Rodney's Ravings: Economics works even if bank economists don't understand it

Guest post from Rodney Dickens

It is understandable if your faith in economics, the dismal science, has been undermined by the bad forecasting track record of the bank economists. However, you can take comfort in knowing economics works even if the bank economists do not understand it.

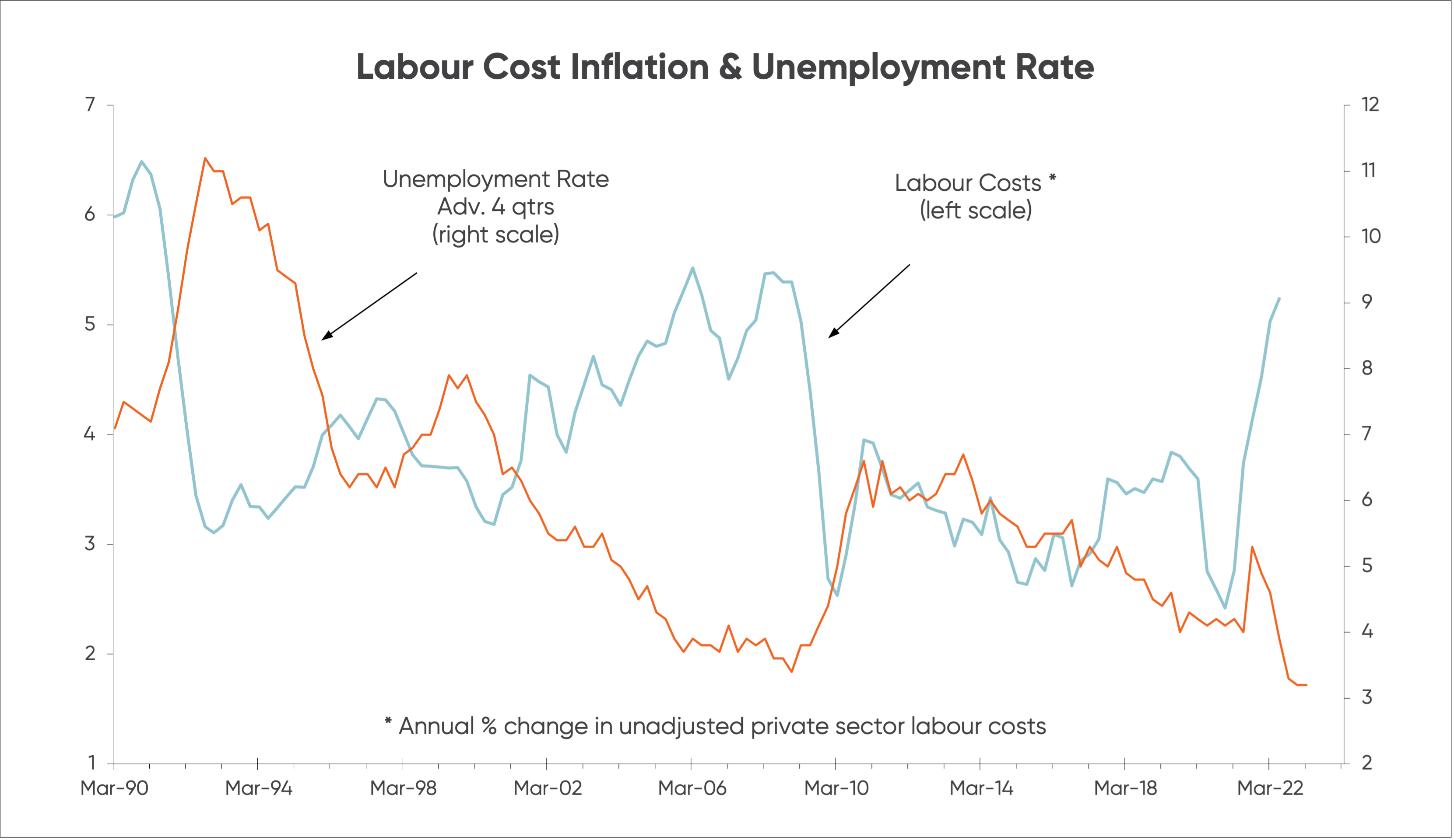

The below chart is at the heart of my assessment of prospects for the housing market, economic growth, interest rates and more. It shows the unemployment rate as a useful leading indicator of annual labour cost inflation. The best fit is with the orange unemployment rate line advanced or leading by four quarters.

This chart is Economics 101 at work.

If the unemployment rate falls, as it did significantly after the temporary, Covid-driven spike in 2020, it gives more bargaining power to employees and it takes them around a year to take advantage of it. Aiding higher labour cost inflation has been large increases in the minimum wage.

It should be no surprise to the Reserve Bank (RB), or bank economists, that labour cost inflation has returned to the sorts of levels experienced in the mid-2000s when labour shortages were last a major problem. It should head a bit higher in the near-term because employees are yet to extract the full extent of the bargaining power they have been granted.

This is the inevitable consequence of overly stimulatory monetary and fiscal policy, and pro-employee government labour market policies that have culminated in the worst labour shortage since the 1980s.

Other factors have contributed to high consumer price inflation, like global Covid capacity constraints, global climate policies and Russia’s invasion of Ukraine.

But at the heart of NZ’s inflation problem is incompetent Official Cash Rate (OCR) decisions by the RB in recent years, that let the unemployment rate fall well below the level consistent with the RB’s inflation target.

Prior to the large increase in the minimum wage and the Fair Pay Bill that is yet to impact, 4.5% was my estimate of the minimum unemployment rate consistent with the RB’s inflation target versus the most recent 3.3% rate. Ironically, the RB’s own research points to it potentially being higher, while I suspect (thanks to government policies and an element of Covid fallout) it could be nearer 5%.

This means the RB has allowed things to reach the stage where the ‘soft landing’ it is predicting for economic growth will not be enough to boost the unemployment rate back up to the level consistent with balanced bargaining power between employers and employees.

The Bank of England, that similarly allowed the labour market to get excessively tight, has acknowledged a recession will be required to fix inflation. This is a central bank being honest about what is required to fix inflation, after having played a key part in allowing the inflation problem to develop.

By contrast, our RB remains in denial about the need for a recession to fix NZ’s inflation problem. It is predicting that economic growth will remain positive for the next three years.

There will not be another sustained period of economic growth or a sustained increase in house prices until the RB has hurt the economy enough to boost the unemployment rate above the rate consistent with low inflation.

The RB’s reactive rather than proactive decision-making means it is highly likely it will now overreact to the inflation threat, as it has in the past, resulting in the unemployment rate increasing above 5%; but this could take 2-3 years to occur.

Despite the prospect the RB needs to pursue a reasonable protracted battle against inflation, it should be no surprise a market-led fall in interest rates has started. Why this can occur and why it is likely to result in only a partial reversal of the increase in interest rates will be discussed next month.

By Rodney Dickens, Managing Director, Strategic Risk Analysis Limited (www.sra.co.nz)

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.