Rodney's Ravings: Why it's too early to get excited about rising house prices

Post by Rodney Dickens

Some bank economists are predicting we’re in for an above-average upside in house prices over the next year. This cannot be completely ruled out.

However, the financial incentives likely to face property investors and would-be home buyers for a while to come don’t provide any basis for getting excited about rising house prices.

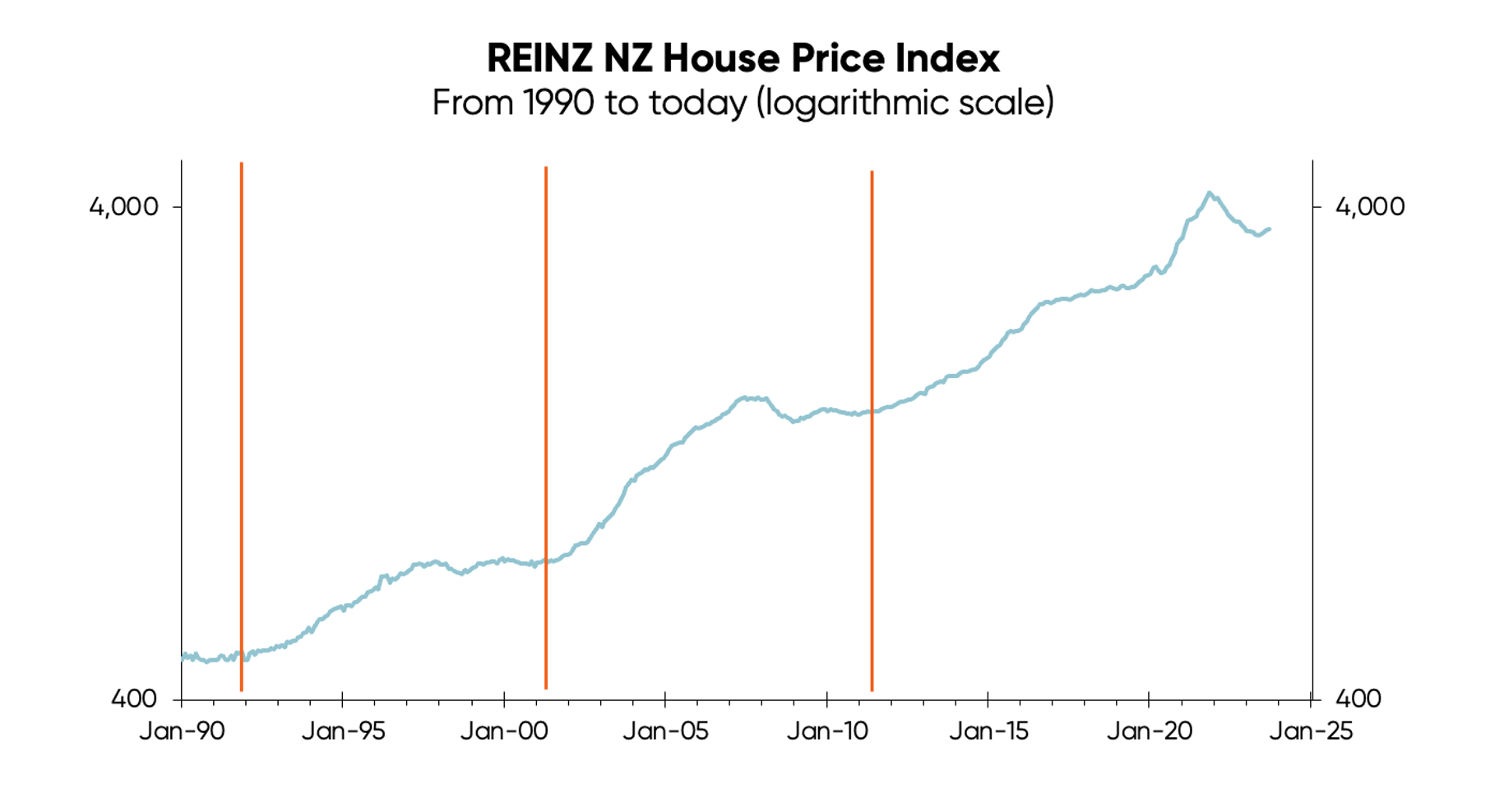

The chart, below, shows how New Zealand’s national average house price has behaved in recent decades, using the REINZ house price index. The vertical lines mark the start of the last three cyclical upturns in house prices, and the chart’s scales are logarithmic scales, as it puts the behaviour of house prices since 1990 in a better perspective.

Then the second and third charts, below, show that the last three major upturns in prices have not started until after the financial incentives facing investors and would-be home buyers were dramatically more favourable than they are now. This implies the financial incentives will have to improve significantly before the next major upturn in prices starts.

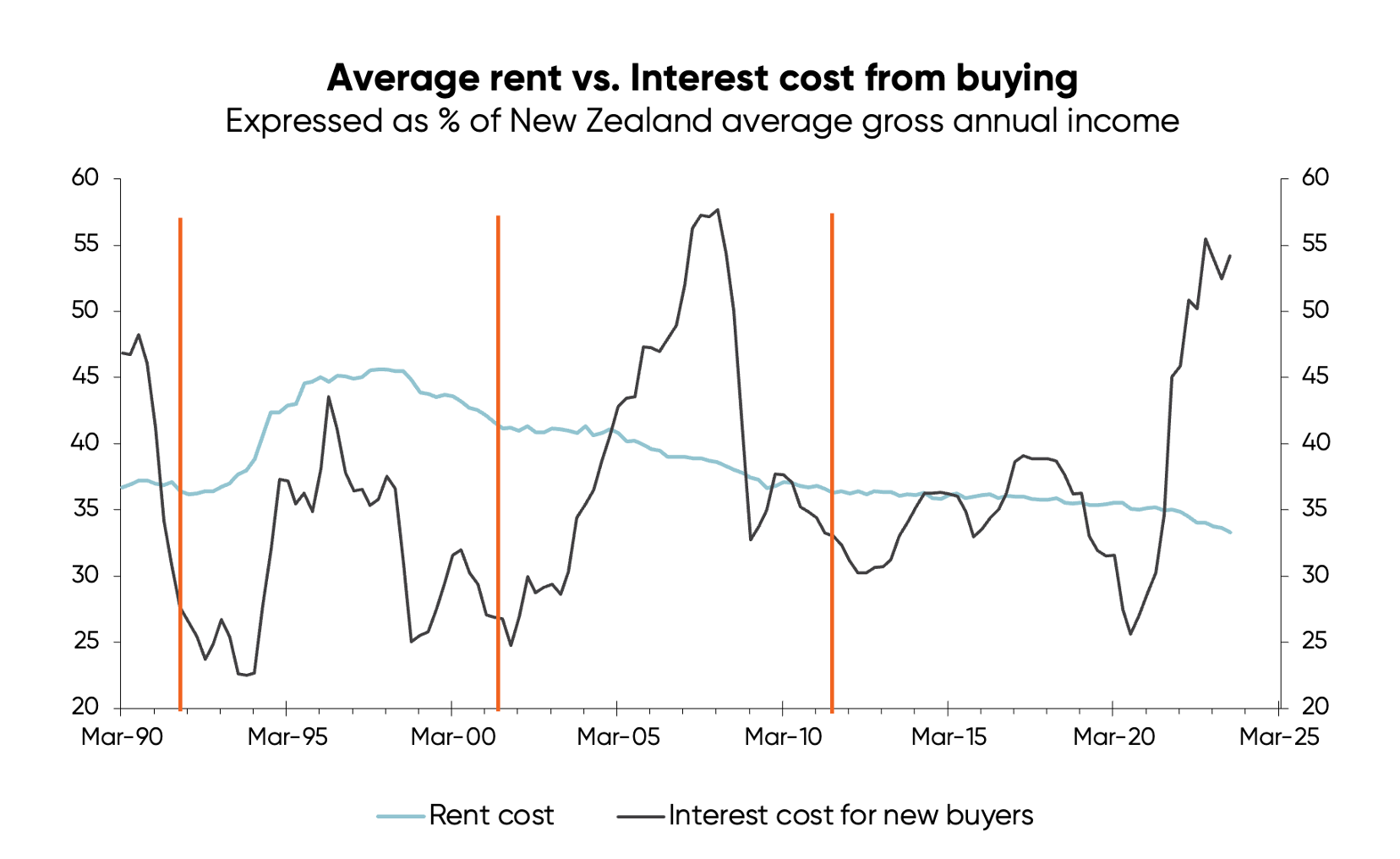

This second chart is relevant to first home buyers and other would-be home buyers — comparing the cost of renting against the cost of buying a house.

Specifically, it compares the percentage of the New Zealand average income required to pay interest when buying an averagely-priced house (assuming a 20% deposit) versus the percentage of income needed to rent the average rental. Interest costs are currently exceptionally high relative to rents.

Again, the vertical lines denote the start of the last three major upturns in house prices. You can see that these upturns in house prices didn’t start until interest costs fell below rental costs. Rents are rising faster than house prices, but the yawning gap in the chart suggests we are a long way away off the point where the financial incentives favour buying over renting.

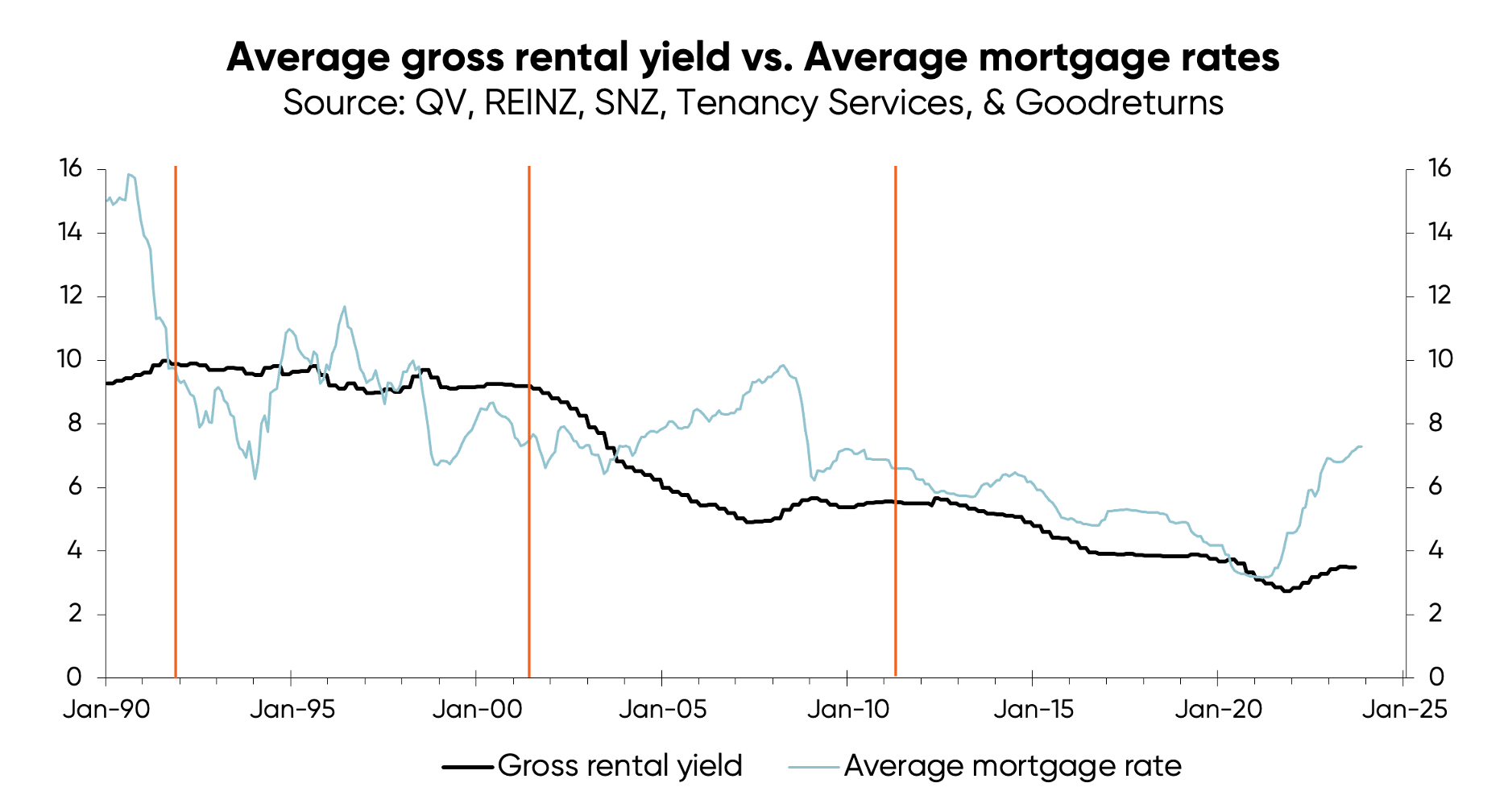

The third chart, below, is relevant to property investors. It compares my estimate of the national average rental yield with the average mortgage rate offered by the major banks — with the vertical lines again denoting the start of the last three major upturns in house prices.

Currently, borrowing costs are dramatically higher than rental yields — as are term deposit rates — meaning the financial incentive for investors to buy is about as low as it has ever been.

If history is anything to go by, the financial incentives facing would-be buyers and investors are not close to the levels needed to fuel the next major upturn in prices. This is especially because, as covered previously, there is likely to be a reasonably protracted battle against inflation.

This conclusion is consistent with that presented in another of my earlier blogs that looked at the relationship between house prices and the unemployment rate, with the latter a good inflation indicator. The unemployment rate has risen from a low of 3.2% to 3.9% and will increase more, but it is still well below the level consistent with low CPI inflation.

In the past, major increases in house prices have not started until after the unemployment rate has peaked, and at times not until a while after the unemployment rate has peaked.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Ltd www.sra.co.nz.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.