Squirrel’s Personal Loan Reserve Fund hits a very important milestone!

Post by Dave Tyrer - COO

Squirrel’s Personal Loan Reserve Fund – or the PLRF as it’s affectionately known round here – is about to mark its 8th birthday!

And this year, it’s not just a birthday we’re celebrating, but one other very important milestone.

After eight years of steady and solid growth, the PLRF has now reached a level where we can be confident it will cover any reasonably expected future credit losses, with a healthy buffer on top of that, too.

It’s a big milestone – and to celebrate, we’ve got a nice little bonus for anyone with an existing investment in the Squirrel Personal Loan Term Investment class.

We’re bumping up the returns on all existing Personal Loan Term Investments by 0.25% (from Tuesday 3rd October 2023). Hooray!

How are we able to do this exactly?

Since our Personal Loan Term Investments launched in late 2015, we’ve put aside a small portion of each borrower payment (the reserve levy) into the associated Reserve Fund – the PLRF – to help protect investors funds.

And now, thanks to the size and maturity of the PLRF, we’re able to reduce the level of reserving (the amount we set aside from each borrower repayment) for all new and existing Personal Loans.

(It’s worth noting that in the years since inception, the PLRF has covered all borrower arrears and loan defaults and, as at 27 September 2023, there’s $957,269 available in the PLRF.)

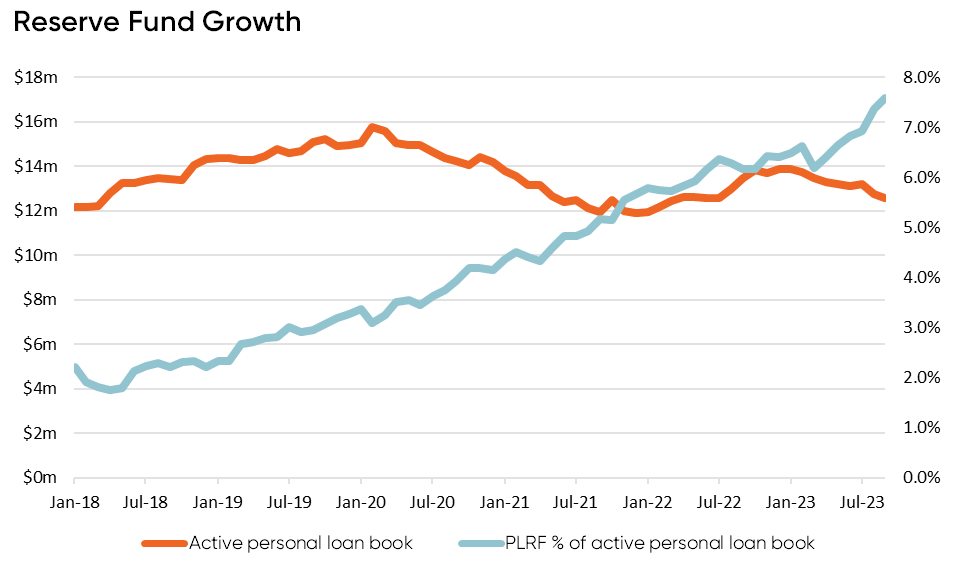

The chart below tracks the ratio of the PLRF against the active personal loan book – showing how it’s grown significantly in the last five years:

Whilst the active personal loan growth has been relatively flat over the last few years, the PLRF continued to grow, and it has been gradually building – reaching a point today where we’ve got a really healthy buffer in there to help cover missed payments and all of the expected future loan defaults.

Squirrel’s Board has the task of governing our Reserve Funds on behalf of investors – and at our most recent review, the directors determined that our PLRF has reached what they consider to be a “mature state”.

In short, what that means is that we believe we have enough of a buffer in the PLRF that we can reduce the amount we’re setting aside from each borrower repayment to go into the PLRF, to match the level of expected future credit losses more closely.

This analysis led us make the decision to increase the interest rate earned by investors on all existing Personal Loan investments by 0.25%, effective 3 October 2023.

Over the rest of this blog, we’ll look at the decisions made more in-depth. So, if you want to really get into the gritty detail of what’s happening, read on!

Overview of the Personal Loan Reserve Fund (as at 31 August 2023)

The table below outlines some of the key statistics and information the Board used to help inform their decision around how we manage the Reserve Fund.

We report most of this information on the marketplace page on our website.

|

Key metric |

Data point |

Description |

|

Size of Personal Loan portfolio |

$12,764,409 |

The outstanding balance of all the personal loans in the portfolio. |

|

Size of PLRF* |

$941,286 |

The amount of money available to support investors should a borrower miss a loan payments or default |

|

Expected Credit Loss rate |

0.87% |

Calculated via Squirrel’s credit model, as the [probability of a loan defaulting] x [loss given default]. |

|

Average reserve levy |

1.13% |

The amount reserved, on average, for loans in the portfolio to the PLRF |

|

Credit risk : Reserve Fund ratio |

8.48 |

The number of times the reserve fund can cover the expected credit loss |

|

Portfolio Net Default Rate |

1.2% |

The actual default rate life to date on the portfolio. |

* PLRF stands for Personal Loan Reserve Fund

Personal Loan portfolio make-up

If you read my regular investor updates, you’ll have heard me talk about the fact that, over time, Squirrel has reduced our credit risk appetite on the personal loans we’re willing to fund.

Back in 2017, the modelled Expected Credit Loss for our Personal Loan portfolio was around 1.60%. Today it’s sitting at 0.87% - meaning the risk has nearly been halved.

A consequence of reducing our risk appetite is that it is harder for us to find new loans that meet our more stringent credit criteria. That means there are fewer loans available and it can take a while to have your investment orders filled for personal loans due to the demand for the loans that are available.

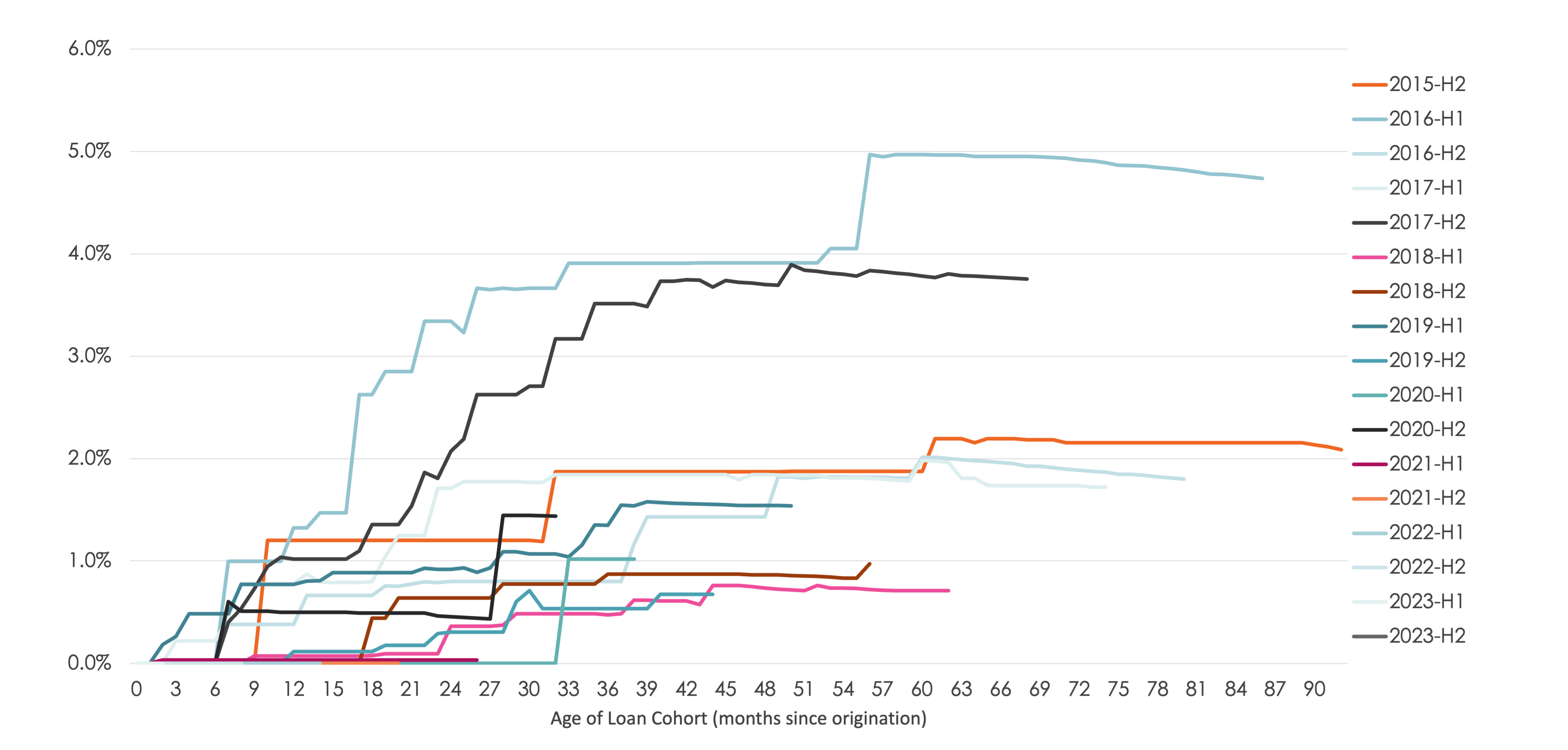

We’re expecting to see the Portfolio Net Default Rate fall over time, given the reduced level of risk in the portfolio. It can take a while to feed through but its increasingly evident in the trajectory of the default rate (net of recoveries) by loan cohort.

The chart below shows how the loan defaults (net of recoveries) have developed for each loan cohort over their life (to date). As we’ve expected, it is clear that the more recent cohorts are performing significantly better than the older cohorts.

Default rate (net of recoveries) by loan cohort

Credit risk : Reserve Fund ratio

This is an important ratio and is something we track really closely across all our loan portfolios. In essence, it looks at the size of the Reserve Fund, divided by a calculated estimate of the level of risk in dollar terms.

The resulting outcome for the PLRF at the end of August 2023 was 8.48. This means that, in theory, the PLRF will cover the expected risk in the portfolio more than 8 times over.

I say in theory, because the denominator in this equation (the calculated risk level) is a modelled number. The numerator (the money we have in the bank in our Reserve Fund) is a real number.

Board decision

If I summarise briefly the discussion and Board decision, the view is that PLRF has reached a level where it holds sufficient reserves to cover all expected future credit losses plus enough of a buffer that should ensure it can handle even a significant unexpected deterioration in loan performance.

Based on the decision to reduce reserving levels, we will be changing the average reserving rate from its current average of 1.13%, to around 0.87%, matching the expected credit loss in the portfolio. As a result of this change, we expect to see a slowdown in the absolute growth of the PLRF and a gradual reduction in the PLRF as a percentage of the active loan book over time.

Will it be this way forever?

In short, probably not. The level of reserving for each reserve fund is something we monitor on a continuous basis and adjustments are made periodically to ensure the growth of each reserve fund is aligned to the risk exposure of the asset class it is set up to protect and the projected growth in the active loan book.

The unique situation with the PLRF at this time is that the ‘buffer’ in the reserve fund has reached a level unlikely to be required under even an extreme credit performance scenario given the expected low growth of the Personal Loan portfolio in the foreseeable future.

If we see the Personal Loan portfolio resume a growth trajectory or if there is any change to Squirrel’s risk appetite in that portfolio, there is a possibility we may need to change the reserving levels again.

Hope you’ve enjoyed this analysis of how the decisions were made in relation to the PLRF levies and investor interest rates.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.