In a nutshell:

- A wave of new non-bank players have emerged in New Zealand in recent years, out to challenge the banking status quo with products that give Kiwi customers better, smarter, more flexible ways of managing their money.

- Traditional savings accounts are the latest bank segment to get a non-bank makeover—with several fintech providers having launched their own high-interest savings account alternatives.

- These products generally offer better returns and lower fees than what’s on offer with many of the banks, while also giving you access to other great investment opportunities to grow your money.

- If you’re thinking about going down the non-bank savings account route, then there are some key differences between these platforms that you need to know about.

- Most of the seven fintech savings accounts covered in this article provide significantly better savings account interest rates than banks, and many are protected by the Depositor Compensation Scheme.

New Zealand’s fintech sector has exploded with new players in the last decade or so.

Many of these businesses—born out of frustration at the way the traditional banking system works—are out to change the way Kiwi manage their money, providing cheaper, faster, more flexible solutions that do a better job of delivering on what customers want.

Most recently, savings accounts have become the latest bank product to get a non-bank makeover.

Since 2023, several fintechs have launched their own savings account options for Kiwi consumers—offering better rates, lower fees, no penalties, and giving you access to other investment opportunities to grow your returns faster.

Over the course of this article, we’ll be looking at seven of the major fintech savings account options on offer in New Zealand, and how they compare:

- Squirrel On-Call Account

- Wedge Savings Fund

- Booster Savvy

- Kernel Smart Saver

- Debut Cash Account

- Dosh Strive Account

- Sharesies Save Account

NB: This is not an exhaustive list. For the purposes of this article, we’ve focused solely on fintech providers, with the exclusion of any products which require a minimum deposit or investment amount to secure the best rate interest rate.

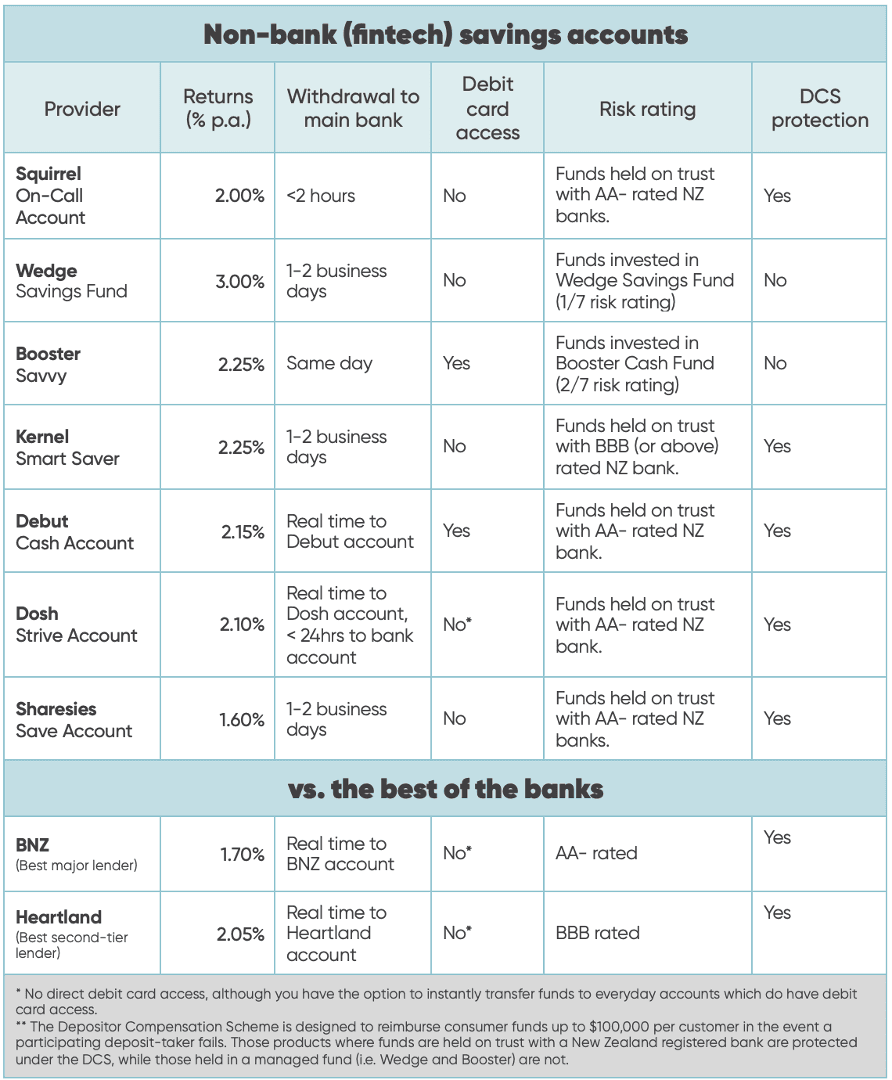

Before we get into the nitty gritty, here's a quick snapshot of the savings account landscape in New Zealand:

The table below looks at how the non-bank savings accounts on this list compare to the best of the banks on a few key things, including rate of return, access to funds, risk ratings and Depositor Compensation Scheme protection.

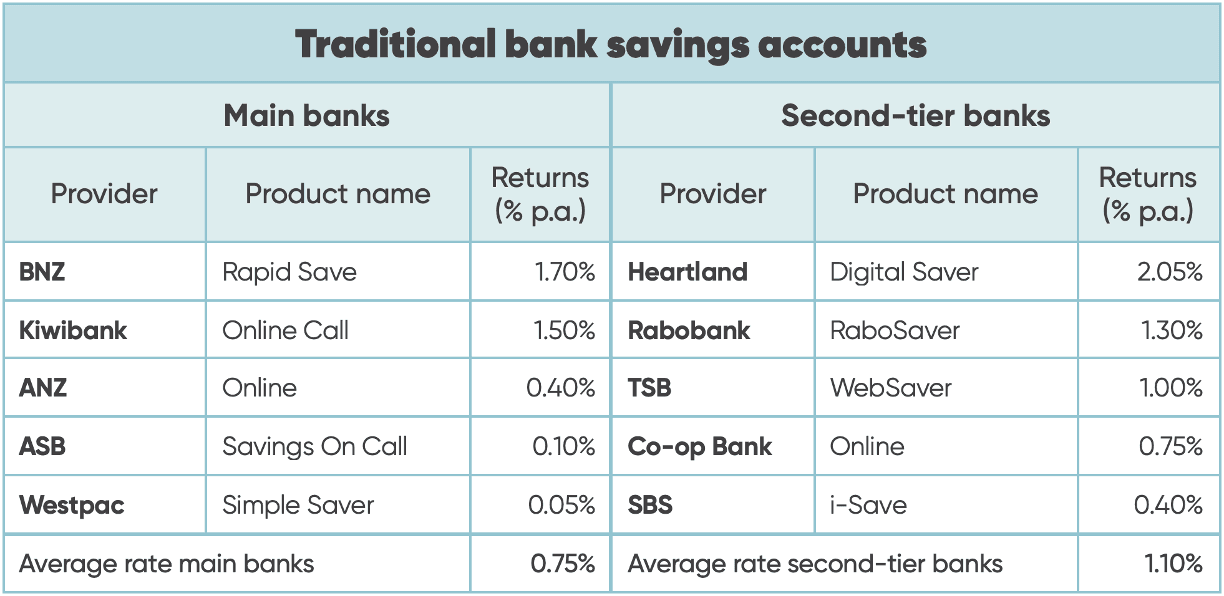

And here’s a summary of the savings accounts on offer across the 10 main retail banks registered in New Zealand:

If you want to read up in more detail about the different bank options available in New Zealand, check out our list of the best and worst traditional bank savings accounts here.

Note that the interest rates quoted in these tables are accurate as at 25/02/2026. Savings accounts interest rates can typically move at any time, and will move with short term interest rate changes in the market.

Now, let’s get into the detail.

1. Squirrel On-Call Account

The Squirrel On-Call Account has (technically) been around since the launch of our peer-to-peer lending and investment platform in 2016, as the place where you deposit funds before going on to invest them with us—or not, as the case may be.

In January 2023—keen to offer Kiwi a fairer return on their savings—we gave it an upgrade, introducing interest payments on Squirrel On-Call account balances, and becoming the first fintech in New Zealand to offer a high-interest on call savings account.

Here’s what you need to know about the Squirrel On-Call Account:

|

Returns: |

2.00% p.a., no strings attached. (Interest accrued daily and paid monthly into your Squirrel On-Call Account) |

|

Deposits: |

Via bank transfer from your verified bank account, using your unique Squirrel account ID as reference. Funds start earning interest from the moment they land in your Squirrel account. |

|

Access to funds: |

Back in your main bank account within two hours, any day of the year (as long as the transaction is set up between the hours of 9:00am and 11:00pm). |

|

Fees / penalties: |

No withdrawal or account fees, or penalties. |

|

Tax: |

Resident Withholding Tax deducted automatically. |

|

Signing up: |

Takes about 5 minutes via the Squirrel website or app. You’ll need a copy of your NZ Passport or Driver’s Licence handy. |

Other things to note:

- For even better returns, you have the option of investing your money in Squirrel Term Investments or the Squirrel Monthly Income Fund, available via our app. You don’t need to invest with us to be a Squirrel On-Call Account holder.

- We've got a raft of new features in the pipeline over the course of 2026—including the option to set up multiple On-Call Accounts for different savings goals.

- Funds held on trust with AA- rated New Zealand registered banks—so it’s like a regular savings account, just with a better interest rate. This also means funds held in the Squirrel On-Call account are protected under the Depositor Compensation Scheme, up to $100,000 per customer.

- Try our investment calculator to see what you could earn with Squirrel.

To get started, register for a Squirrel On-Call Account here.

2. Wedge Savings Fund – www.wedgemoney.co.nz

Wedge is a New Zealand-based fund manager, and the newest entrant on this list. It launched in May 2025, on a mission to 'save New Zealand's savings' from low returns.

To date, Wedge has focused its efforts in the on-call savings account space—with the Wedge Savings Fund available to personal, business and trust customers—but has plans to expand its portfolio to include notice saver and term deposit products sometime in future.

Here's what you need to know about the Wedge Savings Fund:

The way Wedge works is a little different to most of the fintech saving alternatives on this list. Rather than your money being held on trust with a NZ retail bank, it's invested in a Cash and Fixed Interest PIE fund instead.

|

Returns: |

3.00% p.a. Accrued and paid daily into your Wedge Account. The set rate is subject to change at any time. Returns from the previous month are automatically converted to units in the Wedge Savings Fund at the start of the following month. |

|

Deposits: |

Via bank transfer from any NZ bank account, using your Wedge ID as reference. Funds start earning interest from the next business day once they've landed in your Wedge account. |

|

Access to funds: |

Withdrawal to nominated main bank account within 1-2 business days. Transactions processed at 3:30pm on business days; bank account holder's name must match the name on your Wedge account. |

|

Fees / penalties: |

No withdrawal or account fees, or penalties. |

|

Tax: |

PIE tax deducted automatically from your balance whenever you make a withdrawal, and / or at the end of every tax year. |

|

Signing up: |

Signing up takes a few minutes via the Wedge app. |

Other things to note:

- The Wedge Savings Fund invests into a mix of 'high quality' cash and fixed interest assets, with a risk rating of 1 out of 7, and credit rating of AA.

- Unlike most fund managers, Wedge doesn't charge a fund management fee. It uses a performance-based model, meaning it only makes money if the underlying investment outperforms the set customer rate of return. Currently, Wedge's margin + administration fees are estimated to be around 0.19% p.a. Conversely, if the fund underperforms, Wedge will top customers up to the set rate.

- Funds held in the Wedge Savings Fund are not protected by the Depositor Compensation Scheme.

3. Booster Savvy Account – www.boostersavvy.co.nz

Booster came onto the scene in 1998 as an investment and fund manager. In the years since, it’s expanded its offerings to include KiwiSaver funds (it’s a default provider), UK superannuation transfer and life insurance services.

Savvy was introduced in 2021 as a product for wholesale investors, before being released to everyday Kiwi in November 2023.

Here’s what you need to know about Booster Savvy:

Similar to Wedge, the underlying investment behind the Booster Savvy account is a cash-based PIE fund rather than just straight cash in the bank.

The balance of your account is guaranteed (i.e. you won’t lose money) but returns may vary. Booster reviews the interest rate on a monthly basis.

Your Savvy account is also linked to a NZ bank account number and Mastercard debit card, meaning funds can be accessed for EFTPOS, online purchases, bank transfers and ATM withdrawals—including via Apple and Google Pay. Direct debits and international transfers are not currently available.

|

Returns: |

2.25% p.a. (Accrued daily and paid monthly into your Savvy Account) |

|

Deposits: |

Via direct bank transfer from any NZ bank account. Funds start earning interest when they land in your Booster Savvy account. |

|

Access to funds: |

Immediate via the Savvy Mastercard debit card; same-day bank transfers also available if transaction set up before 8:00pm (excluding weekends and public holidays). |

|

Fees / penalties: |

No card, transaction or account fees, or penalties. Booster charges a fund management fee capped at 0.60% p.a., deducted from interest returns paid into your account. |

|

Tax: |

PIE tax deducted automatically. |

|

Signing up: |

Signing up takes a few minutes via the Booster app. |

Other things to note:

- The Booster Cash Fund invests in Bank Deposits, and Government and Bank Securities, and carries a risk rating of 2 out of 7.

- Savvy gives you the ability to set up different ‘Stacks’ to allocate funds towards different expenses and savings goals—with a range of other features (including Salary Split, Sweep and Boost) to encourage you to save.

- You cannot invest in Booster’s other managed fund options direct from your Savvy account.

- Funds held in the Booster Savvy Fund are not protected by the Depositor Compensation Scheme.

4. Kernel Smart Saver – www.kernelwealth.co.nz

Kernel is, first and foremost, an index fund manager. Since launching in 2019, it’s grown its offering to include more than 25 different fund options with portfolios spanning NZ- and globally-listed companies, emerging markets, clean energy, property, cash and bonds.

It launched its high-interest savings account, Kernel Smart Saver, in April 2024.

Here’s what you need to know about Kernel Smart Saver:

|

Returns: |

2.25% p.a. (Accrued daily and paid monthly into your Smart Saver Account) |

|

Deposits: |

Via bank transfer to your Kernel Wallet. You’ll need to transfer funds from your Kernel Wallet to your Smart Saver Account before they start earning interest. |

|

Access to funds: |

Withdrawal to main bank account within 1-2 business days (withdrawals to Kernel Wallet processed at 2:30pm on business days. Withdrawals from Kernel Wallet to main bank account processed at 4:00pm on business days). |

|

Fees / penalties: |

No transaction or account fees, or penalties. |

|

Tax: |

Resident Withholding Tax deducted automatically. |

|

Signing up: |

If you’ve already got a Kernel account, you can sign up in just a few clicks via their app. |

Other things to note:

- Funds in Kernel Smart Saver are held on trust with a New Zealand registered bank with credit rating of BBB or above—meaning they're protected under the Depositor Compensation Scheme, up to $100,000 per customer.

- For a potentially higher rate of return, you can choose to invest in Kernel’s Cash Plus fund instead, with access to funds within 2-3 business days.

- You can also choose to invest in any of Kernel’s other index funds direct from your Cash Plus account.

5. Debut Cash Account– www.makingdebutbank.co.nz

Debut is one of the newer players to come onto New Zealand’s non-bank scene, having launched to everyday Kiwi in May 2024.

At this stage, it offers a raft of innovative transaction and savings account solutions, designed with input and feedback from its customers in order to help better serve their banking needs.

Debut is not a registered NZ bank.

Here’s what you need to know about the Debut Cash Account:

Your Debut Cash Account is linked to a Mastercard debit card, giving you access to funds for ATM withdrawals, online and in-store payments—including via Apple and Google Pay.

|

Returns: |

2.15% p.a. with Universal Interest (Paid monthly into your Cash Account based on a floating average of your total balance across Cash Account and Savings Sheds) NB: You'll need to turn on Universal Interest via the Debut app to start earning interest. |

|

Deposits: |

Via bank transfer from your verified NZ bank account (account holder's name must match that on your Debut account). |

|

Access to funds: |

Immediate access for online and card payments via the Debut Mastercard debit card. Withdrawal to nominated bank account usually within 3-5 business days. |

|

Fees / penalties: |

No card, transaction or monthly account fees, or penalties. |

|

Tax: |

Resident Withholding Tax deducted automatically. |

|

Signing up: |

Takes a few minutes via the Debut app. |

Other things to note:

- Debut Cash Account funds are held on trust with an AA- rated registered NZ bank—meaning they're protected under the Depositor Compensation Scheme, up to $100,000 per customer.

- Debut gives you the ability to set up different ‘Savings Sheds’ for different goals.

6. Dosh Strive Account – www.dosh.nz

Billing itself as a “digital wallet”, Dosh provides a suite of unique payment, savings and borrowing solutions designed to make traditional bank services more efficient and cost-effective—including the high-interest Dosh Strive Account, launched in late-2023.

Dosh has stated its wish to become a registered bank—watch this space.

Here’s what you need to know about the Dosh Strive Account:

|

Returns: |

2.10% p.a. (Accrued daily and paid monthly into your Strive Account) |

|

Deposits: |

Via bank transfer to your Dosh Everyday Account. You'll need to transfer funds to your Strive Account before they start earning interest. |

|

Access to funds: |

Immediate transfer to your Dosh Everyday Account, which is attached to a Visa debit card and allows 24/7 payments to other Dosh users. Withdrawals to main bank account in less than 24 hours (transactions processed twice daily on business days, and once per day on weekends). |

|

Fees / penalties: |

No card, transaction or monthly account fees, or penalties. |

|

Tax: |

Resident Withholding Tax deducted automatically. |

|

Signing up: |

Signing up takes a few minutes via the Dosh app. |

Other things to note:

- Dosh Strive Account funds are held on trust with an AA- registered New Zealand bank—meaning they're protected under the Depositor Compensation Scheme, up to $100,000 per customer.

- Dosh also gives customers the ability to set up up to 20 'Stashes'—linked to their Everyday Account—for different budgeting / short-term savings goals. Funds held in Stashes do not earn interest.

- Dosh has partnered with One NZ to deliver the One NZ Dosh debit card rewards programme—allowing customers to earn 1% back in phone dollars on eligible purchases.

7. Sharesies Save Account– www.sharesies.nz

Sharesies launched in 2017 as an online investment platform, with the goal of making the share market and ETFs more accessible for everyday investors—removing minimum investment amounts and allowing people to buy parts of shares.

That’s still the core of what Sharesies does, but in April 2023, it expanded its product suite to include its new high-interest savings account, Sharesies Save.

Here’s what you need to know about the Sharesies Save Account:

|

Returns: |

1.60% p.a. (Accrued daily and paid monthly into your Save Account) |

|

Deposits: |

Via bank transfer to your Sharesies Wallet. You'll need to transfer funds from your Sharesies Wallet to your Save Account before they start earning interest. |

|

Access to funds: |

Withdrawal to your main bank account takes 1-2 business days. |

|

Fees / penalties: |

No withdrawal or account fees, or penalties. Standard transaction fees apply when placing an investment order with Sharesies. |

|

Tax: |

Resident Withholding Tax deducted automatically |

|

Signing up: |

Signing up to Sharesies takes just a few minutes, or if you've already got a Sharesies account, you can sign up with just a few clicks via their app. |

Other things to note:

- Funds in Sharesies Save Account are held on trust with an AA-rated New Zealand registered bank—meaning they're protected under the Depositor Compensation Scheme, up to $100,000 per customer.

- Sharesies gives you the ability to open multiple Save Accounts for different purposes

- You can invest with Sharesies direct from your Save Account.

- As of January 2026, Sharesies now offers a separate transaction account product, Sharesies Spend, which is linked to a Mastercard debit card—with customers able to earn up to 1% Investback on eligible purchases (directed to your Sharesies Invest account).

Choosing the option that’s right for you

As always, the question of which option is going to suit you best will depend on your personal situation, and your financial goals.

If you don’t want to be tempted to dip into your savings, having them stashed away somewhere you don’t have immediate access to them could be a good option.

If you want something that functions a bit more like a transaction account—except that the balance earns you interest—then opting for something with a debit card attached could be for you.

About the author: David Cunningham, Chief Squirrel

With more than three decades of senior experience across New Zealand’s financial services sector, David knows the world of banking and finance inside out. He's not afraid to call it like he sees it (all part of our fight for a fairer financial system) which is why he's a regular media commentator on matters relating to the economy, housing market, mortgages, saving and investing, and interest rates.