I’ve seen this wheeled out on a number of occasions by commentators to highlight the extent to which house prices are over-valued. Whilst I fully agree that house prices are over-inflated, I don’t think it’s to the extent that this ratio suggests.

The pivot point is around 1980 which to me is when modern laissez-faire economics took hold.

- Top tier income tax rates dropped from circa 65% to 39% and we introduced GST

- Inflation targeting began to lower interest rates long-term

- Deregulation, liberalisation of international trade

- The start of the knowledge economy (internet and technology)

- Manufacturing pushed offshore (outsourcing)

The issue with all fast growing cities is their ability to keep pace. With globalisation we have transitioned from manufacturing sector growth to tertiary/service sector growth. We have liberated trade and labour and capital. Cities at the forefront of globalisation and tertiary sector growth tend to have the same immigration and housing issues. At the same time, economies have had a massive fiscal and monetary easing over the past thirty years. This is a combination of lower interest rates, lower income tax rates, and the liberalisation of lending.

Globalisation

Let’s start with something fairly simple around land supply. If we draw a 5km radius around the Auckland CBD roughly 46% of it is water. Even with a circle at 10km it doesn’t get much better. That’s one of the challenges of coastal harbour cities, many of which are at the forefront of globalisation.

Land supply is an issue for Auckland. That is a function of the geography (water and volcanic rock) but is amplified by local government planning and policy that limits development. The Demographia survey looks at the most and least affordable cities across a number of countries. It is often referred to for benchmarking affordability. A quick look through the survey shows that almost all of the most affordable cities had declining populations. They are industrial cities that have tended to have higher unemployment rates and lower income growth as they transition to modern cities. I’d argue that they have been more open to change and have had urban plans designed to attract growth. Interestingly, on reading up on these cities, they were referred to as “boomtowns” in the early 1900s as hubs for manufacturing and domestic trade and transportation.

| City | Price/Income (Affordability) | Location | Population | Industry |

| Buffalo | 2.6 | Inland/lake | City itself has reduced from 580,000 in 1950 to 292,000 in 2000 | Industrial and trade |

| Cincinnati | 2.6 | Inland/river | Industrial and trade | |

| Cleveland | 2.6 | Inland/lake | Lost 2% population | Industrial |

| Rochester | 2.6 | Inland/lake | Population falling since 1950 | Industrial |

| Pittsburgh | 2.7 | Inland/river | Population falling | Industrial |

In contrast, all of the highest priced cities have high population growth, fuelled by immigration and tertiary sector income growth. They also have coastal ports and have all been driven by global trade.

| City | Price/Income (Affordability) | Location | Population | Industry |

| San Francisco | 9.4 | Coastal | Increased 90,000 in 2015 alone | Services |

| Auckland | 9.7 | Coastal | 1.75% per year | Services |

| Melbourne | 9.7 | Coastal | 2.1% per year or 91,600 | Services |

| Vancouver | 10.8 | Coastal | 1.86% per year | Services |

| Sydney | 12.2 | Coastal | 1,600 people per week. | Services |

| Hong Kong | 19 | Coastal | 0.8% per yeay | Services |

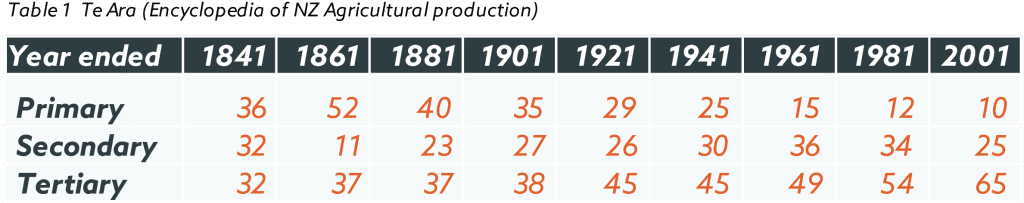

The table below shows the make up of employment in NZ. The shift from manufacturing to the tertiary sector doubled in speed after 1981 with the onset of the latest rounds of deregulation and globalisation.

Fiscal and monetary easing

Whilst we are looking at incomes lets start by recognising that income tax rates have dropped. The biggest benefactors of this were those on higher incomes (more disposable income.) At the same time GST was introduced. GST effectively increases the cost of building and land development. GST disproportionately hits the discretionary income of those on lower incomes. In terms of home ownership, the changing of the tax system favoured high income earners and in particular the baby boomer generation. Baby boomers are the single biggest generation in history. Harry Dent (financial newsletter writer) refers to generational spending cycles a lot in his macro economic analysis. He hypothesises that Boomers experienced significant growth in disposable income as their kids left home in the early 1990s which coincided with the height of their income earning capacity. “Savings” was diverted into property. The biggest shift however is lower interest rates, and liberalisation of lending particularly for housing all of which occurred over the same period. Long term interest rates have been in a steady decline for 30 years. The graph below shows NZ government bond rates. US interest rates follow a similar path.

If you combine lower debt servicing costs (from lower interest rates) with the ability to borrow more (and disposable income growth in Auckland) then it is little wonder that people have bid up the value of property. Essentially property owners have bid away discretionary income and pushed up house prices. Whilst I understand the arguments for taxing property, I don’t think tax on property would have changed this trend. Sydney and Melbourne are amongst the least affordable cities in the world and yet Australia has a capital gains tax. Property has simply been an excellent investment. The same is true of shares and bonds over the same period. With falling interest rates anyone holding income generating assets has done exceptionally well. We have run through an unprecedented period of “housing stimulus” of 30 years of fiscal and monetary easing. At the same time as the biggest generation in history has passed through its highest “savings” life stage. Little wonder property as an asset class has performed incredibly well over the past 30 years. The first is the assertion that house prices always go up (based on the last 30 years of data) is idiotic. This isn’t an Auckland “city” problem, and not a NZ problem. It is a global problem. My second assertion is that you can’t apply the same basic rule across cities that have very different compositions. In the same ways as you don’t expect all companies to perform the same way or have the same P/E ratios. Auckland will rightly be more expensive than other parts of the country. Using a baseline income/price multiple of 3 for all cities is like comparing apples with oranges. Globally orientated cities with immigration, free flowing capital, and income growth will look different and be significantly more expensive. To summarise succinctly, I think where we find ourselves is a function of failing economic orthodoxy and the inability of our leaders to keep up with the increasing pace of societal and technological change. I personally believe that the biggest issue the world faces is that our systems of “organisation” be it government or economies or even law, cannot keep pace with the rate of technological change and that is only going to get worse. We have to get more adaptable and agile. We have to become less mechanic in how we organise ourselves. Imagine if your brain tried to control your body simply by increasing or decreasing your blood pressure!