A big test of New Zealand's banking oligopoly

Post by David Cunningham - Chief Squirrel

Earlier this week, ASB came out and raised its home loan fixed lending rates by about 0.25%, taking rates up near levels we haven’t seen since the Global Financial Crisis (GFC).

Many criticised the move, saying the increase was larger than what can be justified by current market conditions. Meanwhile, several media commentators also speculated that it’s nothing more than a giant profit grab – a move by the banks to counteract low lending growth by expanding their profit margins.

The expectation was that the other banks would quickly follow ASB’s lead – and ANZ and Westpac have subsequently done exactly that.

To me, this is undeniable evidence that banking is an oligopoly – with banks tactically moving together to maximise their own profits at everyday customers’ expense.

Here’s how fixed-term rates stack up today:

|

1-year |

2-year |

3-year |

|

|

ASB |

7.25% |

6.79% |

6.49% |

|

ANZ |

7.19% |

6.79% |

6.49% |

|

BNZ |

6.99% |

6.59% |

6.29% |

|

Kiwibank |

6.89% |

6.59% |

6.29% |

|

Westpac |

6.99% |

6.79% |

6.49% |

Source: Interest.co.nz, retrieved 10:00am, 07/05/2023.

So is the move just a big profit grab?

The signs certainly seem to point to yes.

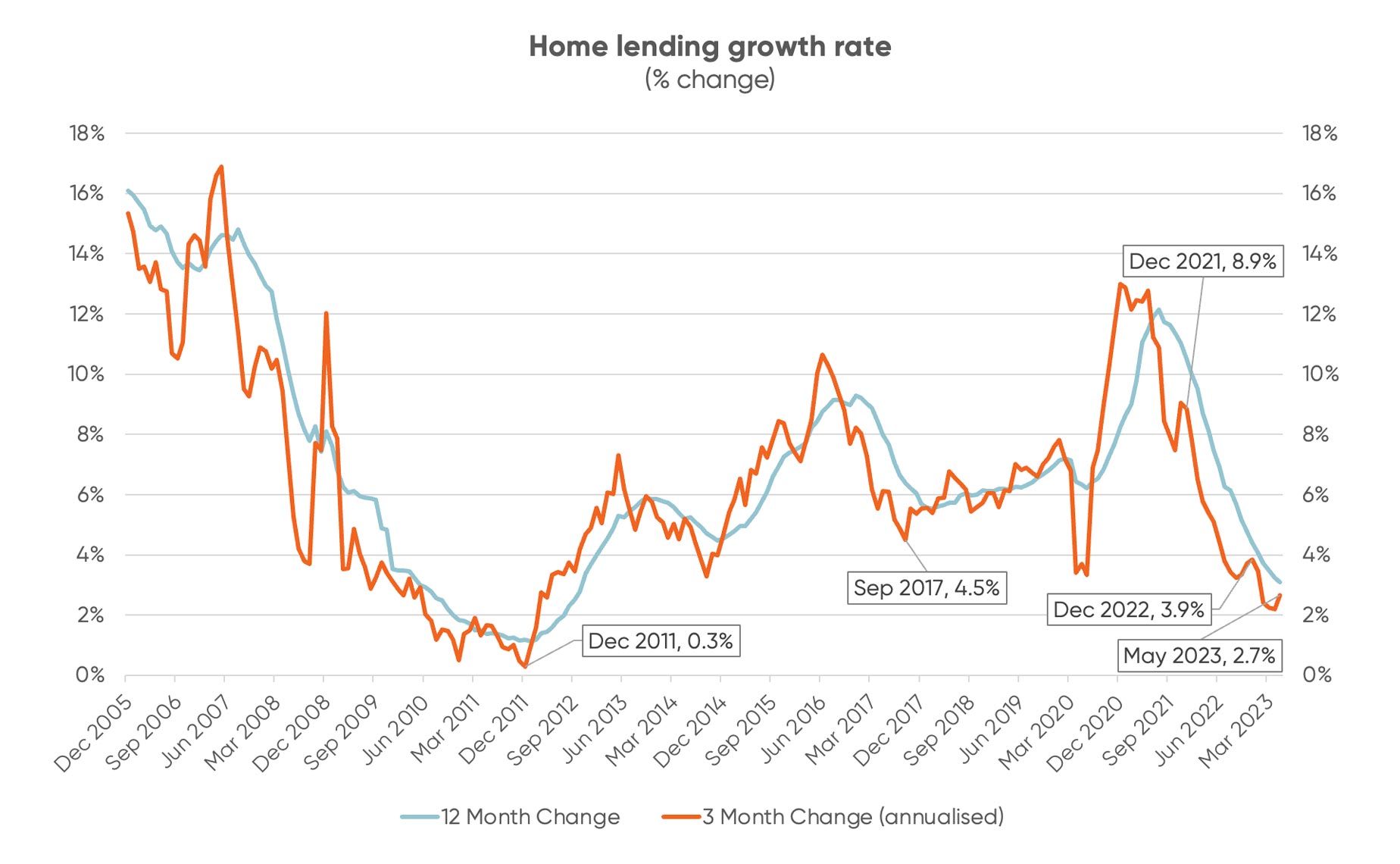

Home lending growth is the lowest it’s been in over a decade, meaning the banks can’t rely on that alone to fuel bigger profits – as they’ve done in previous years.

Source: RBNZ

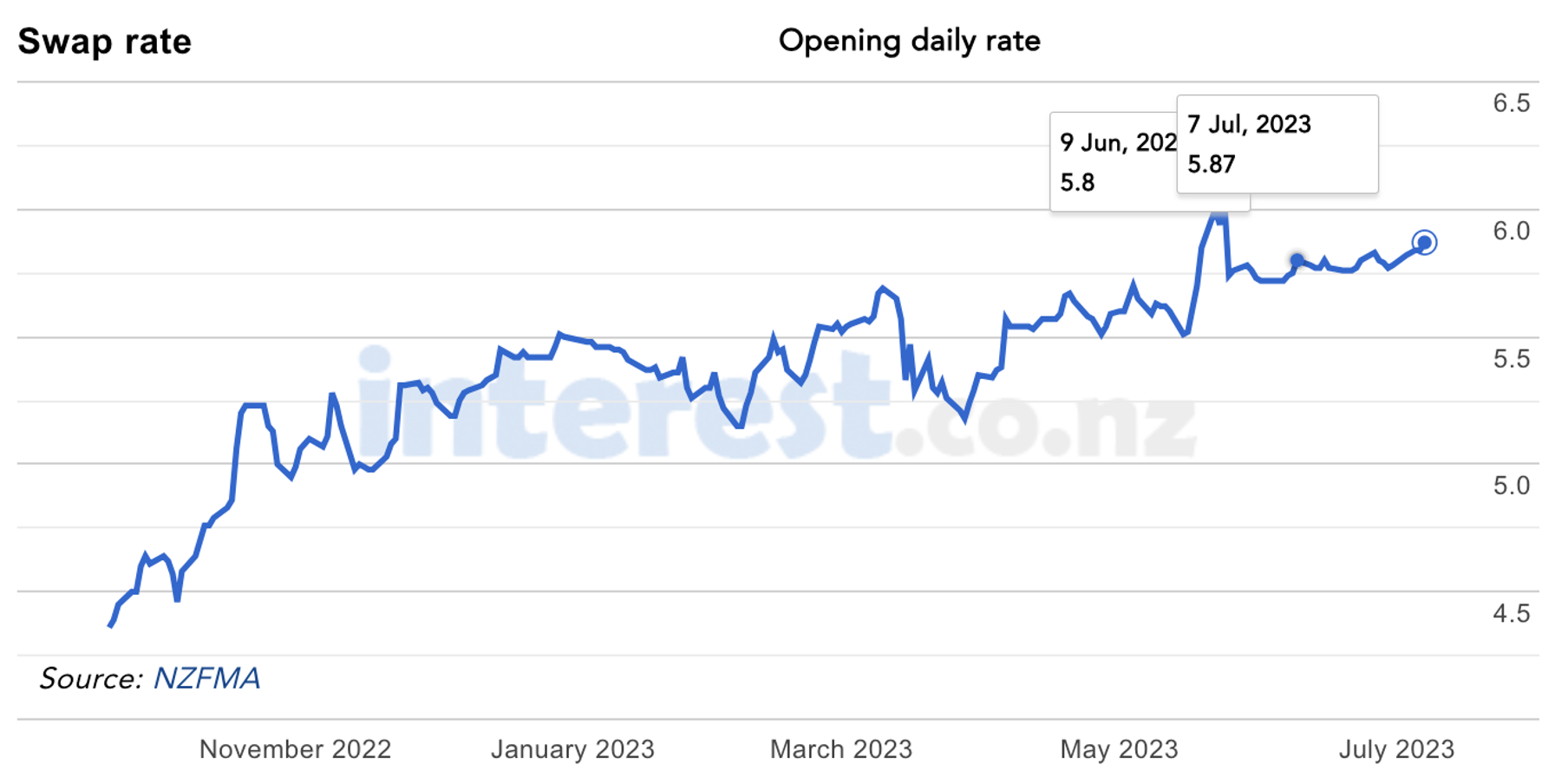

Secondly, there’s the matter of wholesale interest rates. Banks last hiked home loan rates in the immediate wake of the last Official Cash Rate increase on 24th May, but since then wholesale interest rates for the one-year term have barely moved - indicated by the two plotted points in the graph below.

So, there’s nothing there to indicate that the banks should need to take rate hikes further.

Source: interest.co.nz

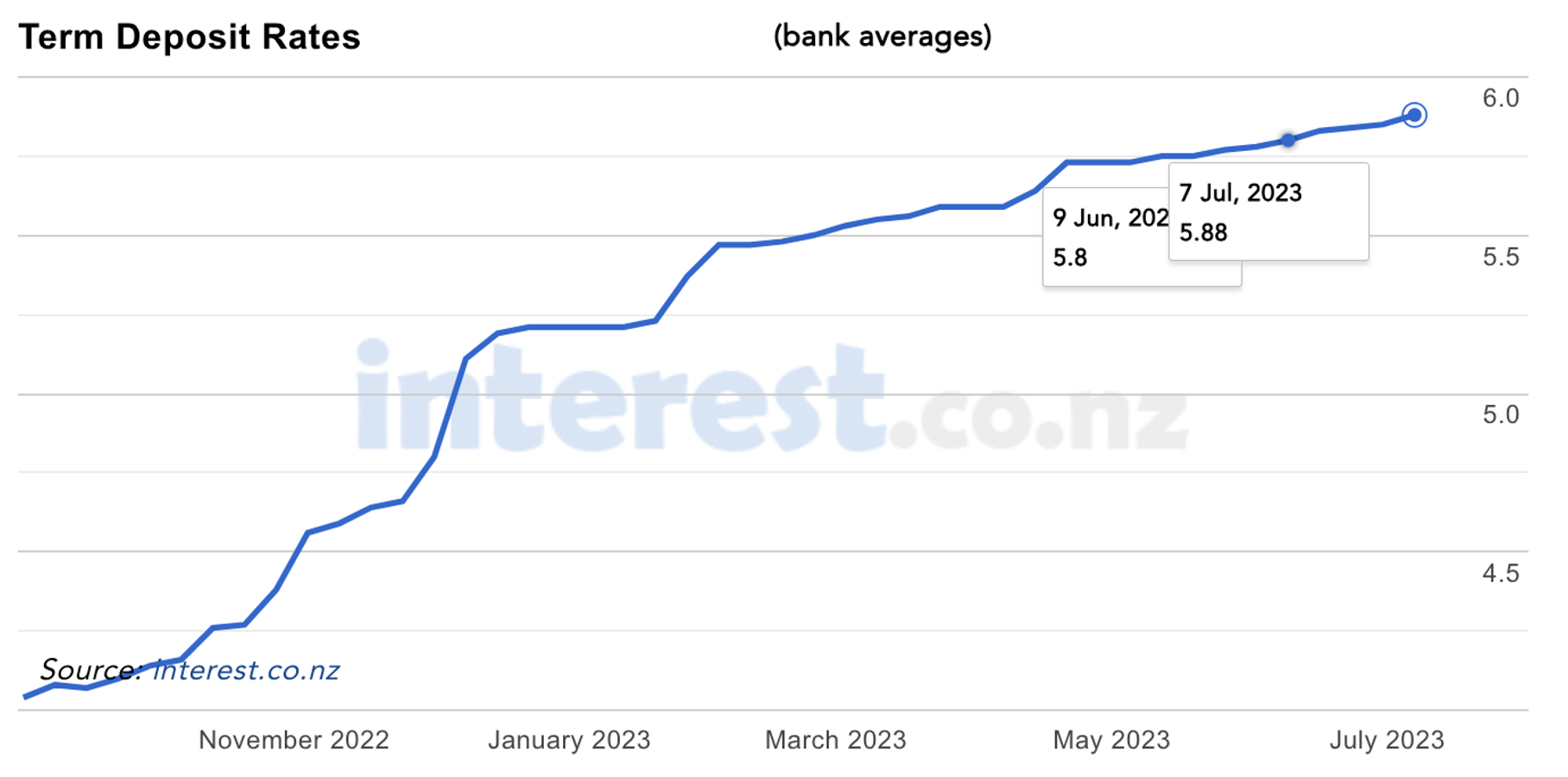

And thirdly, a look at term deposit rates shows that one-year term deposit interest rates for have also barely moved since the last OCR hike - again, indicated by the two plotted points in the graph below.

Source: interest.co.nz

So is it a margin grab to make up for lower lending growth? The evidence is pretty damning.

The real test was always going to be whether our other banks would follow ASB’s lead. And now that they have, it’s solid proof that the banks are behaving in an oligopolistic way, all in the name of earning oligopolistic profits.

And at the expense of everyday Kiwi.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.