Rodney’s Ravings: Why a recession is taking its time to eventuate

Post by Rodney Dickens

It’s been 34 months since interest rates started to climb, and in that time, interest costs have risen more sharply than ever before. And yet, other than a hint of one in late-2022, a recession has failed to eventuate.

Unfortunately, that doesn’t mean one isn’t coming. Rather, it’s pretty common for it to take a few years for a recession to settle in after major interest rate increases begin.

To explain exactly why this is, it helps to think of the economy a bit like a super-tanker – massive ships which, once they’ve built up any sort of momentum, take a very long time to slow down again.

New Zealand’s economy had built up a lot of momentum prior to these latest interest rate increases, thanks to excessively stimulatory monetary policy and (to a lesser extent) stimulatory fiscal policy.

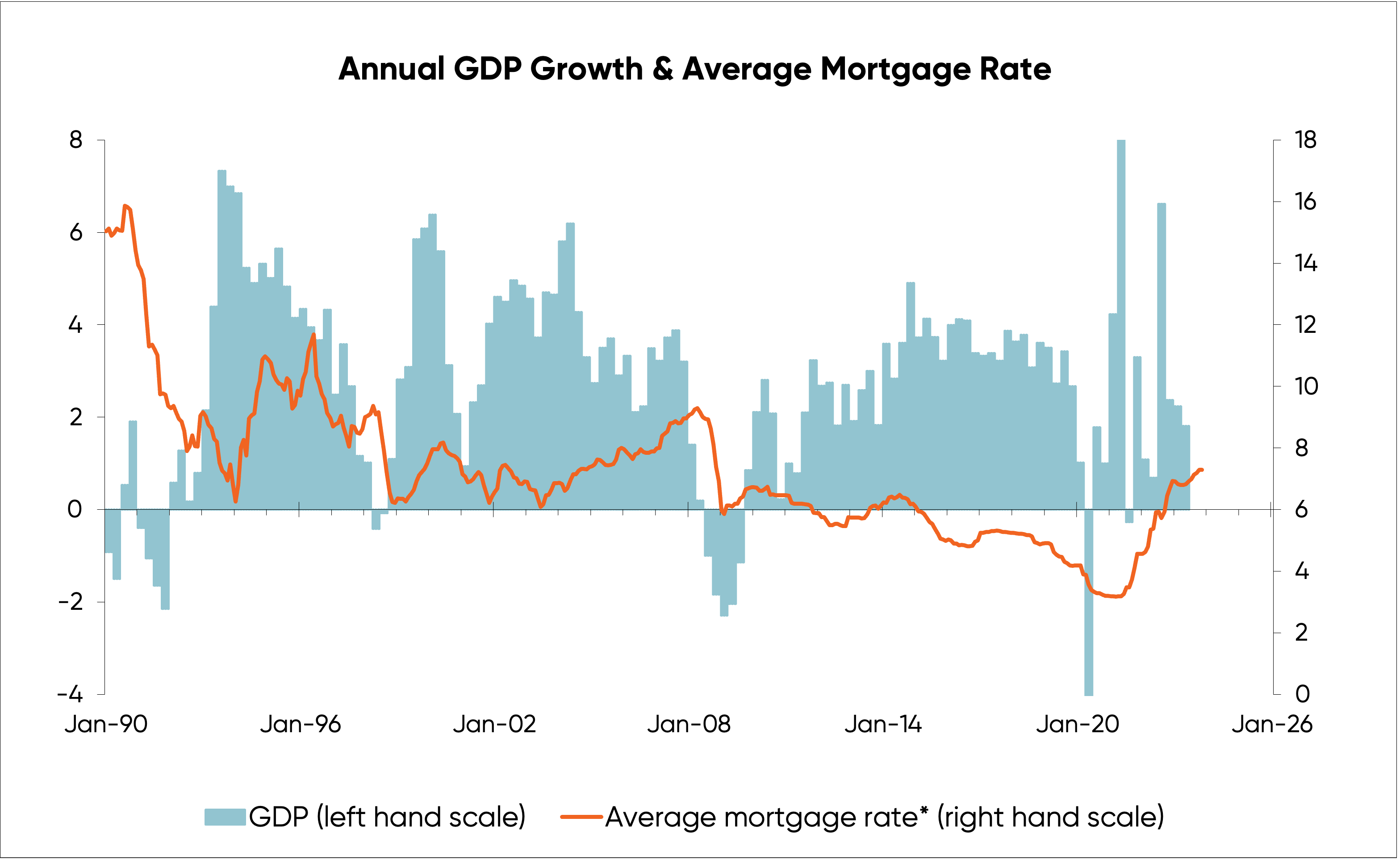

The first chart, below, shows the previous two major increases in mortgage interest rates before this latest one.

In both cases, recession didn’t arrive until a few years after interest rate increases began, with the 1997/98 and 2008/09 recessions shown by negative annual GDP growth.

During our last recession, mortgage interest rates started increasing in mid-2003 – several years before recession began in Q1 2008, followed by the GFC hitting GDP in late-2008. In this case there was a 50% increase in interest costs based on the average mortgage rate.

In the case of the mild recession in 1997/98, interest rates started to increase in early-1994 and remained high but variable until mid-1998. The trough to peak increase in interest costs over this period was 87%.

This time around, interest costs – based on the average mortgage rate offered by the major banks – have increased by roughly 130%.

So although the economy has been exhibiting normal super-tanker-type behaviour, it’s likely a recession isn’t too far away.

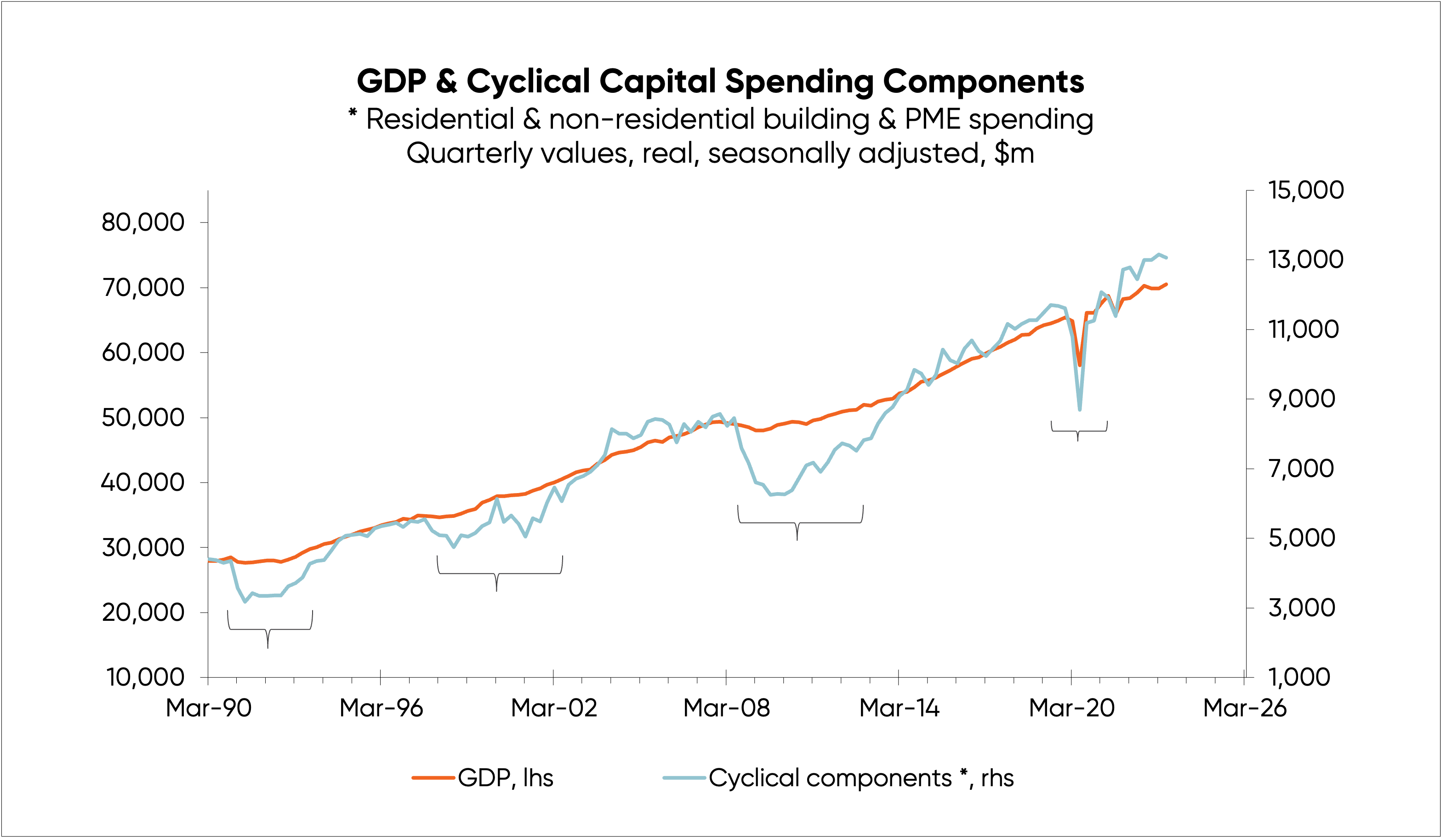

All past recessions have been linked to falling capital spending, as depicted in the second chart. The cyclical components of capital spending largely responsible for driving recessions are residential building, non-residential building, and spending on plant, machinery, and equipment (PME).

These factors don’t make up a huge proportion of GDP overall – 19% in the last year – but in recessions they each can fall by up to 20% or so.

If 19% of the economy shrinks by 20% - and assuming the other 81% of the economy doesn’t grow – that means a 3.8% fall in GDP. And even if the other 81% of the economy does grow by 2%, a 20% fall elsewhere will result in a 2% drop in GDP overall.

Consents for new dwellings have already fallen 34% from the peak in early-2022, but this is yet to be truly reflected in the GDP component for residential building. The most useful leading indicators of non-residential building activity and PME spending point to recessionary scale falls over the next year.

Given that the leading indicators of capital spending aren’t infallible, there’s scope for debate regarding exactly how far the GDP components will fall.

But the odds favour sufficient falls in residential building, non-residential building and PME spending resultin in a reasonable sized recession next year.

After the Reserve Bank’s latest commentary took a somewhat hawkish stance, which may mean even higher interest rates, adds to this risk. Its poor understanding of what’s in the pipeline, especially as far as residential building is concerned, means the Reserve Bank is likely to overdo the recession just as it has in the past.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.