When will ASB fall into line on mortgage rates?

Post by David Cunningham - Chief Squirrel

***Article updated on 25th September to reflect current interest rates***

Most of the time, there’s not a lot of difference in what you get between New Zealand’s main banks.

Home loan rates are a good example. It doesn’t matter which bank you’re with — the rates you’ll get are the same, or near enough, across the board.

But actually, right now, that’s not the case.

Two of our big five banks have stuck their necks out in the home loan market

At one end, there’s ASB. After bumping its rates up twice in the last few weeks, ASB is now charging customers 7.45% on the popular one-year fixed term mortgage rate.

And meanwhile, at the other, there’s Kiwibank — charging 7.15% for the same term.

To put that range into context, the 0.30% difference between Kiwibank and ASB would cost you $1,500 more each year on a $500,000 mortgage. Not exactly chump change.

The rest of the pack (ANZ, BNZ and Westpac) are running somewhere in the middle, between 7.19% and 7.25%.

When ASB last hiked its home loan rates a couple of weeks ago, it took the unusual step of justifying the move.

It cited changes in the OCR, wholesale interest rates, customer term deposit rates and the cost of overseas funding — noting that all had increased significantly in the last two and a half years.

In reality, however, both the OCR and wholesale interest rates have remained flat since May, and the cost of overseas funding has actually fallen since the start of 2022.

So why the difference in rates then? Well, in short, it all comes down to profit.

One bank is prepared to sacrifice market share to earn higher short-term profits.

The other is prepared to forgo higher short-term profits to grow market share, and therefore ensure stronger profits in the longer term.

If anyone wanted proof of where ASB’s thinking is at, in my view you need look no further than recent comments made by Matt Comyn, CEO of Commonwealth Bank — ASB’s parent company in Australia.

He caused a bit of a kerfuffle when he came out bemoaning the poor returns on mortgage lending in New Zealand right now.

To me, what’s so disingenuous about Comyn’s take on the issue is the fact that banks don’t just make their money on mortgages.

Their profits are actually largely determined by the difference between the interest rate they pay to savers and the interest rate they charge borrowers.

So, let’s zoom out for a second, and look at that bigger picture with ASB.

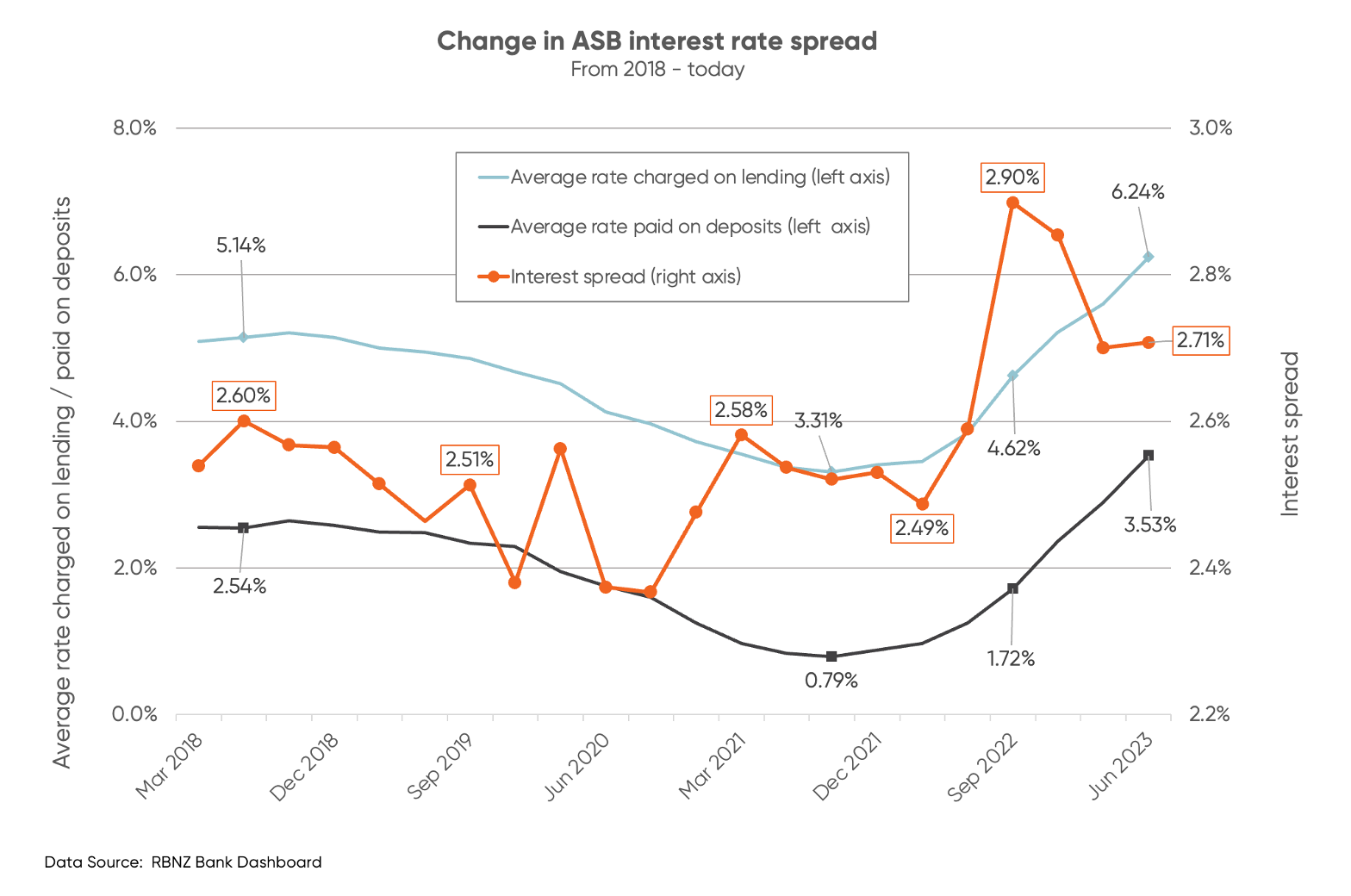

The below graph uses Reserve Bank data to track the average rates ASB has paid, and charged, over the last five years — and therefore gives us an idea of the interest spread it’s making (the line in orange).

Over the last 12 months, ASB’s margin has been higher than at any other time in the last five years.

Not a bad place to be when the rest of the country is in a cost-of-living crisis.

Where to from here?

I’ve got a sneaking suspicion we could see ASB lower its home loan interest rates soon, at least to a level that’s back in line with the other Australian-owned banks.

Its market share is being hit hard and the short-term profit from higher margins will be at the expense of longer-term profits.

For Kiwi who have a mortgage with ASB rolling over soon — or anyone considering a mortgage with ASB — it would be wise to shop around, or ask them to match the best deal you can find.

Chances are good you could get a cheaper rate, and potentially a cashback of up to 1% if you change banks. Even on a $500,000 mortgage, that could leave you thousands better off.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.