NZ vs. the world: How house prices have changed, here & overseas

Post by David Cunningham - Chief Squirrel

If you’re keen to find out more on this topic, check out episode 29 of Live at the Nut Bar, where we take a deeper dive into how house prices have changed around the globe in recent years.

Since 2020, the story of New Zealand house prices has been a truly wild one.

They soared in the wake of our first COVID lockdown, then fell again almost as sharply — and only in very recent months, have started to balance out again.

It’s been enough to leave Kiwi homeowners (and would-be homeowners) feeling dazed and confused.

So, how does that compare to the rest of the world? Have other countries been on the same rollercoaster?

Well, the short answer is: yes and no.

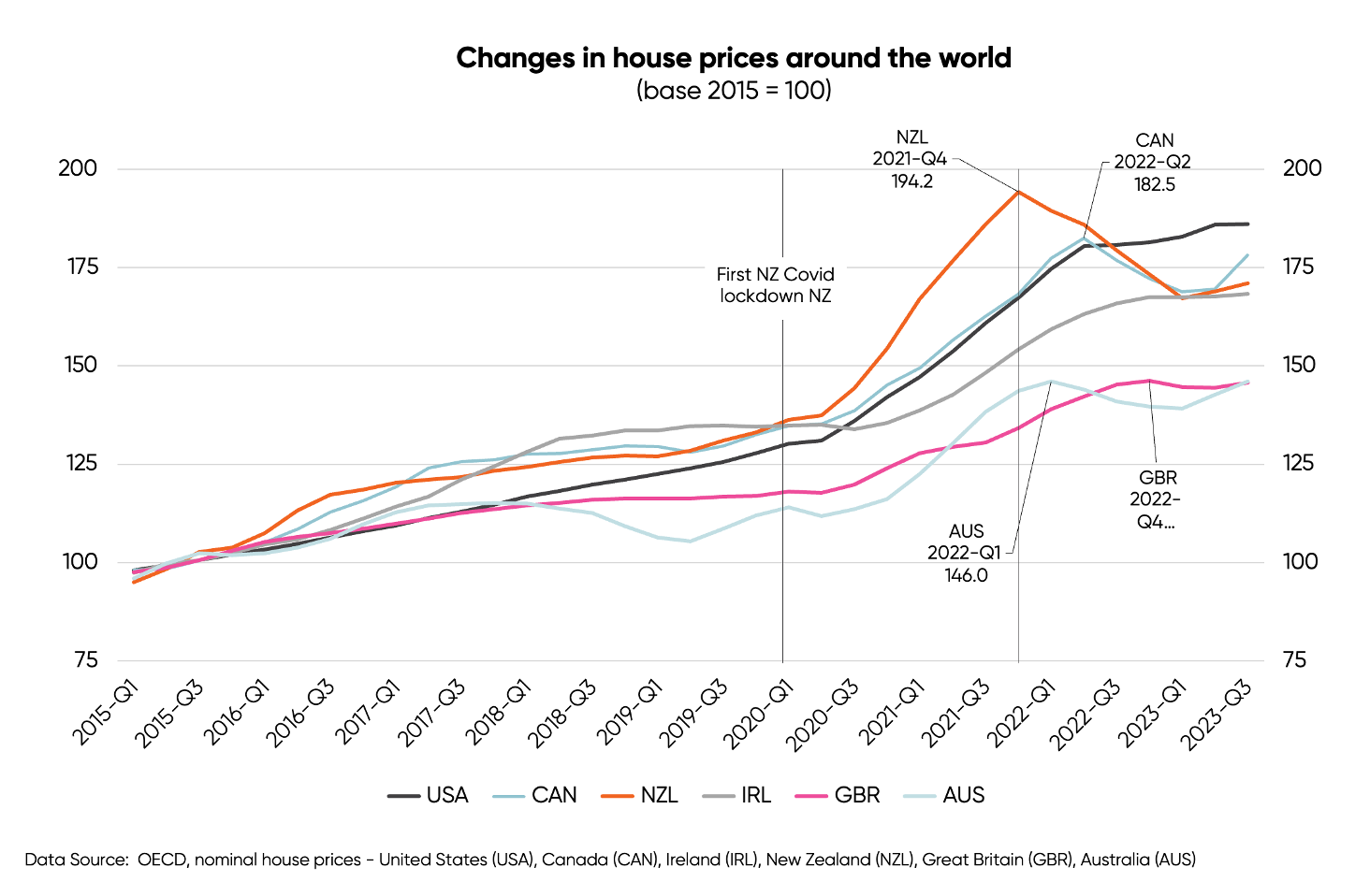

The graph below, based on OECD data, compares movements in house prices across New Zealand, the US, Canada, UK, Ireland and Australia. The numbers date back to 2015 as the baseline, at an index level of 100.

Note: estimates for 2023-Q3 for some countries

You can see that house prices everywhere were tracking upwards in the five years before COVID, with an average increase of about 25% over that period.

And then, again in every market, they lifted — or exploded — upwards come 2020.

The key driver of this was one thing: much lower interest rates, as central banks around the world (like our own Reserve Bank) dramatically lowered their cash rates to keep their economies afloat.

With cash rates at close to 0%, home loan rates dropped to as low as 2% p.a.

And so, we saw the same trend emerge everywhere — homebuyers had a party, borrowing lots in order to buy lots, and driving up house prices with all that cheap money.

But looking again to the graph, the situation in New Zealand stands out for two reasons:

- When it comes to borrowing money, New Zealand partied harder than most. The sheer rate at which house prices increased here was harder and faster than anywhere else.

- And our hangover was all the worse for it. New Zealand alone has had a subsequent, rapid decline in house prices from that COVID-induced peak.

In fact, right now, New Zealand is the only country across the comparison group where house prices are not still near, or even above, the previous peak.

That’s because, after spending up large when interest rates were low, Kiwi borrowers have felt the bite of recent interest rate increases particularly harshly.

Now, after 12 Official Cash Rate hikes (totalling 5.25%) the party is well and truly over — and house prices have fallen 14% on average, and up to 20% in Auckland and Wellington, as a result.

The “good” news for Kiwi homeowners is that, despite these falls, the average house price is still sitting about 25% above pre-COVID levels.

So, why is it that recent house price increases have held pretty consistently elsewhere — but not in New Zealand?

Let’s delve deeper into the factors behind house price outcomes in some of these comparison countries.

1. United States

In the USA, most mortgages are fixed for 30 years. Although borrowers have the option to repay early without penalty, they can’t take their old home loan with them when they move house. This acts as a huge incentive for homeowners to ‘stay put’ in environments where interest rates have risen.

After the 30-year rate hit an all-time low of 2.65% p.a. post-COVID, it’s now sitting at around 7%, having peaked nearer 8%.

As a result, housing market turnover in the US is at 13-year lows, with existing homeowners on low interest rates reluctant to sell. This limited supply, plus ongoing demand from a growing population, has supported house prices — keeping them at all-time highs.

2. Australia

House prices in Australia have recently surpassed their post-COVID high, but only after falling 7.5% from the peak previously set in early 2022.

Australia was one of the last countries to start increasing interest rates again post-COVID, as economies recovered, and inflation surged the world over. And it hasn’t gone quite as hard with its increases as other countries around the globe — up 4.25%, compared with between 4.75% and 5.25% in the USA, Canada, the UK and New Zealand.

But the major factor supporting a lift in house prices this year has been huge migration flows into Australia, currently running at an annual rate of over 500,000. Those people all need somewhere to live — and that’s helped to push up both house prices and rents.

This situation has been further exacerbated by a weak construction sector, struggling with construction cost inflation.

3. Canada

In Q3 of this year, Canada’s house prices were still sitting within 2% of their previous peak — despite moves from the Bank of Canada to lift interest rates by 4.75%.

What’s supporting house prices in Canada is the fact that one of the features of their home loan market is that five-year fixed terms are the norm — compared to one- and two-year terms in NZ.

This has helped to soften the impact of those interest rate increases, and because longer-term rates are lower than shorter-term rates currently (something known as an “inverse yield curve”), the typical home loan interest rate in Canada is much lower than in NZ.

4. United Kingdom

The Bank of England has hiked its bank rate by 5.25% since December 2021, finally hitting pause in August 2023.

Despite the resulting surge in borrowing costs, house prices in the UK remain at record levels, having increased by 25% since the onset of COVID. That’s a result of pent-up demand post-COVID, very low unemployment levels, and construction cost inflation which has also risen about 25% since 2020, while wages have risen about 20%.

What’s interesting to note about UK house prices is just how steadily they’ve increased over this time. The net change is 25%, which is almost identical to New Zealand, but without the boom-bust rollercoaster we’ve had here.

What conclusions can we draw?

It’s obvious that the fall in house prices many were expecting during COVID, predicated on a sharp rise in unemployment globally, just…didn’t happen. The extraordinary monetary policy easing the world over was behind this.

From March 2020, when we went into our first lockdown, the net increase we’ve seen in house prices in New Zealand (roughly 25%) is pretty similar to that in the other countries we’ve looked at.

Despite much higher interest rates in all markets, this largely comes down to a combination of low supply, pent-up demand, inflation lifting construction costs, a material increase in incomes and low unemployment — all of which have supported house price increases.

The exception is the USA, where house prices are up over 40% over that same period, largely down to one thing: a lack of supply. And that caused by the many homeowners with very low 30-year fixed mortgage rates which they’d have to give up by moving.

All things considered — and like many economic shocks — things ultimately tend to return to trend in growing economies.

In NZ, although we sometimes party harder (and suffer the hangover for it), sooner or later we’re always back on even keel.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.