Why are floating mortgage interest rates so high?

Post by David Cunningham - Chief Squirrel

At the top of an interest rate cycle, like where we are now, having your mortgage on a floating rate can be a really smart strategy.

It means that when rates start to fall again, you’re in a position to take advantage of that ASAP, rather than having to wait out the rest of your fixed rate term, or pay through the nose to break early.

Across the ditch in Australia, floating rates are the norm. But in New Zealand, even in the current environment when opting to float can make good sense, less than 10% of all Kiwi mortgages are on floating rates.

Why? Well, the fact that floating rates are consistently so much more expensive than fixed rates is a pretty big deterrent. And the reason for that is simple — it all comes down to New Zealand banks maximising their profits.

Let’s take a look at the key dynamics at play.

1. First, some important context: wholesale markets are currently pricing for interest rates to fall

Wholesale financial markets are where traders put their money on the line.

Right now, New Zealand’s markets are pricing for our Official Cash Rate (OCR) to be about 0.25% lower by July 2024, and 0.70% lower in a year’s time.

It’s a view shared by other markets around the globe. The US, Canada, UK, and other parts of Europe are all pricing their OCR equivalent to have fallen by between 0.25% and 0.75% over the next 12 months.

That’s because these markets are betting we’ll have slain the inflationary dragon by the end of 2024, meaning we should be in a position to ease the tight financial conditions of the last two years.

Expectations of a falling OCR flow through to falls in longer-term wholesale interest rates, often called ‘swap rates’. From their recent peaks, the 1-year swap rate has dropped by 0.4%, while the 2-year to 5-year swap rates have dropped by 0.6%.

Ultimately, those falls should then flow through to fixed home loan interest rates.

(Although we’ve seen the opposite of late, with banks actually lifting their fixed interest rates to widen profit margins.)

All of that is to say that the next move in interest rates should be downwards — and to be able to take advantage of that when it happens, being on a floating rate right now is not a bad idea.

2. Floating interest rates closely follow movements in the OCR – and advertised floating rates are always much higher than fixed rates

When the OCR changes, up or down, floating home loan rates always move in the same direction, and typically always by a similar amount.

Fixed home loans broadly track in the same direction, too, but aren’t quite as closely tied to what’s happening with the OCR.

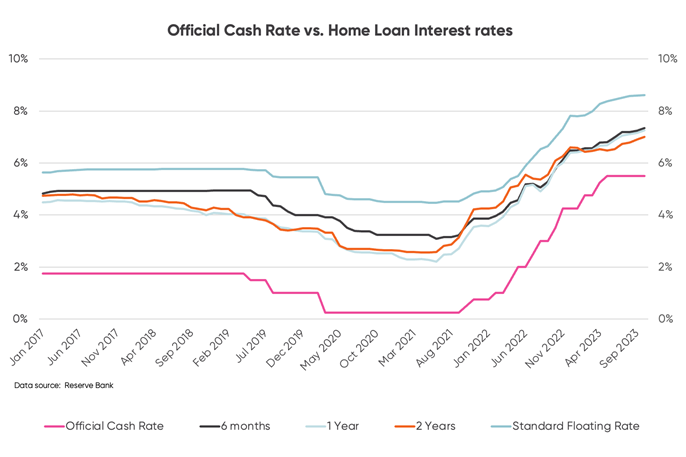

You can see this in the graph below, which depicts movements in the OCR, floating mortgage rates, and a number of short-term fixed term mortgage rates, back to 2017.

The other thing that’s clearly evident from this graph, is just how much higher floating rates are than fixed rates. The reason for this is because banks seek to extract a much higher margin on floating rates to support their profitability.

The fixed home loan interest rate that’s most closely correlated to the OCR is the 6-month rate — and yet, even that is consistently at least 1% lower than the floating home loan rate.

3. The good news is that while advertised floating rates are a lot higher than fixed rates, the actual floating rate that many customers are paying is very different

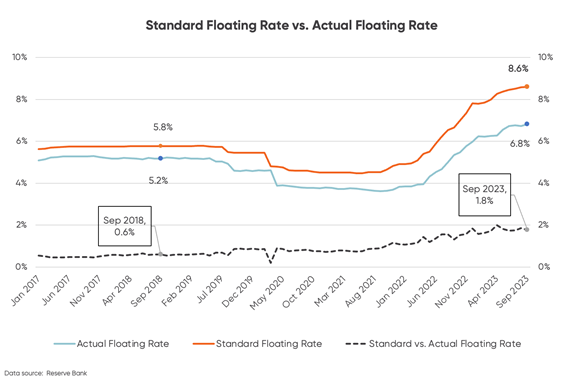

According to Reserve Bank data, Kiwi have about $37 billion worth of home loans on a floating interest rate.

Right now, the average standard floating rate across our five major banks is 8.6%. And yet, the average rate floating mortgage customers are actually paying is about 1.8% below that — at 6.8% — a gap that’s widened from 0.6% five years ago.

The reason for this disparity likely comes down to the number of ‘honeymoon’ deals banks are offering in market.

These might be flood-relief initiatives, special deals for climate-related promotions (such as cheap rates to fund EV purchases or solar panels), or discounts for those customers bold enough to ask.

4. So is opting to float a good idea in the current environment?

If you want to be able to quickly take advantage of falling interest rates when they happen, you’ve got two options:

- Opt to float, and ask your bank for a (substantial) discount off the carded rate, or

- Opt for a 6 or 12-month fixed-term

Don’t be afraid of taking a floating rate right now, but make sure you get a discount if you do – otherwise you’ll be supporting higher bank profits. And who wants that?

In an ideal world, the banks will take a long, hard look at their standard floating home loan interest rates, and lower them to a fair level.

Perhaps the Commerce Commission inquiry into competition in retail banking will force that. But then again, perhaps not.

Receive updates on the housing market, interest rates and the economy. No spam, we promise.

The opinions expressed in this article should not be taken as financial advice, or a recommendation of any financial product. Squirrel shall not be liable or responsible for any information, omissions, or errors present. Any commentary provided are the personal views of the author and are not necessarily representative of the views and opinions of Squirrel. We recommend seeking professional investment and/or mortgage advice before taking any action.

To view our disclosure statements and other legal information, please visit our Legal Agreements page here.