Rodney's Ravings: Auckland's decline will sow the seeds for its next outperformance

Guest post by Rodney Dickens

House prices are falling more in Auckland than in most of the country, and for good reason. It is losing population at the same time as having a building boom. But however grim it sounds, it's this that will ultimately sow the seeds for Auckland’s revival.

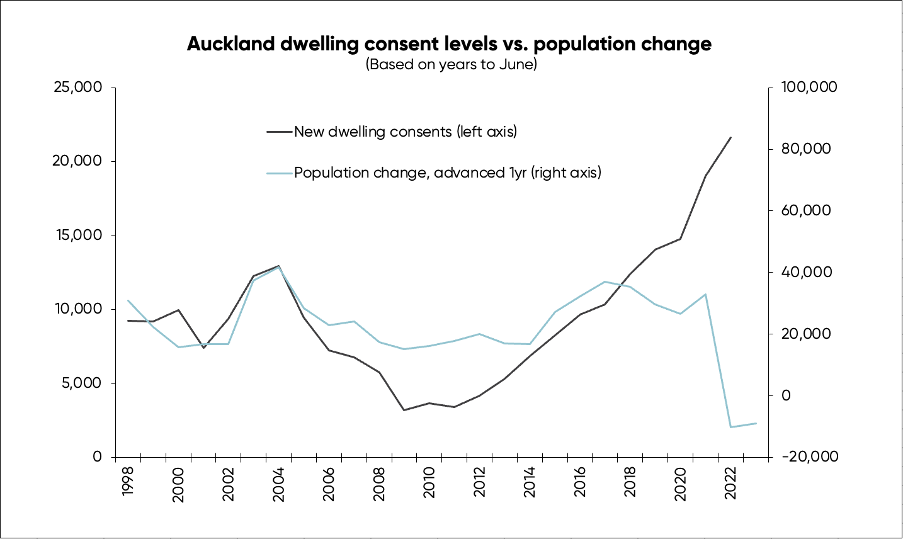

The chart below tracks the annual change in Auckland population compared to the number of consents issued for new dwellings. It takes about a year for changes in the population to impact on demand for new housing - so to reflect this, the blue population line has been shifted to the right to advance it by one year.

The chart suggests Auckland was under-building relative to population growth, mainly from 2006 to 2013, and that since 2018 it has been increasingly building more than needed to house population growth.

A yawning gap has developed between Auckland's consent levels and population growth.

And it's this which goes a long way to explaining why Auckland house prices and rents are underperforming relative to most of the country.

The Auckland Unitary Plan has made it easier for developers to build townhouses and terraced housing on existing housing sites, and played an important part in Auckland’s building boom. It's an important factor behind the high level of Auckland’s building relative to population growth.

Meanwhile, from June 2020 to June 2022, Auckland lost 19,000 population according to Statistic NZ estimates, which will be ballpark accurate. And looking at regional population estimates, the main beneficiaries have been regions close to Auckland, like Northland, Waikato and Bay of Plenty.

At a district level the big winners have been Kaipara and Waikato, that are adjacent to Auckland, with a few major winners further afield like Western Bay of Plenty, Tauranga, Central Otago, and (most of all) Queenstown Lakes. Waimakariri and Selwyn have had strong population growth, but this will largely reflect the demise of Christchurch.

The fallout isn't over, because it will take some time for the oversupply of housing (relative to what's needed in Auckland) to filter through to house prices and rents. The places that have benefited haven't avoided falling house prices, but in general price falls have been smaller.

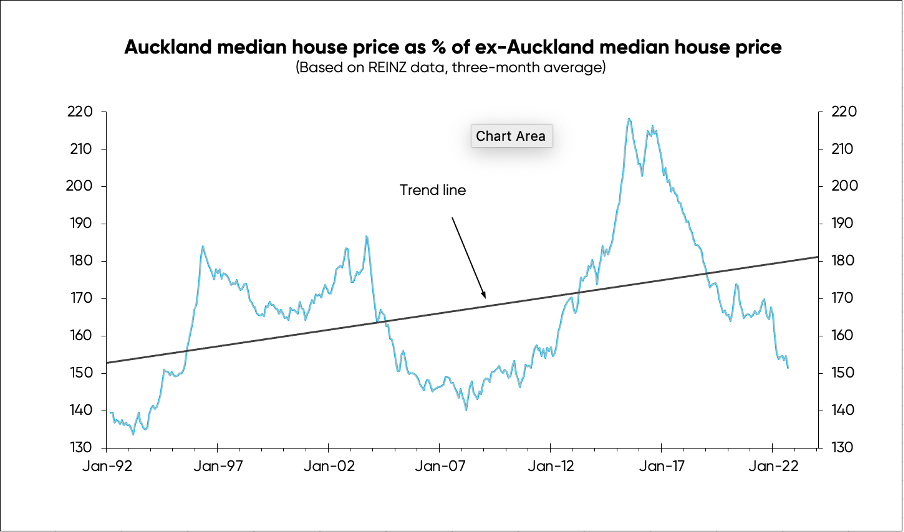

There's nothing new in Auckland’s housing market outperforming and underperforming, in turn, compared to the rest of the country.

Based on REINZ data, the chart below tracks Auckland median house prices as a percentage of the median for the rest of NZ. At 2016's peak, after the Auckland housing market had been performing much stronger, its median price was 215% of that for the rest of NZ. After something of an adjustment since 2017, the Auckland median price now sits at 152% of that for the rest of NZ.

The chart shows a rising trend line, indicating that over time Auckland house prices have performed slightly stronger. More so, however, it shows distinct periods of outperformance and underperformance by Auckland prices.

Auckland prices will get cheaper on a relative basis for at least another year - probably quite a bit longer - but that will make Auckland more attractive (or less unattractive) and will in time provide a basis for Auckland house prices outperforming again.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.