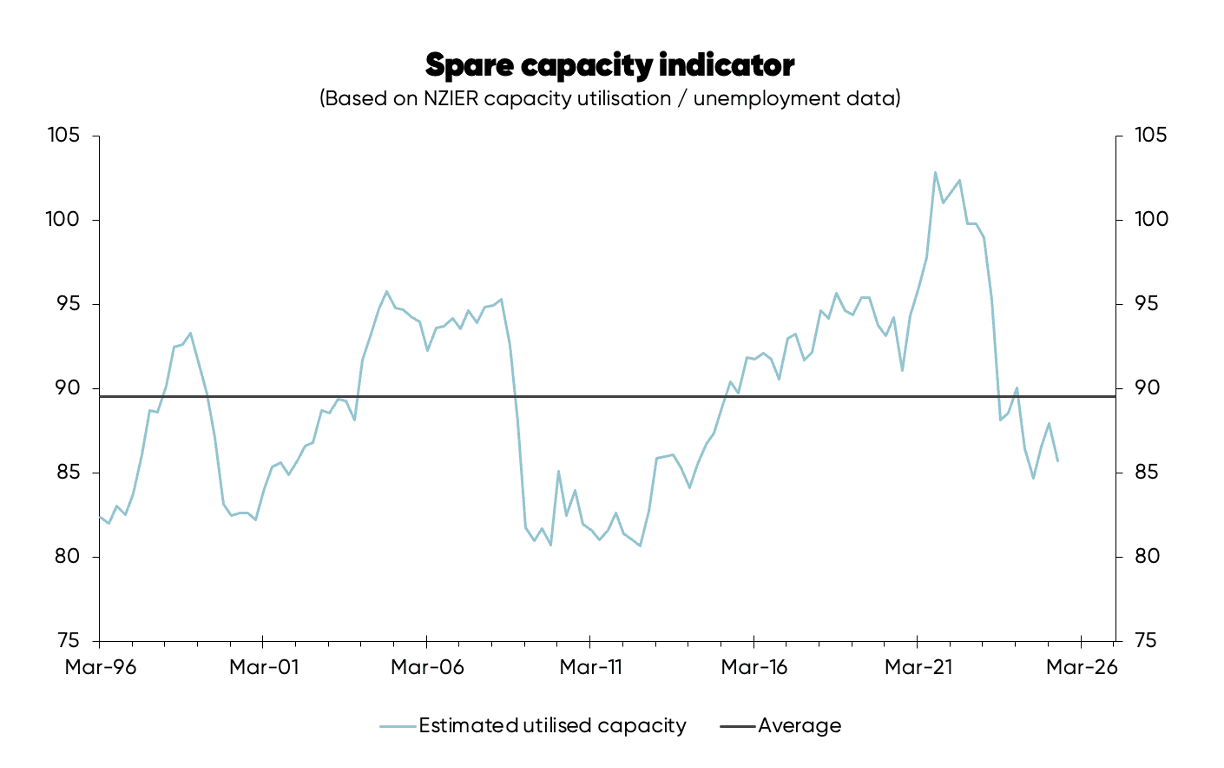

And in the third chart, I’ve combined the NZIER data and the unemployment rate to calculate a spare capacity indicator—to put into context how much spare capacity we currently have in the economy, compared to following the previous two recessions.

When there is spare capacity in the economy the Reserve Bank can be growth-friendly, because the spare capacity will constrain inflation

After the previous two recessions (not counting the Covid-induced recession that is a special case) there followed economic growth phases lasting a decade or more.

While there is less spare capacity in the economy now than after the previous two recessions, there is enough to mean the Reserve Bank should be able to take a growth-positive approach for some time. This includes the likelihood that if there is any negative global or other shock to growth the Reserve Bank will respond as quickly as possible (for a bureaucratic organisation) to offset the fallout by cutting interest rates more.

For example, in 2015 when the Reserve Bank was still in growth-friendly mode, there was a large fall in dairy export prices which, along with some other factors, posed some threat to economic growth. The Reserve Bank responded by cutting the OCR from 3.5% to 1.75% to help promote economic growth.

The recovery from the 2024 recession has started with GDP growing at a 2.6% annualised rate over the last quarter of 2024 and first quarter of 2025. Recently there seems to have been some setback to growth with most business and consumer surveys weakening somewhat and the housing recovery stalling.

It is hard to say exactly what is behind the weakness but a candidate is concern around fallout from Trump’s trade war.

To the extent fallout from the trade war is a threat to New Zealand economic growth, because there is spare capacity in the economy we can rely on the Reserve Bank to lean against any such fallout by cutting the OCR more if needed.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.