Why do banks make term investments such hard work?

Post by Dave Tyrer - Squirrel COO

In the past, getting the best returns on your savings probably meant taking out a bank term investment was the way to go.

But if you’ve ever tried to decipher the finer detail of how bank term investments actually work, you’ll know it’s not simple or easy.

There’s so much variation between different lenders’ rules and criteria – and they often have qualifying criteria (like minimum deposit amounts) that can make it tough for the average saver to invest for the best outcomes.

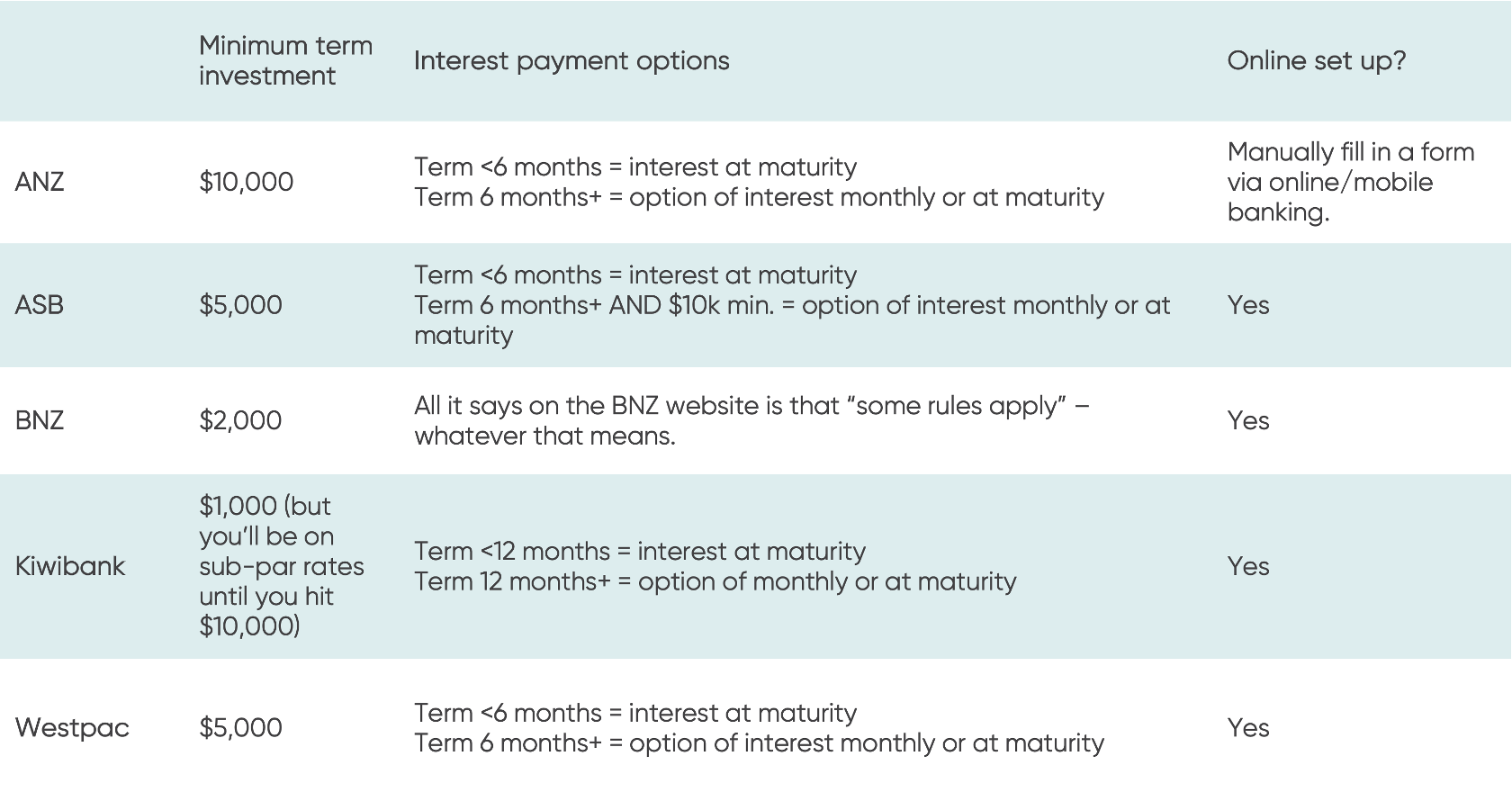

To save you the hassle of trawling different bank websites, we’ve done the research for you.

Here’s how our five largest banks stack up on their term investment offerings:

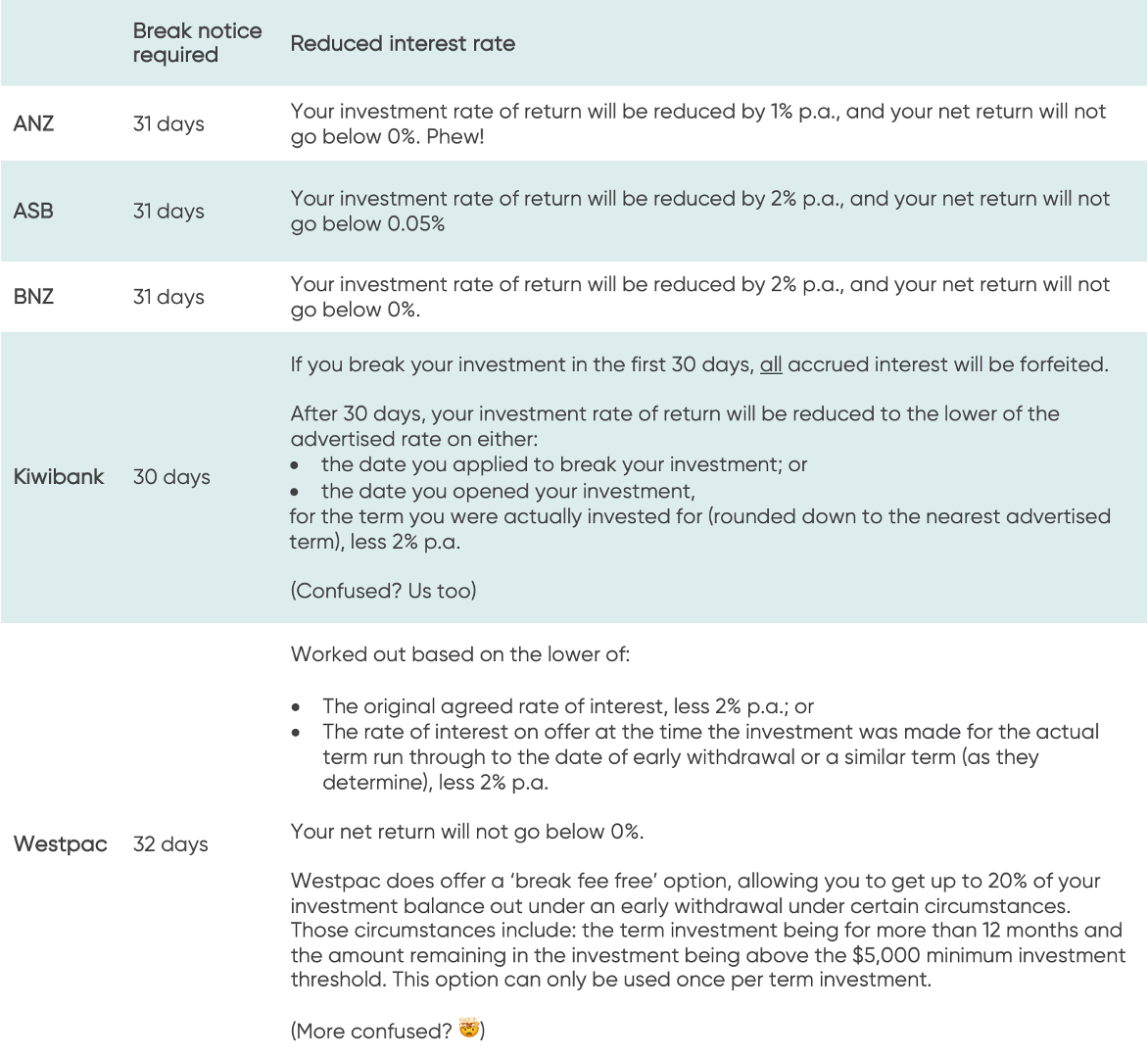

And if you want to break your investment term before its original maturity date, there are T&Cs for that, too.

The table below summarises (as best we can) the key features of the T&Cs each bank has and may apply if you seek to break your term investment before its original maturity date.

Early termination of a term investment will usually result in the bank reducing the interest rate of return on your investment. And that may involve the bank ‘clawing back’ some (or all) of the interest that’s already been paid to you, against the outstanding principal remaining on your term investment.

The banks’ detailed break fee T&Cs can be complicated, and are often scattered in various places, including the banks’ websites, term sheets and other ‘special’ documents discussing the early termination of an investment.

There’s a lot of fine print to wade through – so the below take does not attempt to be a comprehensive summary of how break fees work across the different lenders.

Basically, term investment products really aren’t designed to help the average saver get the most from their money.

1. Minimum investment requirements make term investments really tough to access when you’re just setting out on your savings journey.

Until you’ve got thousands squirrelled away, your only real option with the banks is to go with a savings product that pays nothing like the sort of interest you could get on a term investment (assuming you’re saving towards a longer-term goal).

2. Break fees can be a serious cost if you want to access your money before the end of your investment term.

Take Westpac’s break fee conditions for example. I had to read, re-read, and then read them again to make sure I had it right… that they can go so far as to dip into your principal in some situations. That is NOT OK.

3. Term investment interest rates are a whole other can of worms.

The banks are jedi masters at shifting their special rates around on various investment terms – all in the name of maximising their own revenue.

You also often don’t get the best rate available unless you call the bank directly to negotiate (if they’re willing to have the conversation, that is) and there’s no way of knowing if what you end up getting is actually the best they could’ve done.

Even the fact you only have the option of interest at maturity – rather than monthly – on investments under 6 months (or 12 months with Kiwibank) is pretty cheeky.

So… why do the banks make term investments so hard?

Over the last few months, I’ve been asking myself this very question – and as an ex-product manager for two of NZ’s largest banks, I’ve got a fair understanding of the answer.

In effect, the banks’ whole approach is about making them money.

The way term investments are structured is basically a throwback to the days when you had to go into a branch to do anything. That created costs for the bank, so they designed features to try and pass those costs on.

In today’s connected world, a lot of those costs have been eliminated from term investment transactions (and most other transactions, actually) and yet the banks still haven’t ditched those money making mechanisms. Perhaps ask your bank what its justification is for paying less interest on smaller term investments! The marginal costs are the same whether you’re investing $1,000 or $1m.

It means that in essence, the banks are designing for themselves, NOT their customers.

Now, I don’t want this to come across as a teardown of the main banks. There’s no denying they provide a pretty darn safe and secure way to manage your money, and I hope it stays that way for a long time to come.

But the fact is that some of the features and conditions they wrap around their products are overly restrictive, and just not in the best interests of their savers and investors.

Term investments with Squirrel

Note: We’re not attempting to compare Squirrel term investments to the term investments that the banks offer. The risk associated with our investments is different to the term investments typically offered by registered banks.

You can read about the risk associated with Squirrel term investments on our website.

That said, we CAN compare on product design. We’ve worked hard to do things differently, to deliver better outcomes for savers and investors:

To reiterate, we’re NOT saying Squirrel term investments are the same as bank term investments. We’re not a bank, and the risk of investing with Squirrel is different.

What we are doing is looking purely at the basic product design of the respective term investments discussed above.

My conclusion: I’m pretty stoked with the design of Squirrel's term investment products, and how they deliver for savers and investors. And the goal is to get better from here!

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.